SunTrust 2014 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

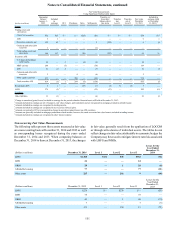

Notes to Consolidated Financial Statements, continued

143

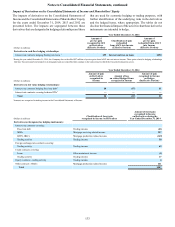

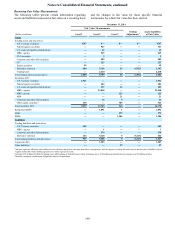

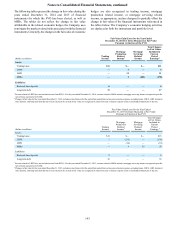

The following tables present the change in fair value during the

years ended December 31, 2014 and 2013 of financial

instruments for which the FVO has been elected, as well as

MSRs. The tables do not reflect the change in fair value

attributable to the related economic hedges the Company uses

to mitigate the market-related risks associated with the financial

instruments. Generally, the changes in the fair value of economic

hedges are also recognized in trading income, mortgage

production related income, or mortgage servicing related

income, as appropriate, and are designed to partially offset the

change in fair value of the financial instruments referenced in

the tables below. The Company’s economic hedging activities

are deployed at both the instrument and portfolio level.

Fair Value Gain/(Loss) for the Year Ended

December 31, 2014 for Items Measured at Fair Value

Pursuant to Election of the FVO

(Dollars in millions) Trading

Income

Mortgage

Production

Related

Income 1

Mortgage

Servicing

Related

Income

Total Changes

in Fair Values

Included in

Current

Period

Earnings 2

Assets:

Trading loans $11 $— $— $11

LHFS — 3 — 3

LHFI — 11 — 11

MSRs — 3 (401) (398)

Liabilities:

Brokered time deposits 6 — — 6

Long-term debt 17 — — 17

1 Income related to LHFS does not include income from IRLCs. For the year ended December 31, 2014, income related to MSRs includes mortgage servicing income recognized upon the

sale of loans reported at LOCOM.

2 Changes in fair value for the year ended December 31, 2014 exclude accrued interest for the period then ended. Interest income or interest expense on trading loans, LHFS, LHFI, brokered

time deposits, and long-term debt that have been elected to be carried at fair value are recognized in interest income or interest expense in the Consolidated Statements of Income.

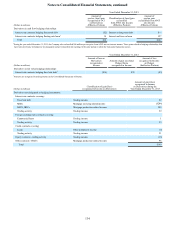

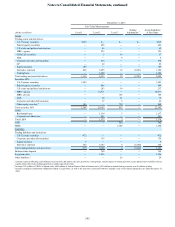

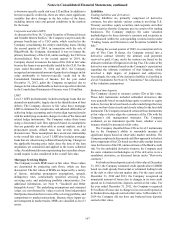

Fair Value Gain/(Loss) for the Year Ended

December 31, 2013 for Items Measured at Fair Value

Pursuant to Election of the FVO

(Dollars in millions) Trading

Income

Mortgage

Production

Related

Income 1

Mortgage

Servicing

Related

Income

Total Changes

in Fair Values

Included in

Current

Period

Earnings 2

Assets:

Trading loans $13 $— $— $13

LHFS 1 (135) — (134)

LHFI — (10) — (10)

MSRs — 4 50 54

Liabilities:

Brokered time deposits 8 — — 8

Long-term debt 36 — — 36

1 Income related to LHFS does not include income from IRLCs. For the year ended December 31, 2013, income related to MSRs includes mortgage servicing income recognized upon the

sale of loans reported at LOCOM.

2 Changes in fair value for the year ended December 31, 2013 exclude accrued interest for the period then ended. Interest income or interest expense on trading loans, LHFS, LHFI, brokered

time deposits, and long-term debt that have been elected to be carried at fair value are recognized in interest income or interest expense in the Consolidated Statements of Income.