SunTrust 2014 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

126

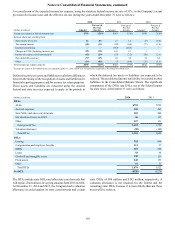

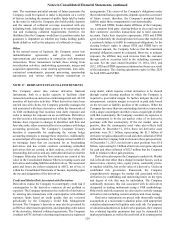

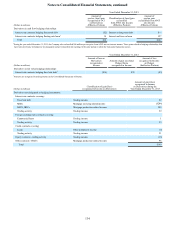

Other changes in plan assets and benefit obligations recognized in AOCI during 2014 were as follows:

(Dollars in millions) Pension Benefits Other Postretirement

Benefits

Current year actuarial loss/(gain) $230 ($13)

Amortization of actuarial loss (16) —

Amortization of prior service credit — 6

Total recognized in AOCI, pre-tax $214 ($7)

Total recognized in net periodic benefit and AOCI, pre-tax $159 ($15)

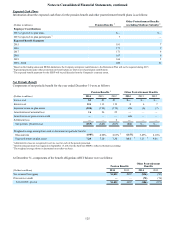

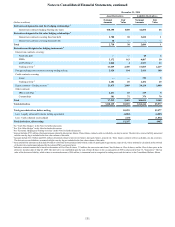

For pension plans, the estimated actuarial loss that will be

amortized from AOCI into net periodic benefit in 2015 is $21

million. For the other postretirement plans, the estimated prior

service credit to be amortized from AOCI into net periodic

benefit in 2015 is $6 million.

NOTE 16 – GUARANTEES

The Company has undertaken certain guarantee obligations in

the ordinary course of business. The issuance of a guarantee

imposes an obligation for the Company to stand ready to perform

and make future payments should certain triggering events occur.

Payments may be in the form of cash, financial instruments, other

assets, shares of stock, or provision of the Company’s services.

The following is a discussion of the guarantees that the Company

has issued at December 31, 2014. The Company has also entered

into certain contracts that are similar to guarantees, but that are

accounted for as derivatives as discussed in Note 17, “Derivative

Financial Instruments.”

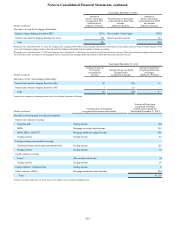

Letters of Credit

Letters of credit are conditional commitments issued by the

Company, generally to guarantee the performance of a client to

a third party in borrowing arrangements, such as CP, bond

financing, and similar transactions. The credit risk involved in

issuing letters of credit is essentially the same as that involved

in extending loan facilities to clients and may be reduced by

selling participations to third parties. The Company issues letters

of credit that are classified as financial standby, performance

standby, or commercial letters of credit.

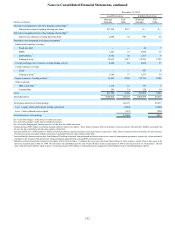

At December 31, 2014 and 2013, the maximum potential

amount of the Company’s obligation for issued financial and

performance standby letters of credit was $3.0 billion and $3.3

billion, respectively. The Company’s outstanding letters of credit

generally have a term of less than one year but may extend longer.

Some standby letters of credit are designed to be drawn upon

and others are drawn upon only under circumstances of dispute

or default in the underlying transaction to which the Company

is not a party. In all cases, the Company is entitled to

reimbursement from the applicant. If a letter of credit is drawn

upon and reimbursement is not provided by the applicant, the

Company may take possession of the collateral securing the line

of credit, where applicable. The Company monitors its credit

exposure under standby letters of credit in the same manner as

it monitors other extensions of credit in accordance with its credit

policies. An internal assessment of the PD and loss severity in

the event of default is performed consistent with the

methodologies used for all commercial borrowers. The

management of credit risk regarding letters of credit leverages

the risk rating process to focus greater visibility on higher risk

and/or higher dollar letters of credit. The allowance for credit

losses associated with letters of credit is a component of the

unfunded commitments reserve recorded in other liabilities in

the Consolidated Balance Sheets and is included in the allowance

for credit losses as disclosed in Note 7, “Allowance for Credit

Losses.” Additionally, unearned fees relating to letters of credit

are recorded in other liabilities. The net carrying amount of

unearned fees was $5 million and $3 million at December 31,

2014 and 2013, respectively.

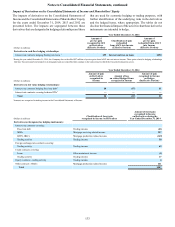

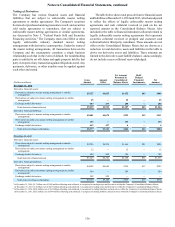

Loan Sales and Servicing

STM, a consolidated subsidiary of the Company, originates and

purchases residential mortgage loans, a portion of which are sold

to outside investors in the normal course of business, through a

combination of whole loan sales to GSEs, Ginnie Mae, and non-

agency investors. Prior to 2008, the Company also sold loans

through a limited number of Company-sponsored

securitizations. When mortgage loans are sold, representations

and warranties regarding certain attributes of the loans sold are

made to third party purchasers. Subsequent to the sale, if a

material underwriting deficiency or documentation defect is

discovered, STM may be obligated to repurchase the mortgage

loan or to reimburse an investor for losses incurred (make whole

requests) if such deficiency or defect cannot be cured by STM

within the specified period following discovery. Additionally,

defects in the securitization process or breaches of underwriting

and servicing representations and warranties can result in loan

repurchases, as well as adversely affect the valuation of MSRs,

servicing advances, or other mortgage loan-related exposures,

such as OREO. These representations and warranties may extend

through the life of the mortgage loan. STM’s risk of loss under

its representations and warranties is partially driven by borrower

payment performance since investors will perform extensive

reviews of delinquent loans as a means of mitigating losses.

Non-agency loan sales include whole loan sales and loans

sold in private securitization transactions. While representations

and warranties have been made related to these sales, they differ

from those made in connection with loans sold to the GSEs in

that non-agency loans may not be required to meet the same

underwriting standards and non-agency investors may be

required to demonstrate that an alleged breach is material and

caused the investors' loss. For legal claims related to

representations and warranties for which it is probable that a loss