SunTrust 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

95

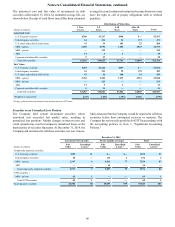

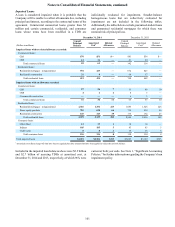

activities as well as non-trading activities and assumes a limited

degree of market risk by managing the size and nature of its

exposure. The Company has pledged $1.1 billion and $731

million of trading securities to secure $1.1 billion and $717

million of repurchase agreements at December 31, 2014 and

2013, respectively. Additionally, the Company has pledged $202

million and $97 million of trading securities to secure certain

derivative agreements at December 31, 2014 and 2013,

respectively.

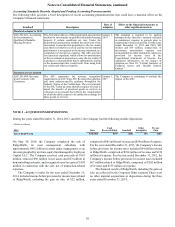

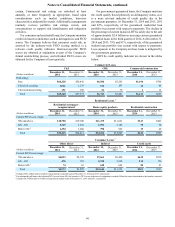

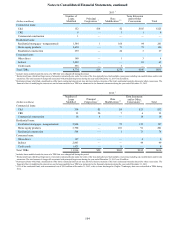

NOTE 5 – SECURITIES AVAILABLE FOR SALE

Securities Portfolio Composition

December 31, 2014

(Dollars in millions) Amortized

Cost Unrealized

Gains Unrealized

Losses Fair

Value

U.S. Treasury securities $1,913 $9 $1 $1,921

Federal agency securities 471 15 2 484

U.S. states and political subdivisions 200 9 — 209

MBS - agency 22,573 558 83 23,048

MBS - private 122 2 1 123

ABS 19 2 — 21

Corporate and other debt securities 38 3 — 41

Other equity securities 1921 2 — 923

Total securities AFS $26,257 $600 $87 $26,770

December 31, 2013

(Dollars in millions) Amortized

Cost Unrealized

Gains Unrealized

Losses Fair

Value

U.S. Treasury securities $1,334 $6 $47 $1,293

Federal agency securities 1,028 13 57 984

U.S. states and political subdivisions 232 7 2 237

MBS - agency 18,915 421 425 18,911

MBS - private 155 1 2 154

ABS 78 2 1 79

Corporate and other debt securities 39 3 — 42

Other equity securities 1841 1 — 842

Total securities AFS $22,622 $454 $534 $22,542

1 At December 31, 2014, other equity securities was comprised of the following: $376 million in FHLB of Atlanta stock, $402 million in Federal Reserve Bank of Atlanta stock, $138 million

in mutual fund investments, and $7 million of other. At December 31, 2013, other equity securities was comprised of the following: $336 million in FHLB of Atlanta stock, $402 million

in Federal Reserve Bank of Atlanta stock, $103 million in mutual fund investments, and $1 million of other.

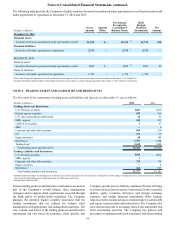

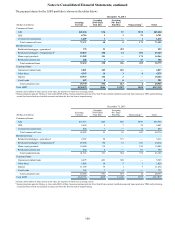

The following table presents interest and dividends on securities AFS:

Year Ended December 31

(Dollars in millions) 2014 2013 2012

Taxable interest $565 $537 $579

Tax-exempt interest 10 10 15

Dividends 38 32 61

Total interest and dividends $613 $579 $655

Securities AFS pledged to secure public deposits, repurchase

agreements, trusts, and other funds had a fair value of $2.6 billion

and $11.0 billion at December 31, 2014 and 2013, respectively.

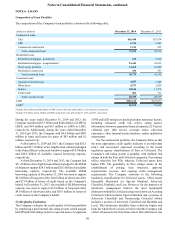

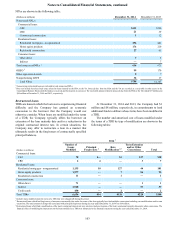

During the year ended December 31, 2012, the Company

accelerated the termination of the Agreements that hedged the

Company's investment in The Coca-Cola Company common

stock, and the Company sold, in the market or to The Coca-Cola

Company Counterparty, 59 million of its 60 million shares of

The Coca-Cola Company and contributed the remaining 1

million shares of The Coca-Cola Company to the SunTrust

Foundation for a net gain of $1.9 billion. The $38 million

contribution to the SunTrust Foundation was recognized in

noninterest expense. Details of the transactions are discussed in

Note 17, "Derivative Financial Instruments."