SunTrust 2014 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

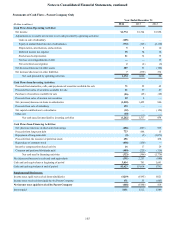

Notes to Consolidated Financial Statements, continued

160

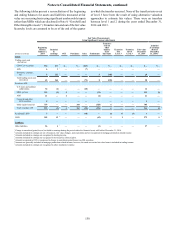

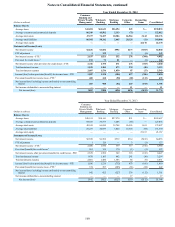

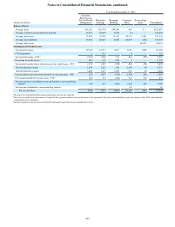

Year Ended December 31, 2014

(Dollars in millions)

Consumer

Banking and

Private Wealth

Management Wholesale

Banking Mortgage

Banking Corporate

Other Reconciling

Items Consolidated

Balance Sheets:

Average loans $41,694 $62,643 $26,494 $43 $— $130,874

Average consumer and commercial deposits 86,249 43,502 2,333 (72) — 132,012

Average total assets 47,377 74,307 30,386 26,964 3,142 182,176

Average total liabilities 86,982 50,242 2,665 20,128 (11) 160,006

Average total equity — — — — 22,170 22,170

Statements of Income/(Loss):

Net interest income $2,636 $1,682 $552 $273 ($303) $4,840

FTE adjustment 1 139 — 3 (1) 142

Net interest income - FTE 12,637 1,821 552 276 (304) 4,982

Provision for credit losses 2191 71 81 — (1) 342

Net interest income after provision for credit losses - FTE 2,446 1,750 471 276 (303) 4,640

Total noninterest income 1,528 1,104 473 238 (20) 3,323

Total noninterest expense 2,887 1,536 1,050 87 (17) 5,543

Income/(loss) before provision/(benefit) for income taxes - FTE 1,087 1,318 (106) 427 (306) 2,420

Provision/(benefit) for income taxes - FTE 3400 418 (50) (20) (113) 635

Net income/(loss) including income attributable to noncontrolling

interest 687 900 (56) 447 (193) 1,785

Net income attributable to noncontrolling interest — — — 11 — 11

Net income/(loss) $687 $900 ($56) $436 ($193) $1,774

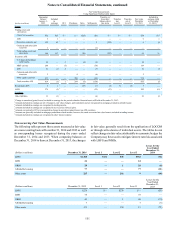

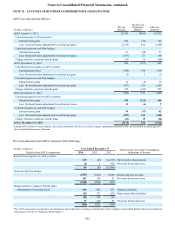

Year Ended December 31, 2013

(Dollars in millions)

Consumer

Banking and

Private Wealth

Management Wholesale

Banking Mortgage

Banking Corporate

Other Reconciling

Items Consolidated

Balance Sheets:

Average loans $40,511 $54,141 $27,974 $31 $— $122,657

Average consumer and commercial deposits 84,359 39,577 3,206 (66) — 127,076

Average total assets 45,541 66,094 32,708 26,503 1,651 172,497

Average total liabilities 85,237 46,697 3,845 15,645 (94) 151,330

Average total equity — — — — 21,167 21,167

Statements of Income/(Loss):

Net interest income $2,599 $1,566 $539 $314 ($165) $4,853

FTE adjustment 1 124 — 3 (1) 127

Net interest income - FTE 12,600 1,690 539 317 (166) 4,980

Provision/(benefit) for credit losses 2261 124 170 (1) (1) 553

Net interest income after provision/(benefit) for credit losses - FTE 2,339 1,566 369 318 (165) 4,427

Total noninterest income 1,478 1,103 402 241 (10) 3,214

Total noninterest expense 2,801 1,450 1,503 86 (9) 5,831

Income/(loss) before provision/(benefit) for income taxes - FTE 1,016 1,219 (732) 473 (166) 1,810

Provision/(benefit) for income taxes - FTE 3374 397 (205) (63) (54) 449

Net income/(loss) including income attributable to noncontrolling

interest 642 822 (527) 536 (112) 1,361

Net income attributable to noncontrolling interest — — — 17 — 17

Net income/(loss) $642 $822 ($527) $519 ($112) $1,344