SunTrust 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Estimates of fair value are also required when performing

an impairment analysis of goodwill, intangible assets, and long-

lived assets. For long-lived assets, including intangible assets

subject to amortization, an impairment loss is recognized if the

carrying amount of the asset is not recoverable and exceeds its

fair value. In determining the fair value, management uses

models which require assumptions about growth rates, the life

of the asset, and/or the market value of the assets. We test long-

lived assets for impairment whenever events or changes in

circumstances indicate that our carrying amount may not be

recoverable.

Other Liabilities

The fair value methodology and assumptions related to our

IRLCs are described in Note 18, “Fair Value Election and

Measurement,” to the Consolidated Financial Statements in this

Form 10-K.

Goodwill

At December 31, 2014, our reporting units with goodwill

balances were Consumer Banking/Private Wealth Management

and Wholesale Banking. In May 2014, we sold RidgeWorth

Capital Management, resulting in the removal of the goodwill

asset associated with that reporting unit. See Note 20, "Business

Segment Reporting," to the Consolidated Financial Statements

in this Form 10-K for further discussion of our reportable

segments.

We review goodwill of each reporting unit for impairment

on an annual basis as of September 30, or more often, if events

or circumstances indicate that it is more-likely-than-not that the

fair value of the reporting unit is below the carrying value of its

equity. Our goodwill impairment test as of September 30, 2014

resulted in an increase in the percentage of the fair value in excess

of the carrying value for the Consumer Banking/Private Wealth

Management reporting unit and a decrease in the excess fair value

related to the Wholesale Banking reporting unit compared to the

2013 test results. Due to an increase in the carrying value of the

Wholesale Banking reporting unit during the fourth quarter of

2014, we elected to perform an interim goodwill impairment

analysis for the Wholesale Banking reporting unit as of

December 31, 2014.

The carrying value of a reporting unit is determined by

allocating the total equity of the Company to each of its reporting

units based on an equal weighting of regulatory risk-based capital

and an approach based on tangible equity relative to tangible

assets. A portion of the Company’s equity is assigned to the

Corporate Other operating segment, which is attributed to the

corporate assets and liabilities assigned to that segment that do

not relate to the operations of any reporting unit.

The goodwill impairment analysis estimates the fair value

of equity using discounted cash flow analyses which require

assumptions, as well as guideline company information, where

available. The inputs and assumptions specific to each reporting

unit are incorporated in the valuations, including projections of

future cash flows, discount rates, the fair value of tangible assets

and intangible assets and liabilities, and applicable valuation

multiples based on the guideline information. We assess the

reasonableness of the estimated fair value of the reporting units

by giving consideration to our market capitalization over a

reasonable period of time; however, supplemental information

is applied based on observable multiples from guideline

companies.

Based on our annual impairment analysis of goodwill as of

September 30, we determined for the Consumer Banking/Private

Wealth Management and Wholesale Banking reporting units that

the respective reporting unit's fair value was in excess of its

carrying value by the following percentages:

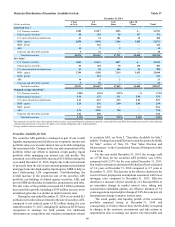

Table 24

2014 2013 2012

Consumer Banking/Private Wealth

Management 68% 56% 21%

Wholesale Banking 13% 14% 31%

Based on our interim goodwill analysis as of December 31,

2014 for the Wholesale reporting unit, we determined that the

fair value in excess of carrying value decreased to 7%. The

carrying value allocated to the Wholesale reporting unit

increased based on both asset growth within the reporting unit

and increased total equity of the Company. There was not a

commensurate increase in fair value due to changes in forecast

inputs including expectations of lower forward interest rates and

other reporting unit specific matters. Circumstances that could

negatively impact the fair value in excess of carrying value for

the Wholesale reporting unit in the future include significant

growth in assets, growth in the Company’s total equity, an

increase in the applicable discount rate, or deterioration in the

Wholesale Banking reporting unit’s forecasts.

Multi-year financial forecasts are developed for each

reporting unit by considering several key business drivers such

as new business initiatives, client service and retention standards,

market share changes, anticipated loan and deposit growth,

forward interest rates, historical performance, and industry and

economic trends, among other considerations. The long-term

growth rate used in determining the terminal value of each

reporting unit was estimated at 3.4% as of December 31, 2014,

September 30, 2014 and September 30, 2013, based on

management's assessment of the minimum expected terminal

growth rate of each reporting unit, as well as broader economic

considerations such as gross domestic product and inflation.

Discount rates are estimated based on the Capital Asset

Pricing Model, which considers the risk-free interest rate, market

risk premium, beta, and unsystematic risk adjustments specific

to a particular reporting unit. The discount rates are also

calibrated based on risks related to the projected cash flows of

each reporting unit. The discount rate utilized for the Wholesale

Banking reporting unit as of December 31, 2014 and September

30, 2014 was 11.1%. In the annual analysis as of September 30,

2014, the discount rate for the Consumer Banking/Private Wealth

Management reporting unit was approximately 11.6%. In the

annual analysis at September 30, 2013, the discount rates for the

Consumer Banking/Private Wealth Management and Wholesale

Banking reporting units were 13.1% and 13.3%, respectively.

The discount rates at September 30, 2014 were lower than

September 30, 2013 due to a combination of decreases in Capital

Asset Pricing Model inputs including the risk-free interest rate,

market risk premium, and beta, partially offset by an increase in

the unsystematic risk adjustments specific to each reporting unit.

The estimated fair value of each reporting unit is derived

from the valuation techniques described above and is analyzed