SunTrust 2014 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

124

decisions regarding short-term concerns and any single

investment. Asset allocation, as a percent of the total market

value of the total portfolio, is set with the target percentages and

ranges presented in the investment policy statement.

Rebalancing occurs on a periodic basis to maintain the target

allocation, but normal market activity may result in deviations.

The basis for determining the overall expected long-term

rate of return on plan assets considers past experience, current

market conditions, and expectations on future trends. A building

block approach is used that considers long-term inflation, real

returns, equity risk premiums, target asset allocations, market

corrections, and expenses. Capital market simulations from

internal and external sources, survey data, economic forecasts,

and actuarial judgment are all used in this process. The expected

2014 long-term gross rate of return on plan assets for the

SunTrust Retirement Plan and NCF Retirement Plan was 7.20%

and 6.65%, respectively, gross of administration fees. For 2013,

the expected long-term rate of return on both plans was 7.00%.

The expected long-term gross rate of return is 6.95% for the

SunTrust Retirement Plan and 6.15% for the NCF Retirement

Plan for 2015.

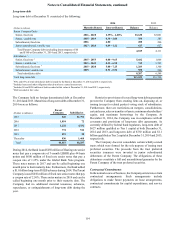

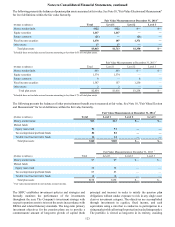

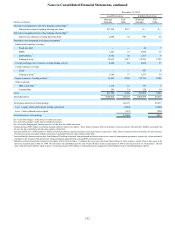

The target allocation and weighted average allocation for

pension plan assets, by asset category, are as follows:

Target

Allocation December 31

2015 2014 2013

Cash equivalents 0-10 % 4% 3%

Equity securities 0-50 48 48

Debt securities 50-100 48 49

Total 100% 100%

The investment strategy for the other postretirement benefit

plans is maintained separately from the strategy for the pension

plans. The Company’s investment strategy is to create a series

of investment returns sufficient to provide a commensurate

amount of long-term growth of capital (both principal and

income) in order to satisfy the other postretirement benefit plan's

obligations. These assets are diversified among equity funds and

fixed income investments according to the asset mix approved

by the SBFC, which is presented in the target allocation table

below. With the other postretirement benefits having a shorter

time horizon, a lower equity profile is appropriate. The pre-tax

expected long-term rate of return on retiree life insurance plan

assets was 5.25% for 2014 and 5.00% for 2013. The 2015 pre-

tax expected long-term rate of return on retiree life plan assets

is 5.00%. The after-tax expected long-term rate of return on

retiree health plan assets was 3.41% for 2014 and 3.25% for

2013. The 2015 after-tax expected long-term rate of return on

retiree health plan assets is 3.25%. During 2014 and 2013, there

was no SunTrust common stock held in the other postretirement

benefit plans.

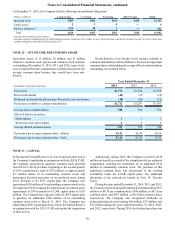

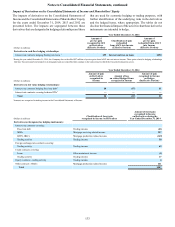

The target allocation and weighted average allocation for

other postretirement benefit plan assets, by asset category, are

as follows:

Target

Allocation December 31

2015 2014 2013

Cash equivalents 5-15 % 8% 5%

Equity securities 20-40 32 33

Debt securities 50-70 60 62

Total 100% 100%

The Company sets pension asset values equal to their market

value, in contrast to the use of a smoothed asset value that

incorporates gains and losses over a period of years. Utilization

of market value of assets provides a more realistic economic

measure of the plan’s funded status and cost. Assumed discount

rates and expected returns on plan assets affect the amounts of

net periodic benefit. A 25 basis point increase/decrease in the

expected long-term return on plan assets would increase/

decrease the net periodic benefit by $7 million for all pension

and other postretirement plans. A 25 basis point increase/

decrease in the discount rate would change the net periodic

benefit by less than $1 million for all pension and other

postretirement plans.

Assumed healthcare cost trend rates have a significant effect

on the amounts reported for the other postretirement benefit

plans. At December 31, 2014, the Company assumed that pre-65

retiree health care costs will increase at an initial rate of

7.50% per year. The Company expects this annual cost increase

to decrease over a 10-year period to 5.00% per year. A 1%

increase or decrease on other postretirement benefit obligations,

service cost, and interest cost are less than $1 million,

respectively.