SunTrust 2014 Annual Report Download - page 152

Download and view the complete annual report

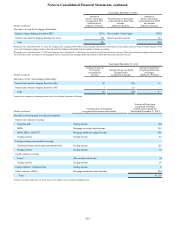

Please find page 152 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

129

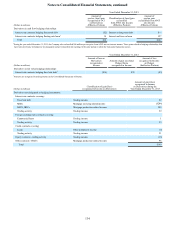

state. The maximum potential amount of future payments the

Company could be required to make is dependent on a variety

of factors, including the amount of public funds held by banks

in the states in which the Company also holds public deposits

and the amount of collateral coverage associated with any

defaulting bank. Individual states appear to be monitoring this

risk and evaluating collateral requirements; therefore, the

likelihood that the Company would have to perform under this

guarantee is dependent on whether any banks holding public

funds default as well as the adequacy of collateral coverage.

Other

In the normal course of business, the Company enters into

indemnification agreements and provides standard

representations and warranties in connection with numerous

transactions. These transactions include those arising from

securitization activities, underwriting agreements, merger and

acquisition agreements, swap clearing agreements, loan sales,

contractual commitments, payment processing, sponsorship

agreements, and various other business transactions or

arrangements. The extent of the Company's obligations under

these indemnification agreements depends upon the occurrence

of future events; therefore, the Company's potential future

liability under these arrangements is not determinable.

STIS and STRH, broker-dealer affiliates of the Company,

use a common third party clearing broker to clear and execute

their customers' securities transactions and to hold customer

accounts. Under their respective agreements, STIS and STRH

agree to indemnify the clearing broker for losses that result from

a customer's failure to fulfill its contractual obligations. As the

clearing broker's rights to charge STIS and STRH have no

maximum amount, the Company believes that the maximum

potential obligation cannot be estimated. However, to mitigate

exposure, the affiliate may seek recourse from the customer

through cash or securities held in the defaulting customers'

account. For the years ended December 31, 2014, 2013, and

2012, STIS and STRH experienced minimal net losses as a result

of the indemnity. The clearing agreements expire in May 2020

for both STIS and STRH.

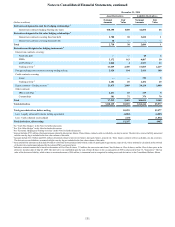

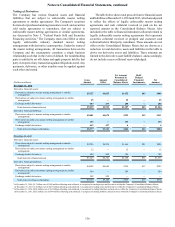

NOTE 17 - DERIVATIVE FINANCIAL INSTRUMENTS

The Company enters into various derivative financial

instruments, both in a dealer capacity to facilitate client

transactions and as an end user as a risk management tool. ALCO

monitors all derivative activities. When derivatives have been

entered into with clients, the Company generally manages the

risk associated with these derivatives within the framework of

its VAR methodology that monitors total daily exposure and

seeks to manage the exposure on an overall basis. Derivatives

are also used as a risk management tool to hedge the Company’s

balance sheet exposure to changes in identified cash flow and

fair value risks, either economically or in accordance with hedge

accounting provisions. The Company’s Corporate Treasury

function is responsible for employing the various hedge

accounting strategies to manage these objectives. Additionally,

as a normal part of its operations, the Company enters into IRLCs

on mortgage loans that are accounted for as freestanding

derivatives and has certain contracts containing embedded

derivatives that are carried, in their entirety, at fair value. All

freestanding derivatives and any embedded derivatives that the

Company bifurcates from the host contracts are carried at fair

value in the Consolidated Balance Sheets in trading assets and

derivatives and trading liabilities and derivatives. The associated

gains and losses are either recognized in AOCI, net of tax, or

within the Consolidated Statements of Income, depending upon

the use and designation of the derivatives.

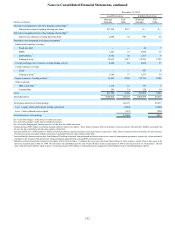

Credit and Market Risk Associated with Derivatives

Derivatives expose the Company to counterparty credit risk if

counterparties to the derivative contracts do not perform as

expected. The Company minimizes the credit risk of derivatives

by entering into transactions with counterparties with defined

exposure limits based on credit quality that are reviewed

periodically by the Company’s Credit Risk Management

division. The Company’s derivatives may also be governed by

an ISDA or other master agreement, and depending on the nature

of the derivative, bilateral collateral agreements. The Company

is subject to OTC derivative clearing requirements as a registered

swap dealer, which requires certain derivatives to be cleared

through central clearing members in which the Company is

required to post initial margin. To further mitigate the risk of

non-payment, variation margin is received or paid daily based

on the net asset or liability position of the contracts. When the

Company has more than one outstanding derivative transaction

with a single counterparty and there exists a legal right of offset

with that counterparty, the Company considers its exposure to

the counterparty to be the net market value of its derivative

positions with that counterparty. If the net market value is

positive, then the counterparty asset value also reflects held

collateral. At December 31, 2014, these net derivative asset

positions were $1.1 billion, representing the $1.5 billion of

derivative net gains adjusted for cash and other collateral of $386

million that the Company held in relation to these gain positions.

At December 31, 2013, net derivative asset positions were $1.0

billion, representing $1.5 billion of derivative net gains, adjusted

for cash and other collateral of $523 million that the Company

held in relation to these gain positions.

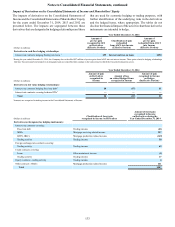

Derivatives also expose the Company to market risk. Market

risk is the adverse effect that a change in market factors, such as

interest rates, currency rates, equity prices, commodity prices,

or implied volatility, has on the value of a derivative. Under an

established risk governance framework, the Company

comprehensively manages the market risk associated with its

derivatives by establishing and monitoring limits on the types

and degree of risk that may be undertaken. The Company

continually measures this risk associated with its derivatives

designated as trading instruments using a VAR methodology.

Other tools and risk measures are also used to actively manage

derivatives risk including scenario analysis and stress testing.

Derivative instruments are priced with observable market

assumptions at a mid-market valuation point, with appropriate

valuation adjustments for liquidity and credit risk. For purposes

of valuation adjustments to its derivative positions, the Company

has evaluated liquidity premiums that may be demanded by

market participants, as well as the credit risk of its counterparties