SunTrust 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

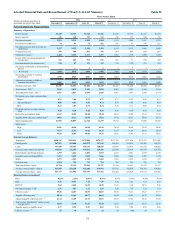

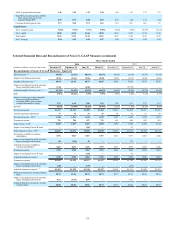

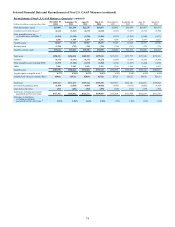

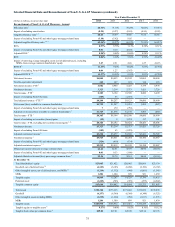

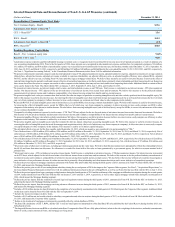

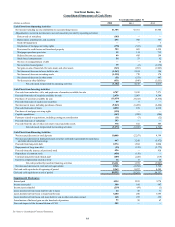

Selected Financial Data and Reconcilement of Non-U.S. GAAP Measures (continued)

(Dollars in billions) December 31, 2014

Reconciliation of Common Equity Tier 1 Ratio

Tier 1 Common Equity - Basel I $15.6

Adjustments from Basel I to Basel III 22 —

CET 1 - Basel III 23 15.6

RWA - Basel I 162.5

Adjustments from Basel I to Basel III 24 (1.7)

RWA - Basel III 23 160.8

Resulting Regulatory Capital Ratios

Basel I - Tier 1 common equity ratio 9.60%

Basel III - CET 1 ratio 23 9.69

1 Amortization expense related to qualified affordable housing investment costs is recognized in provision/(benefit) for income taxes for all periods presented as a result of adoption of a

new accounting standard during 2014. Prior to the first quarter of 2014, these amounts were recognized in other noninterest expense, and therefore, for comparative purposes, $16 million,

$12 million, $10 million, and $10 million of amortization expense was reclassified to provision/(benefit) for income taxes for the three months ended December 31, 2013, September 30,

2013, June 30, 2013, and March 31, 2013, respectively, and $49 million, $39 million, $40 million, and $44 million for the years ended December 31, 2013, 2012, 2011, and 2010, respectively.

See Note 1, "Significant Accounting Policies," to the Consolidated Financial Statements in this Form 10-K for additional information.

2 We present certain income statement categories and also total adjusted revenue-FTE, adjusted noninterest income, adjusted noninterest expense, adjusted net income per average common

diluted share, adjusted net income, adjusted net income available to common shareholders, an adjusted efficiency ratio, an adjusted tangible efficiency ratio, adjusted ROA, adjusted

ROTCE, and the effective tax rate, excluding Form 8-K items and other legacy mortgage-related items. We believe these measures are useful to investors because it removes the effect of

material items impacting the periods' results and is more reflective of normalized operations as it reflects results that are primarily client relationship and client transaction driven. Removing

these items also allows investors to compare our results to other companies in the industry that may not have had similar items impacting their results. Additional detail on certain of these

items can be found in the Form 8-Ks filed with the SEC on January, 5, 2015, September 9, 2014, July 3, 2014, and October 10, 2013.

3 We present net interest income, net interest margin, total revenue, and total adjusted revenue on an FTE basis. Total revenue is calculated as net interest income - FTE plus noninterest

income. Net interest income - FTE adjusts for the tax-favored status of net interest income from certain loans and investments. We believe this measure to be the preferred industry

measurement of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt sources.

4 We present a tangible book value per common share that excludes the after-tax impact of purchase accounting intangible assets and also excludes preferred stock from tangible equity. We

believe this measure is useful to investors because, by removing the effect of intangible assets that result from merger and acquisition activity as well as preferred stock (the level of which

may vary from company to company), it allows investors to more easily compare our common stock book value to other companies in the industry.

5 We present ROTCE to exclude intangible assets (net of deferred taxes), except for MSRs, from average common shareholders' equity. We believe this measure is useful to investors because,

by removing the effect of intangible assets, except for MSRs, (the level of which may vary from company to company), it allows investors to more easily compare our ROE to other

companies in the industry who present a similar measure. We also believe that removing intangible assets (net of deferred taxes), except for MSRs, is a more relevant measure of the return

on our common shareholders' equity.

6 Computed by dividing noninterest expense by total revenue - FTE. The FTE basis adjusts for the tax-favored status of net interest income from certain loans and investments. We believe

this measure to be the preferred industry measurement of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt sources.

7 We present a tangible efficiency ratio which excludes amortization. We believe this measure is useful to investors because it allows investors to more easily compare our efficiency to other

companies in the industry. This measure is utilized by us to assess our efficiency and that of our lines of business.

8 We present a tangible equity to tangible assets ratio that excludes the after-tax impact of purchase accounting intangible assets. We believe this measure is useful to investors because, by

removing the effect of intangible assets that result from merger and acquisition activity (the level of which may vary from company to company), it allows investors to more easily compare

our capital adequacy to other companies in the industry. This measure is used by us to analyze capital adequacy.

9 The calculated effective tax rate for the three months ended September 30, 2013, which was negative, was considered to be not meaningful, or "NM."

10 Net of deferred taxes of $214 million, $210 million, $206 million, and $193 million at December 31, 2014, September 30, 2014, June 30, 2014, and March 31, 2014, respectively. Net of

deferred taxes of $186 million, $180 million, $174 million, and $169 million at December 31, 2013, September 30, 2013, June 30, 2013, and March 31, 2013, respectively. Net of deferred

taxes of $163 million, $154 million, and $134 million at December 31, 2012, 2011, and 2010, respectively.

11 Net of deferred taxes of $0, $0, $1 million, and $1 million at December 31, 2014, September 30, 2014, June 30, 2014, and March 31, 2014, respectively. Net of deferred taxes of $2 million,

$2 million, $4 million, and $5 million at December 31, 2013, September 30, 2013, June 30, 2013, and March 31, 2013, respectively. Net of deferred taxes of $7 million, $16 million, and

$26 million at December 31, 2012, 2011, and 2010, respectively.

12 We present a ratio of allowance to total loans, excluding government-guaranteed and fair value loans. We believe that this presentation more appropriately reflects the relationship between

the ALLL and loans that attract an allowance. No allowance is recorded for loans held at fair value or loans guaranteed by a government agency for which we assume nominal risk of

principal loss.

13 We present total revenue - FTE excluding net securities (losses)/gains. Total Revenue is calculated as net interest income - FTE plus noninterest income. Net interest income is presented

on an FTE basis, which adjusts for the tax-favored status of net interest income from certain loans and investments. We believe this measure to be the preferred industry measurement of

net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt sources. We also believe that revenue without net securities (losses)/gains is

more indicative of our performance because it isolates income that is primarily client relationship and client transaction driven and is more indicative of normalized operations.

14 Reflects the pre-tax impact of mortgage repurchase settlements with Fannie Mae and Freddie Mac during the third quarter of 2013, announced in Form 8-K filed with the SEC on October

10, 2013, and impacts the Mortgage Banking segment.

15 Reflects the pre-tax gain on sale of asset management subsidiary during the second quarter of 2014 that impacts the Corporate Other segment. See Note 2, "Acquisitions/Dispositions," to

the Consolidated Financial Statements in this Form 10-K for additional information related to the sale of RidgeWorth, as well as our Form 8-K that was filed with the SEC on July 3, 2014.

16 Reflects the pre-tax impact from legacy mortgage-related matters during the fourth quarter of 2014 and the settlement of the mortgage modification investigation during the second quarter

of 2014, further detailed in Form 8-Ks filed with the SEC on January 5, 2015 and July 3, 2014, respectively, as well as other legacy mortgage-related items during the second quarter of

2014, which impact the Mortgage Banking segment.

17 Reflects the pre-tax impact from the settlement of certain legal and regulatory matters during the third quarter of 2013, announced in Form 8-K filed with the SEC on October 10, 2013,

and primarily impacts the Mortgage Banking segment.

18 Reflects the pre-tax impact from the mortgage servicing advances allowance increase during the third quarter of 2013, announced in Form 8-K filed with the SEC on October 10, 2013,

and impacts the Mortgage Banking segment.

19 Includes a $130 million income tax benefit related to the completion of a tax authority examination in the third quarter of 2014 that impacts the Corporate Other segment. Additional detail

on this item can be found in Form 8-K filed with the SEC on September 9, 2014.

20 Includes the income tax impact on above items.

21 Includes a $113 million net tax benefit related to subsidiary reorganization and other tax matters during the third quarter of 2013, as disclosed in Form 8-K filed with the SEC on October

10, 2013, and impacts the Corporate Other segment.

22 Relates to the treatment of mortgage servicing assets essentially offset by certain disallowed DTAs.

23 The Basel III calculations of CET 1, RWA, and the CET 1 ratio are based upon our interpretation of the final Basel III rules published by the Federal Reserve during October 2013, on a

fully phased in basis.

24 The largest differences between our RWA as calculated under Basel I compared to Basel III (on a fully phased in basis) relate to the risk-weightings for derivatives, unfunded commitments,

letters of credit, certain commercial loans, and mortgage servicing assets.