SunTrust 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

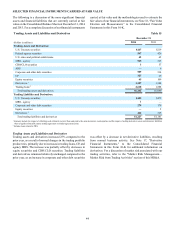

49

Long-Term Debt

Long-term debt at December 31 consisted of the following:

Table 21

(Dollars in millions) 2014 2013

Parent Company Only:

Senior, fixed rate $3,630 $3,001

Senior, variable rate 358 283

Subordinated, fixed rate 200 200

Junior subordinated, variable rate 627 627

Total Parent Company debt 4,815 4,111

Subsidiaries:

Senior, fixed rate 5,682 1,006

Senior, variable rate 1742 3,783

Subordinated, fixed rate 21,283 1,300

Subordinated, variable rate 500 500

Total subsidiaries debt 8,207 6,589

Total long-term debt $13,022 $10,700

1 Includes $0 and $256 million of debt recorded at fair value at December 31,

2014 and 2013, respectively.

2 Debt recorded at fair value.

During the year ended December 31, 2014, our long-term debt

increased by $2.3 billion, or 22%. The increase was due to the

addition of a $1.0 billion long-term FHLB advance during the

second quarter of 2014 and three senior note issuances totaling

$1.5 billion during the first half of 2014. Specifically, during the

first quarter we issued $250 million of 3-year floating rate senior

notes and $600 million of 3-year fixed rate senior notes under

our Global Bank Note program. Additionally, during the second

quarter of 2014, we issued $650 million of 5-year fixed rate

senior notes. These issuances allowed us to add to our wholesale

funding at relatively low long-term borrowing rates. Partially

offsetting these senior note issuances and the long-term FHLB

advance during 2014 was the deconsolidation of $256 million

of VIE debt in the second quarter in connection with the sale of

RidgeWorth. See Note 10, “Certain Transfers of Financial Assets

and Variable Interest Entities,” for additional information

regarding the deconsolidation of VIE debt.

Average long-term debt for 2014 increased $2.5 billion, or

25%, compared to 2013, predominantly driven by the same

factors as discussed above related to senior note issuances and

the long-term FHLB advance.

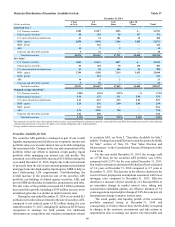

CAPITAL RESOURCES

Our primary federal regulator, the Federal Reserve, measures

capital adequacy within a framework that sets capital

requirements relative to the risk profiles of individual banking

companies. The framework assigns risk weights to assets and

off-balance sheet risk exposures according to predefined

classifications, creating a base from which to compare capital

levels. Tier 1 capital includes primarily certain equity and

qualified preferred instruments, less intangible assets such as

goodwill and core deposit intangibles, and certain other

regulatory deductions. Total capital consists of Tier 1 capital and

Tier 2 capital, which includes qualifying portions of

subordinated debt, ALLL up to a maximum of 1.25% of RWA,

and 45% of unrealized gains on equity securities. Mark-to-

market adjustments related to our credit spreads for fair value

debt and index-linked CDs are excluded from regulatory capital.

Both the Company and the Bank are subject to minimum

Tier 1 capital and Total capital ratios of 4% and 8%, respectively.

To be considered “well-capitalized,” ratios of 6% and 10%,

respectively, are required. Additionally, the Company and the

Bank are subject to a Tier 1 leverage ratio requirement, which

measures Tier 1 capital against average total assets less certain

deductions, as calculated in accordance with regulatory

guidelines. The minimum and well-capitalized leverage ratio

thresholds are 3% and 5%, respectively.

Tier 1 common equity represents the portion of Tier 1 capital

that is attributable to common shareholders. We calculate this,

together with the Tier 1 common equity ratio, using the

methodology specified by our primary regulator. Our calculation

of these measures may differ from those of other financial

services companies that calculate similar metrics.

Basel III

The Federal Reserve published final rules implementing Basel

III on October 11, 2013. The rules require banks subject to the

standardized approach for RWA to meet revised minimum

regulatory capital ratios beginning on January 1, 2015, and to

begin transitioning to revised definitions of regulatory capital

with accompanying revisions to capital adjustments and

deductions. In particular, the rules require the phase out of non-

qualifying Tier 1 capital instruments such as trust preferred

securities. As such, beginning on January 1, 2015, approximately

$627 million in principal amount of Parent Company trust

preferred and other hybrid capital securities currently

outstanding will start to be phased out of Tier 1 capital, qualifying

instead for Tier 2 capital treatment. Accordingly, we anticipate

that by January 1, 2016, all $627 million of our outstanding trust

preferred securities will lose Tier 1 capital treatment, and will

be reclassified as Tier 2 capital.

A transition period applies to certain capital elements and

risk weighted assets. One of the more significant transitions

required by the final rules relates to the risk weighting applied

to MSRs, which will impact the CET1 ratio during the transition

period when compared to the currently disclosed CET1 ratio that

is calculated on a fully phased-in basis. Specifically, the fully

phased-in risk weight of MSRs is 250%, while the risk weight

to be applied during the transition period is 100%. The transition

period is applicable from January 1, 2015 through December 31,

2017. Our fully phased-in, estimated Basel III CET 1 ratio of

9.69% at December 31, 2014 considers the 250% risk-weighting

for MSRs.

The final rules introduce a capital conservation buffer of

2.5% of RWA that is layered on top of the minimum capital risk-

based ratios, which places restrictions on the amount of retained

earnings that may be used for capital distributions or

discretionary bonus payments as risk-based capital ratios

approach their respective “adequately capitalized” minimums.

The capital conservation buffer begins to take effect on January

1, 2016 and is fully phased-in as of January 1, 2019.

The final rules specify a number of minimum capital

requirements, including a CET 1 ratio of 4.5%; Tier 1 capital

ratio of 6%; Total capital ratio of 8%; and a Leverage ratio of

4%. At December 31, 2014, our estimated CET 1 ratio on a fully