SunTrust 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

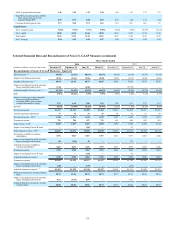

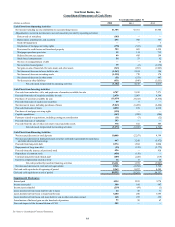

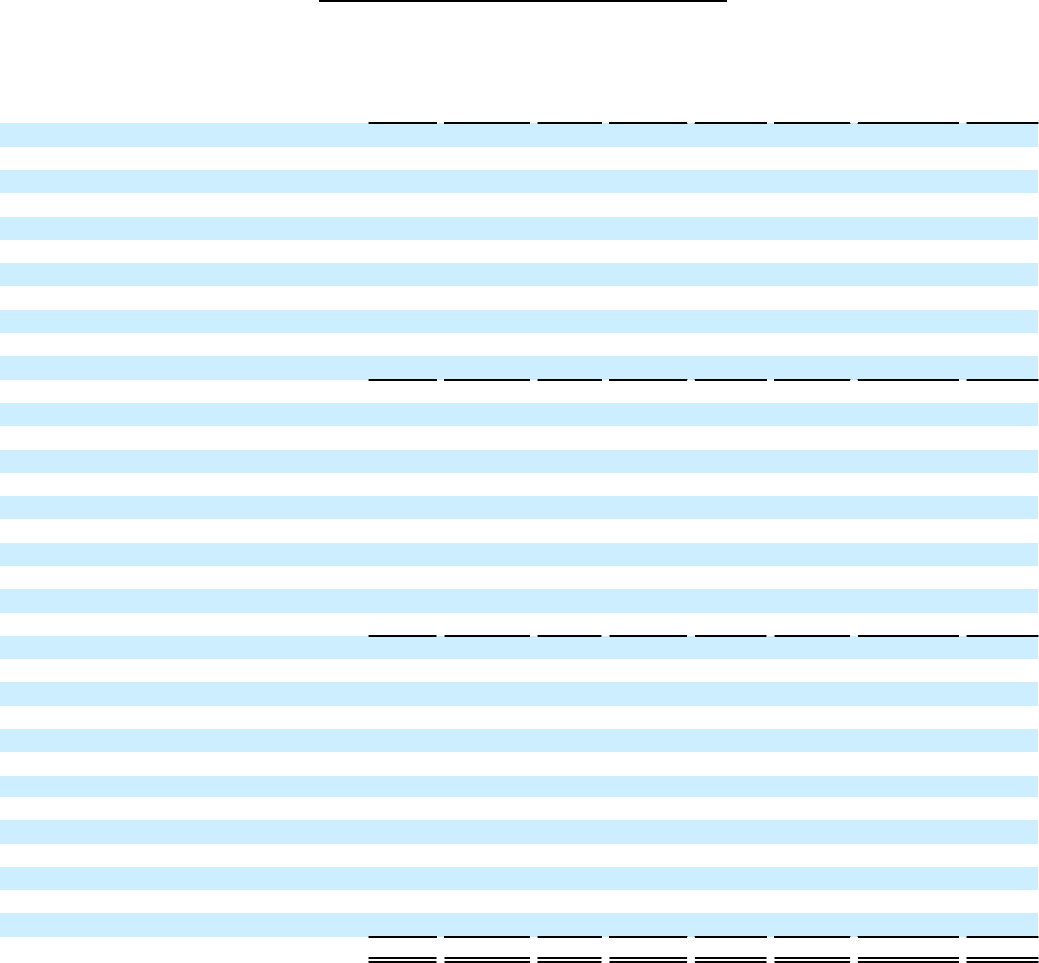

83

SunTrust Banks, Inc.

Consolidated Statements of Shareholders’ Equity

(Dollars and shares in millions, except per share data)

Preferred

Stock

Common

Shares

Outstanding

Common

Stock

Additional

Paid in

Capital

Retained

Earnings

Treasury

Stock and

Other 1

Accumulated

Other

Comprehensive

(Loss)/Income 2Total

Balance, January 1, 2012 $275 537 $550 $9,306 $8,978 ($792) $1,749 $20,066

Net income — — — — 1,958 — — 1,958

Other comprehensive loss — — — — — — (1,440) (1,440)

Change in noncontrolling interest — — — — — 7 — 7

Common stock dividends, $0.20 per share — — — — (107) — — (107)

Preferred stock dividends 3— — — — (12) — — (12)

Issuance of preferred stock 450 — — (12) — — — 438

Exercise of stock options and stock compensation expense — 1 — (44) — 65 — 21

Restricted stock activity — 1 — (63) — 69 — 6

Amortization of restricted stock compensation — — — — — 30 — 30

Issuance of stock for employee benefit plans and other — — — (13) — 31 — 18

Balance, December 31, 2012 $725 539 $550 $9,174 $10,817 ($590) $309 $20,985

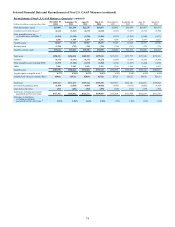

Net income — — — — 1,344 — — 1,344

Other comprehensive loss — — — — — — (598) (598)

Change in noncontrolling interest — — — — — 5 — 5

Common stock dividends, $0.35 per share — — — — (188) — — (188)

Preferred stock dividends 3— — — — (37) — — (37)

Acquisition of treasury stock — (5) — — — (150) — (150)

Exercise of stock options and stock compensation expense — 1 — (27) — 43 — 16

Restricted stock activity — 1 — (35) — 39 — 4

Amortization of restricted stock compensation — — — — — 32 — 32

Issuance of stock for employee benefit plans and other — — — 3 — 6 — 9

Balance, December 31, 2013 $725 536 $550 $9,115 $11,936 ($615)($289) $21,422

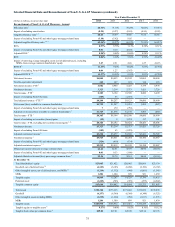

Net income — — — — 1,774 — — 1,774

Other comprehensive income — — — — — — 167 167

Change in noncontrolling interest — — — — — 5 — 5

Common stock dividends, $0.70 per share — — — — (371) — — (371)

Preferred stock dividends 3— — — — (42) — — (42)

Issuance of preferred stock 500 — — (4) — — — 496

Acquisition of treasury stock —(12) — — — (458) — (458)

Exercise of stock options and stock compensation expense — 1 — (16) — 20 — 4

Restricted stock activity — — — 18 (2) 1 — 17

Amortization of restricted stock compensation — — — — — 27 — 27

Change in equity related to the sale of subsidiary — — — (23) — (16) — (39)

Issuance of stock for employee benefit plans and other — — — (1) — 4 — 3

Balance, December 31, 2014 $1,225 525 $550 $9,089 $13,295 ($1,032)($122) $23,005

1 At December 31, 2014, includes ($1,119) million for treasury stock, ($21) million for compensation element of restricted stock, and $108 million for noncontrolling interest.

At December 31, 2013, includes ($684) million for treasury stock, ($50) million for compensation element of restricted stock, and $119 million for noncontrolling interest.

At December 31, 2012, includes ($656) million for treasury stock, ($48) million for compensation element of restricted stock, and $114 million for noncontrolling interest.

2 At December 31, 2014, includes $298 million in unrealized net gains on AFS securities, $97 million in unrealized net gains on derivative financial instruments, and ($517) million related to

employee benefit plans.

At December 31, 2013, includes ($77) million in unrealized net gains on AFS securities, $279 million in unrealized net gains on derivative financial instruments, and ($491) million related to

employee benefit plans.

At December 31, 2012, includes $520 million in unrealized net gains on AFS securities, $532 million in unrealized net gains on derivative financial instruments, and ($743) million related to

employee benefit plans.

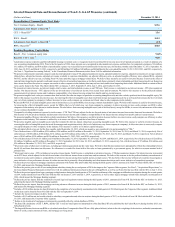

3 For the year ended December 31, 2014, dividends were $4,056 per share for both Perpetual Preferred Stock Series A and B, and $5,875 per share for Perpetual Preferred Stock Series E.

For the year ended December 31, 2013, dividends were $4,056 per share for both Perpetual Preferred Stock Series A and B, and $5,793 per share for Perpetual Preferred Stock Series E.

For the year ended December 31, 2012, dividends were $4,052 per share for both Perpetual Preferred Stock Series A and B.

See Notes to Consolidated Financial Statements.