SunTrust 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

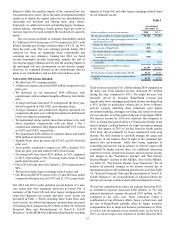

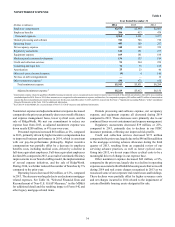

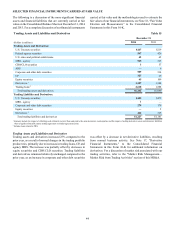

Selected Loan Maturity Data Table 8

(Dollars in millions)

At December 31, 2014

Total 1 year or less 1-5 years After 5 years

Loan Maturity

C&I and CRE 1$66,863 $19,905 $40,953 $6,005

Commercial construction 1,211 191 944 76

Total $68,074 $20,096 $41,897 $6,081

Interest Rate Sensitivity:

Selected loans with:

Predetermined interest rates $4,872 $3,172

Floating or adjustable interest rates 37,025 2,909

Total $41,897 $6,081

1 Excludes $4.6 billion in lease financing and $687 million in installment loans.

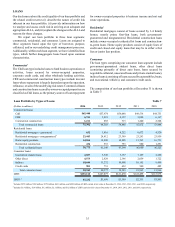

Table 9 shows our commercial lending exposure to select industries at December 31:

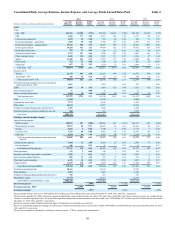

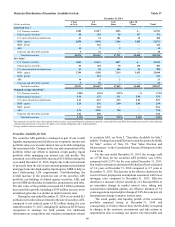

Funded Exposures by Selected Industries Table 9

2014 2013

(Dollars in millions) Commercial

loans % of total

commercial Commercial

loans % of total

commercial

Real Estate $11,343 15% $8,500 13%

Diversified Financials and Insurance 9,018 12 7,249 11

Consumer Products and Services 8,822 12 8,152 13

Health Care & Pharmaceuticals 6,329 9 5,995 9

Automotive 5,638 8 4,604 7

Energy and Utilities 5,393 7 3,971 6

Government 4,457 6 5,036 8

Retailing 4,132 6 3,715 6

Diversified Commercial Services and Supplies 3,759 5 3,460 5

Capital Goods 3,338 4 3,057 5

Media & Telecommunication Services 2,681 4 2,494 4

Transportation 2,317 3 1,896 3

Technology (Hardware & Software) 1,967 3 1,226 2

Religious Organizations/Non-Profits 1,959 3 1,899 3

Materials 1,934 3 1,860 3

Other Industries 305 — 1,196 2

Total commercial loans $73,392 100% $64,310 100%

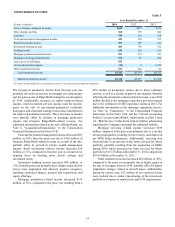

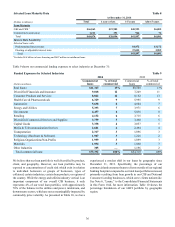

We believe that our loan portfolio is well diversified by product,

client, and geography. However, our loan portfolio may be

exposed to concentrations of credit risk which exist in relation

to individual borrowers or groups of borrowers, types of

collateral, certain industries, certain loan products, or regions of

the country. While the energy and utilities industry vertical is an

important component of our overall CIB business, it only

represents 4% of our total loan portfolio, with approximately

70% of the balance in the utilities and power, midstream, and

downstream sectors, which are not as meaningfully impacted by

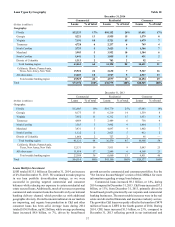

commodity price volatility. As presented in Table 10, we have

experienced a modest shift in our loans by geography since

December 31, 2013. Specifically, the percentage of our

commercial and consumer loans to clients outside of our regional

banking footprint compared to our total loan portfolio increased,

primarily resulting from loan growth in our CIB and National

Consumer Lending businesses, which serve clients nationwide.

See Note 6, “Loans,” to the Consolidated Financial Statements

in this Form 10-K for more information. Table 10 shows the

percentage breakdown of our LHFI portfolio by geographic

region.