SunTrust 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

decreased to $4.2 billion at December 31, 2014 from $4.9 billion

at December 31, 2013.

As mentioned above, the Bank and Parent Company

maintain programs to access the debt capital markets. The Parent

Company maintains a SEC shelf registration from which it may

issue senior or subordinated notes and various capital securities

such as common or preferred stock. Our Board has authorized

the issuance of up to $5.0 billion of such securities, of which

approximately $2.4 billion of issuance capacity remained

available at December 31, 2014.

The Bank maintains a Global Bank Note program under

which it may issue senior or subordinated debt with various

terms. At December 31, 2014, the Bank retained $35.4 billion of

remaining capacity to issue notes under the Global Bank Note

program.

Our issuance capacity under these Bank and Parent

Company programs refers to authorization granted by our Board,

which is formal program capacity and not a commitment to

purchase by any investor. Debt and equity securities issued under

these programs are designed to appeal primarily to domestic and

international institutional investors. Institutional investor

demand for these securities depends upon numerous factors,

including but not limited to our credit ratings and investor

perception of financial market conditions and the health of the

banking sector. Therefore, our ability to access these markets in

the future could be impaired for either systemic or idiosyncratic

reasons.

We assess liquidity needs that may occur in both the normal

course of business and times of unusual adverse events,

considering both on and off-balance sheet arrangements and

commitments that may impact liquidity in certain business

environments. We have contingency funding scenarios and plans

that assess liquidity needs that may arise from certain stress

events such as severe economic recessions, financial market

disruptions, and credit rating downgrades. In particular, a ratings

downgrade could adversely impact the cost and availability of

some of our liquid funding sources. Factors that affect our credit

ratings include, but are not limited to, the credit risk profile of

our assets, the adequacy of our ALLL, the level and stability of

our earnings, the liquidity profile of both the Bank and the Parent

Company, the economic environment, and the adequacy of our

capital base. As illustrated in Table 28, at December 31, 2014,

both Moody’s and S&P and Fitch maintained a "Stable" outlook

on our credit ratings based on our improving overall risk profile

and asset quality, solid liquidity profile, and sound capital

position, while Fitch maintained a “Positive” outlook on our

credit ratings. Future credit rating downgrades are possible,

although not currently anticipated given the “Positive” and

“Stable” credit rating outlooks.

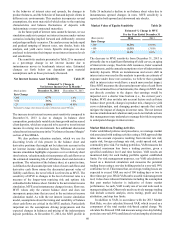

Debt Credit Ratings and Outlook Table 28

December 31, 2014

Moody’s S&P Fitch

SunTrust Banks, Inc.

Short-term P-2 A-2 F2

Senior long-term Baa1 BBB+ BBB+

SunTrust Bank

Short-term P-2 A-2 F2

Senior long-term A3 A- BBB+

Outlook Stable Stable Positive

Although the Company's investment portfolio is a use of

funds, we manage that investment portfolio primarily as a store

of liquidity, maintaining substantially all (approximately 96%)

of our securities in liquid and high-grade asset classes such as

agency MBS, agency debt, and U.S. Treasury securities; nearly

all of those liquid, high-grade securities qualify as high-quality

liquid assets under the U.S. LCR Final Rule. At December 31,

2014, the Company's AFS investment portfolio contained $22.2

billion of unencumbered high-quality, liquid securities at book

value.

As mentioned above, we maintain contingency funding

scenarios to anticipate and manage the likely impact of impaired

capital markets access and other adverse liquidity circumstances.

Our contingency plans also provide for continuous monitoring

of net borrowed funds dependence and available sources of

contingency liquidity. These sources of contingency liquidity

include available cash reserves; the ability to sell, pledge, or

borrow against unencumbered securities in the Company’s

investment portfolio; the capacity to borrow from the FHLB

system; and the capacity to borrow at the Federal Reserve

Discount Window.

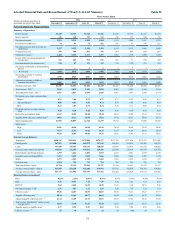

Table 29 presents year end and average balances from these

four sources as of and for the years ended December 31, 2014

and 2013. We believe these contingency liquidity sources exceed

any contingent liquidity needs measured in our contingency

funding scenarios.

Contingency Liquidity Sources Table 29

December 31, 2014 December 31, 2013

(Dollars in billions) As of

Average

for the

Year

Ended ¹ As of

Average

for the

Year

Ended ¹

Excess reserves $4.5 $3.5 $1.3 $1.6

Free and liquid investment

portfolio securities 22.2 13.8 10.0 11.5

FHLB borrowing capacity 8.4 13.2 12.3 13.1

Discount Window borrowing

capacity 18.4 19.2 20.8 19.5

Total $53.5 $49.7 $44.4 $45.7

1 Average based upon month-end data, except excess reserves, which is based upon a daily

average.