SunTrust 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

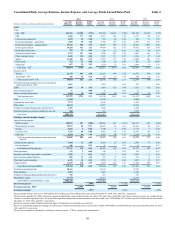

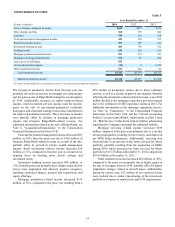

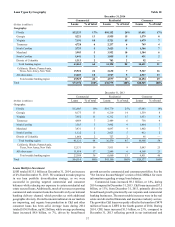

Consolidated Daily Average Balances, Income/Expense, and Average Yields Earned/Rates Paid Table 2

2014 2013 2012

(Dollars in millions; yields on taxable-equivalent basis) Average

Balances Income/

Expense Yields/

Rates Average

Balances Income/

Expense Yields/

Rates Average

Balances Income/

Expense Yields/

Rates

Assets

Loans: 1

C&I - FTE 2$61,181 $2,184 3.57% $54,788 $2,181 3.98% $51,228 $2,329 4.55%

CRE 6,150 177 2.88 4,513 146 3.24 4,517 165 3.65

Commercial construction 1,078 35 3.28 701 24 3.46 816 31 3.79

Residential mortgages - guaranteed 1,890 70 3.68 3,708 106 2.85 5,589 165 2.96

Residential mortgages - nonguaranteed 23,691 944 3.99 23,007 958 4.17 22,621 1,023 4.52

Home equity products 14,329 512 3.57 14,474 525 3.63 14,962 551 3.68

Residential construction 457 21 4.64 549 27 4.91 692 36 5.17

Guaranteed student loans 5,375 197 3.66 5,426 207 3.82 6,863 265 3.87

Other consumer direct 3,635 153 4.22 2,535 111 4.37 2,226 97 4.34

Indirect 11,459 366 3.19 11,072 377 3.41 10,468 403 3.85

Credit cards 772 75 9.64 646 62 9.66 567 57 10.06

Nonaccrual 3857 22 2.59 1,238 33 2.63 2,344 31 1.32

Total loans - FTE 130,874 4,756 3.63 122,657 4,757 3.88 122,893 5,153 4.19

Securities AFS:

Taxable 23,779 603 2.54 22,383 569 2.54 21,875 640 2.93

Tax-exempt - FTE 2245 13 5.26 258 13 5.18 368 20 5.33

Total securities AFS - FTE 24,024 616 2.56 22,641 582 2.57 22,243 660 2.97

Fed funds sold and securities borrowed or purchased

under agreements to resell 1,067 — — 1,024 — 0.02 897 — 0.04

LHFS 2,085 78 3.75 3,096 107 3.44 3,267 112 3.41

Interest-bearing deposits 31 — 0.08 21 — 0.09 22 — 0.21

Interest earning trading assets 4,108 76 1.86 4,289 69 1.61 4,157 65 1.55

Total earning assets 162,189 5,526 3.41 153,728 5,515 3.59 153,479 5,990 3.90

ALLL (1,995) (2,121)(2,295)

Cash and due from banks 5,773 4,530 5,482

Other assets 14,674 14,287 14,854

Noninterest earning trading assets and derivatives 1,255 1,660 2,184

Unrealized gains on securities available for sale, net 280 413 2,430

Total assets $182,176 $172,497 $176,134

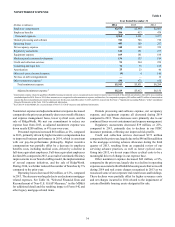

Liabilities and Shareholders’ Equity

Interest-bearing deposits:

NOW accounts $28,879 $22 0.08% $26,083 $17 0.07% $22,155 $23 0.09%

Money market accounts 44,813 66 0.15 42,655 54 0.13 42,101 88 0.21

Savings 6,076 2 0.04 5,740 3 0.05 5,113 5 0.10

Consumer time 7,539 66 0.88 9,018 102 1.13 10,597 145 1.37

Other time 4,294 46 1.06 4,937 64 1.29 5,954 91 1.52

Total interest-bearing consumer and commercial

deposits 91,601 202 0.22 88,433 240 0.27 88,920 352 0.40

Brokered time deposits 1,584 33 2.08 2,030 51 2.49 2,204 77 3.42

Foreign deposits 146 — 0.12 35 — 0.13 51 — 0.17

Total interest-bearing deposits 93,331 235 0.25 90,498 291 0.32 91,175 429 0.47

Funds purchased 931 1 0.09 639 1 0.10 798 1 0.11

Securities sold under agreements to repurchase 2,202 3 0.14 1,857 3 0.14 1,602 3 0.18

Interest-bearing trading liabilities 806 21 2.65 705 17 2.45 676 15 2.24

Other short-term borrowings 6,135 14 0.23 4,953 13 0.26 6,952 18 0.27

Long-term debt 12,359 270 2.19 9,872 210 2.12 11,806 299 2.53

Total interest-bearing liabilities 115,764 544 0.47 108,524 535 0.49 113,009 765 0.68

Noninterest-bearing deposits 40,411 38,643 37,329

Other liabilities 3,473 3,602 4,348

Noninterest-bearing trading liabilities and derivatives 358 561 953

Shareholders’ equity 22,170 21,167 20,495

Total liabilities and shareholders’ equity $182,176 $172,497 $176,134

Interest rate spread 2.94% 3.10% 3.22%

Net interest income - FTE 4$4,982 $4,980 $5,225

Net interest margin 53.07% 3.24% 3.40%

1 Interest income includes loan fees of $196 million, $153 million, and $112 million for the years ended December 31, 2014, 2013, and 2012, respectively.

2 Interest income includes the effects of taxable-equivalent adjustments using a federal income tax rate of 35% and, where applicable, state income taxes to increase tax-exempt interest

income to a taxable-equivalent basis. The net taxable-equivalent adjustment amounts included in the above table were $142 million, $127 million, and $123 million for the years ended

December 31, 2014, 2013, and 2012, respectively.

3 Income on consumer and residential nonaccrual loans, if recognized, is recognized on a cash basis.

4 Derivative instruments employed to manage our interest rate sensitivity increased net interest income $419 million, $444 million, and $528 million for the years ended December 31, 2014,

2013, and 2012, respectively.

5 The net interest margin is calculated by dividing net interest income – FTE by average total earning assets.