SunTrust 2014 Annual Report Download - page 168

Download and view the complete annual report

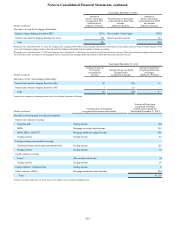

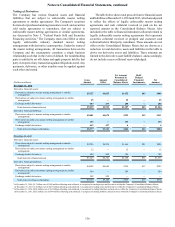

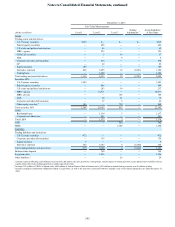

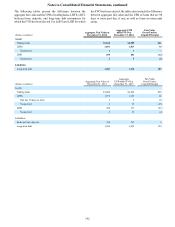

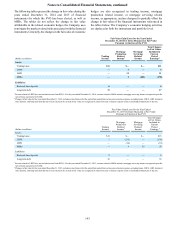

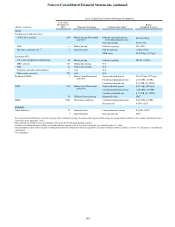

Please find page 168 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

145

these securities had high investment grade ratings; however,

through the credit crisis, they have experienced deterioration in

credit quality leading to downgrades to non-investment grade

levels. Generally, the Company obtains pricing for its securities

from an independent pricing service. The Company evaluates

third party pricing to determine the reasonableness of the

information relative to changes in market data, such as any

recent trades, market information received from outside market

participants and analysts, and/or changes in the underlying

collateral performance. Even though third party pricing has been

available, the Company continued to classify private MBS as

level 3, as the Company believes that this third party pricing

relies on significant unobservable assumptions, as evidenced by

a persistently wide bid-ask price range and variability in pricing

from the pricing services, particularly for the vintage and

exposures held by the Company.

These securities that are classified as AFS are in a small net

unrealized gain position at December 31, 2014. See Note 5,

“Securities Available for Sale,” for details regarding

assumptions used to value private MBS.

CLO securities

The Company has CLO preference share exposure valued at $3

million at December 31, 2014. The Company estimated fair

value based on pricing from observable trading activity for

similar securities. Accordingly, the Company has classified

these instruments as level 2.

The Company’s investments in level 3 trading CDOs at

December 31, 2013 consisted of senior ARS interests in

Company-sponsored securitizations of trust preferred collateral.

The auctions related to these securities were failing, requiring

the Company to make significant adjustments to valuation

assumptions. As such, the Company classified these as level 3

investments. The Company valued these interests utilizing a

pricing matrix based on a range of overcollateralization levels

that was periodically updated based on discussions with the

dealer community and limited trade data. Under this modified

approach, at December 31, 2013, all CDO ARS were valued

using a simplified discounted cash flow approach that prices the

securities to their expected maturity. The primary inputs and

assumptions considered by the Company in valuing these

retained interests were overcollateralization levels (impacted by

credit losses) and the discount margin over LIBOR. See the level

3 assumptions table in this note for information on the sensitivity

of these interests to changes in the assumptions. The Company

sold all of its level 3 investments in trading CDOs during 2014.

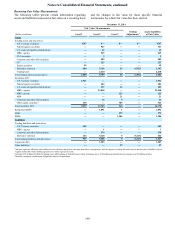

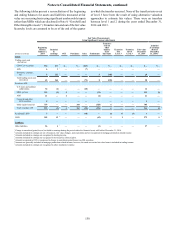

Asset-Backed Securities

Level 2 ABS classified as securities AFS at December 31, 2013

were primarily interests collateralized by third party

securitizations of 2009 through 2011 vintage auto loans. These

ABS were either publicly traded or 144A privately placed bonds.

The Company utilized an independent pricing service to obtain

fair values for publicly traded securities and similar securities

for estimating the fair value of the privately placed bonds. No

significant unobservable assumptions were used in pricing the

auto loan ABS, therefore, the Company classified these bonds

as level 2. The Company sold all of its interests in these level 2

ABS during 2014.

Level 3 ABS classified as securities AFS includes

purchased interests in third party securitizations collateralized

by home equity loans and are valued based on third party pricing

with significant unobservable assumptions. At December 31,

2013 trading ARS consisted of student loan ABS that were

generally collateralized by FFELP student loans, the majority

of which benefited from a maximum guarantee amount of 97%.

However, for valuations of subordinate securities in the same

structure, the Company adjusts valuations on the senior

securities based on the likelihood that the issuer will refinance

in the near term, a security’s level of subordination in the

structure, and/or the perceived risk of the issuer as determined

by credit ratings or total leverage of the trust. These adjustments

may be significant; therefore, the subordinate student loan ARS

held as trading assets was classified as level 3. The Company

sold the remaining interests in these subordinate student loan

ARS during 2014.

Corporate and other debt securities

Corporate debt securities are predominantly comprised of senior

and subordinate debt obligations of domestic corporations and

are classified as level 2. Other debt securities in level 3 primarily

include bonds that are redeemable with the issuer at par and

cannot be traded in the market; as such, observable market data

for these instruments is not available.

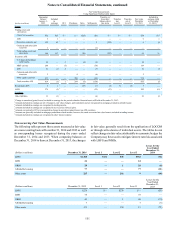

Commercial Paper

From time to time, the Company acquires third party CP that is

generally short-term in nature (less than 30 days) and highly

rated. The Company estimates the fair value of this CP based

on observable pricing from executed trades of similar

instruments; thus, CP is classified as level 2.

Equity securities

Level 3 equity securities classified as securities AFS include

FHLB of Atlanta stock and Federal Reserve Bank of Atlanta

stock, which are redeemable with the issuer at cost and cannot

be traded in the market. As such, observable market data for

these instruments is not available. The Company accounts for

the stock based on industry guidance that requires these

investments be carried at cost and evaluated for impairment

based on the ultimate recovery of cost.

Derivative contracts

The Company holds derivative instruments for both trading

purposes and risk management purposes.

Level 1 derivative contracts generally include exchange-

traded futures or option contracts for which pricing is readily

available. The Company’s level 2 instruments are

predominantly standard OTC swaps, options, and forwards,

measured using observable market assumptions for interest

rates, foreign exchange, equity, and credit. Because fair values

for OTC contracts are not readily available, the Company

estimates fair values using internal, but standard, valuation

models. The selection of valuation models is driven by the type

of contract: for option-based products, the Company uses an

appropriate option pricing model such as Black-Scholes. For

forward-based products, the Company’s valuation methodology

is generally a discounted cash flow approach.

Level 2 derivative instruments are primarily transacted in

the institutional dealer market and priced with observable