SunTrust 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

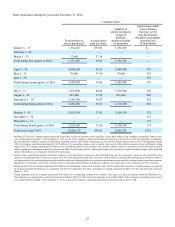

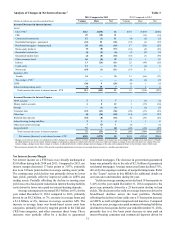

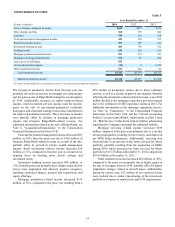

Item 6. SELECTED FINANCIAL DATA

Year Ended December 31

(Dollars in millions and shares in thousands, except per share data) 2014 2013 2012 2011 2010

Summary of Operations:

Interest income $5,384 $5,388 $5,867 $6,181 $6,343

Interest expense 544 535 765 1,116 1,489

Net interest income 4,840 4,853 5,102 5,065 4,854

Provision for credit losses 342 553 1,395 1,513 2,651

Net interest income after provision for credit losses 4,498 4,300 3,707 3,552 2,203

Noninterest income 3,323 3,214 5,373 3,421 3,729

Noninterest expense 15,543 5,831 6,284 6,194 5,867

Income before provision/(benefit) for income taxes 2,278 1,683 2,796 779 65

Provision/(benefit) for income taxes 1493 322 812 119 (141)

Net income attributable to noncontrolling interest 11 17 26 13 17

Net income $1,774 $1,344 $1,958 $647 $189

Net income/(loss) available to common shareholders $1,722 $1,297 $1,931 $495 ($87)

Adjusted net income/(loss) available to common shareholders 2$1,729 $1,476 $1,178 $495 ($87)

Net interest income - FTE 2$4,982 $4,980 $5,225 $5,179 $4,970

Total revenue - FTE 28,305 8,194 10,598 8,600 8,699

Total revenue - FTE, excluding net securities (losses)/gains 2 8,320 8,192 8,624 8,483 8,508

Total adjusted revenue - FTE 28,200 8,257 9,123 8,600 8,699

Net income/(loss) per average common share:

Diluted 33.23 2.41 3.59 0.94 (0.18)

Adjusted diluted 2, 3 3.24 2.74 2.19 0.94 (0.18)

Basic 3.26 2.43 3.62 0.94 (0.18)

Dividends paid per average common share 0.70 0.35 0.20 0.12 0.04

Book value per common share 41.52 38.61 37.59 36.86 36.34

Tangible book value per common share 229.82 27.01 25.98 25.18 23.76

Market capitalization 21,978 19,734 15,279 9,504 14,768

Market price:

High 43.06 36.99 30.79 33.14 31.92

Low 33.97 26.93 18.07 15.79 20.16

Close 41.90 36.81 28.35 17.70 29.51

Period End Balances:

Total assets $190,328 $175,335 $173,442 $176,859 $172,874

Earning assets 168,678 156,856 151,223 154,696 148,473

Loans 133,112 127,877 121,470 122,495 115,975

ALLL 1,937 2,044 2,174 2,457 2,974

Consumer and commercial deposits 139,234 127,735 130,180 125,611 120,025

Brokered time and foreign deposits 1,333 2,024 2,136 2,311 3,019

Long-term debt 13,022 10,700 9,357 10,908 13,648

Total shareholders’ equity 23,005 21,422 20,985 20,066 23,130

Selected Average Balances:

Total assets $182,176 $172,497 $176,134 $172,440 $172,375

Earning assets 162,189 153,728 153,479 147,802 147,187

Loans 130,874 122,657 122,893 116,308 113,925

Consumer and commercial deposits 132,012 127,076 126,249 122,672 117,129

Brokered time and foreign deposits 1,730 2,065 2,255 2,386 2,916

Intangible assets including MSRs 7,630 7,535 7,322 7,780 7,837

MSRs 1,255 1,121 887 1,331 1,317

Preferred stock 800 725 290 1,328 4,929

Total shareholders’ equity 22,170 21,167 20,495 20,696 22,834

Average common shares - diluted 533,391 539,093 538,061 527,618 498,744

Average common shares - basic 527,500 534,283 534,149 523,995 495,361

Financial Ratios:

Effective tax rate 1, 4 22% 19% 29% 16% NM

ROA 0.97 0.78 1.11 0.38 0.11

ROE 8.06 6.34 9.56 2.56 (0.49)

ROTCE 211.33 9.25 14.02 3.83 (0.76)

Net interest margin - FTE 23.07 3.24 3.40 3.50 3.38

Efficiency ratio 1 66.74 71.16 59.29 72.02 67.44

Tangible efficiency ratio 1, 266.44 70.89 58.86 71.52 66.85

Adjusted tangible efficiency ratio 1, 263.34 65.27 66.91 71.52 66.85

Total average shareholders’ equity to total average assets 12.17 12.27 11.64 12.00 13.25

Tangible equity to tangible assets 29.17 9.00 8.82 8.10 10.12

ALLL to period-end loans 1.46 1.60 1.80 2.01 2.58

NPAs to period-end loans, OREO, other repossessed assets, and nonperforming LHFS 0.59 0.91 1.52 2.76 4.08

Common dividend payout ratio 521.5 14.5 5.6 12.9 N/A