SunTrust 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

helped to offset the negative impact of the sustained low rate

environment on revenues. These favorable developments helped

enable us to double the capital return for our shareholders by

increasing our dividend and buying back more shares.

Separately, we addressed several outstanding legacy mortgage-

related matters, including a fourth quarter legal provision to

increase legal reserves and complete the resolution of a specific

matter.

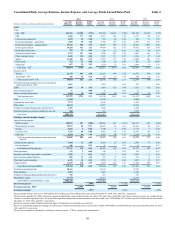

Our net income available to common shareholders totaled

$1.7 billion for 2014, an increase of 33% compared to 2013, with

diluted earnings per average common share of $3.23, up 34%

from the prior year. Our core earnings growth during 2014

reflected our focus on expanding client relationships and

executing our core strategies. Coming into 2014, we faced

several meaningful revenue headwinds, namely the end of

elevated mortgage refinance activity and the ongoing impact of

the prolonged low rate environment on net interest margin.

However, we remained focused on the commitments that we

made to our stakeholders, and we delivered on those goals.

Noteworthy 2014 items included:

• We delivered 33% earnings growth;

• Noninterest expense decreased $288 million compared to the

prior year;

• We delivered on our announced 2014 efficiency ratio

commitment, with an adjusted tangible efficiency ratio below

64%;

• Average total loans increased 7% compared to the prior year,

driven by growth in C&I, CRE, and consumer loans;

• Average consumer and commercial deposits increased 4%

compared to the prior year, with the favorable mix shift toward

lower-cost deposits continuing;

• We maintained strong capital ratios that continue to be well

above regulatory requirements, with our Basel I Tier 1

common and estimated, fully phased-in Basel III CET 1 ratios

at 9.60% and 9.69%, respectively;

• We repurchased $458 million of common shares and issued

$500 million of preferred stock;

• Tangible book value per share was $29.82, up 10% from the

prior year;

• Asset quality continued to improve as NPLs declined 35%

from the prior year and totaled 0.48% of total loans;

• Net charge-offs were down $233 million, or 34%, compared

to 2013, representing 0.34% of average loans, down 21 basis

points from the prior year;

• Our LCR is already above the January 1, 2016 requirement of

90%;

• We resolved many legacy mortgage-related issues; and

• Our ROA and ROTCE improved by 19 and 208 basis points

compared to the prior year, to 0.97% and 11.33%, respectively.

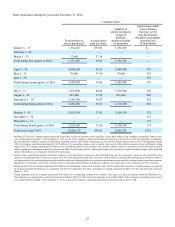

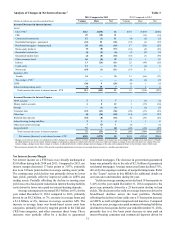

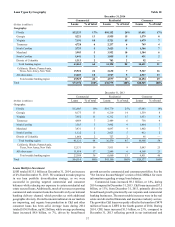

Our 2014 and 2013 results included several matters of a non-

core nature that were separately disclosed in Forms 8-K. A

summary of the Form 8-K and other legacy mortgage-related

items that impacted our current and prior years' results are

presented in Table 1. When excluding these items from each

year's results, our diluted earnings per common share increased

18% during 2014, compared to 2013. Refer to Table 34, "Selected

Financial Data and Reconcilement of Non-U.S. GAAP

Measures," in this MD&A for additional detail and the resulting

impacts of Form 8-K and other legacy mortgage-related items

on our financial results.

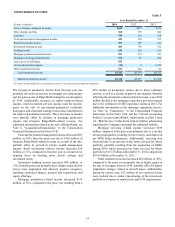

Table 1

Year Ended

December 31

(Dollars in millions, except per share amounts) 2014 2013

Net income available to common shareholders $1,722 $1,297

Form 8-K and other legacy mortgage-related items

impacting the periods:

Charges for legacy mortgage-related matters 324 482

Gain on sale of RidgeWorth (105) —

Tax benefit related to above items (82) (190)

Tax benefit related to completion of tax authority

examination (130) —

Net tax benefit related to subsidiary reorganization

and other —(113)

Adjusted net income available to common

shareholders $1,729 $1,476

Net income per average common share, diluted $3.23 $2.41

Adjusted net income per average common share,

diluted $3.24 $2.74

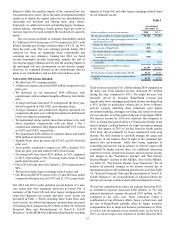

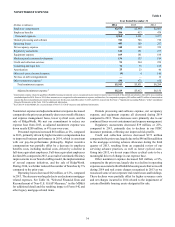

Total revenue increased $111 million during 2014 compared to

the prior year. Total adjusted revenue decreased $57 million

during the year, compared to 2013. The slight decrease was

primarily driven by foregone RidgeWorth revenue and

significantly lower mortgage production income resulting from

a 45% decline in production volume due to lower refinance

activity. Largely offsetting these reductions were higher

investment banking, mortgage servicing, and retail investment

services income, as well as gains on the sale of mortgage LHFS.

Net interest income for 2014 was relatively flat compared to

2013, as strong loan growth offset a 17 basis point decline in net

interest margin. Looking forward, we expect net interest margin

in the first quarter of 2015 to decline from the fourth quarter

2014 level, driven primarily by lower commercial loan swap

income. We will continue to carefully manage the usage and

sensitivity of our balance sheet in light of the continued low

interest rate environment, while also being cognizant of

controlling interest rate risk in advance of what we expect will

eventually be higher interest rates. See additional discussion

related to revenue, noninterest income, and net interest income

and margin in the "Noninterest Income" and "Net Interest

Income/Margin" sections of this MD&A. Also in this MD&A,

see Table 25, "Net Interest Income Asset Sensitivity," for an

analysis of potential changes in net interest income due to

instantaneous moves in benchmark interest rates, as well as Table

34, "Selected Financial Data and Reconcilement of Non-U.S.

GAAP Measures," for reconciliations of adjusted diluted net

income per average common share and total adjusted revenue.

We met our commitment to reduce our expense base from 2013,

as noninterest expense decreased $288 million, or 5%, and

adjusted noninterest expense decreased $193 million, or 4%,

compared to the prior year. These reductions reflect a

combination of our efficiency efforts, lower cyclical costs, and

the sale of RidgeWorth, partially offset by higher incentive

compensation due to improved business performance in 2014,

as well as our investments in key growth areas. As we look to

2015, we do not expect core expenses to decline from the 2014