SunTrust 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

simulation approach based on a continuous twelve-month

historical window that reflects a period of significant financial

stress to our portfolio. As such, our Stressed VAR calculation

uses the same methodology and models as regular VAR, which

is a requirement under the Market Risk Rule.

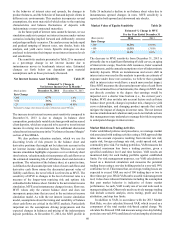

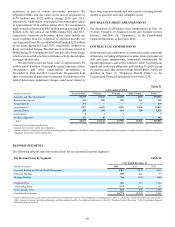

Table 27 presents VAR and Stressed VAR for the year ended

December 31, as well as VAR by Risk Factor at December 31,

2014 and 2013:

Value at Risk Profile Table 27

Year Ended December 31

(Dollars in millions) 2014 2013

VAR (1-day holding period):

Ending $1 $3

High 38

Low 12

Average 24

Stressed VAR (10-day holding period):

Ending $41 $29

High 83 92

Low 18 11

Average 43 27

(Dollars in millions) December 31,

2014 December 31,

2013

VAR by Risk Factor (1-day holding period):

Equity risk $1 $2

Interest rate risk 12

Credit spread risk 12

VAR total (1-day diversified) 1 3

The trading portfolio, measured in terms of VAR, is

predominantly comprised of four material sub-portfolios of

covered positions: Credit Trading, Fixed Income Securities,

Interest Rate Derivatives, and Equity Derivatives. While there

were no material changes in composition of the trading portfolio

during 2014, there was a reduction in average daily VAR during

2014 compared to 2013. This was driven primarily by lower

levels of volatility as well as some risk reducing activities in the

trading portfolio. Daily VAR decreased to $1 million at

December 31, 2014 compared to $3 million at December 31,

2013. The trading portfolio of covered positions did not contain

any correlation trading positions or on- or off-balance sheet

securitization positions during 2014.

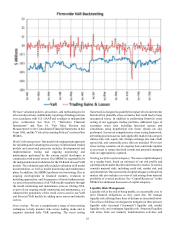

In accordance with the Market Risk Rule, we evaluate the

accuracy of our VAR model through daily backtesting by

comparing daily trading gains and losses (excluding fees,

commissions, reserves, net interest income, and intraday trading)

with the corresponding daily VAR-based measures. As

illustrated below for the year ended December 31, 2014, there

was one instance in the fourth quarter where trading losses

exceeded firmwide VAR which created a backtest exception.

This was primarily driven by the widening of credit spreads in

the corporate debt markets. The actual number of backtesting

exceptions over the preceding 12 months is used to determine

the multiplication factor for the VAR-based capital requirement

under the Market Risk Rule, whereby the capital multiplication

factor increases from a minimum of three to a maximum of four,

depending on the number of exceptions. This exception did not

result in an increase in the capital multiplication factor.