SunTrust 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

100

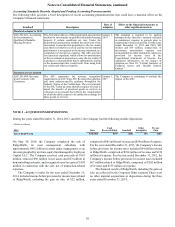

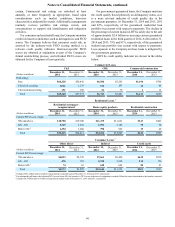

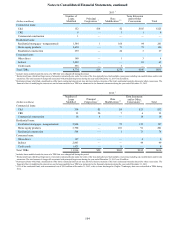

The payment status for the LHFI portfolio is shown in the tables below:

December 31, 2014

(Dollars in millions) Accruing

Current

Accruing

30-89 Days

Past Due

Accruing

90+ Days

Past Due Nonaccruing 2Total

Commercial loans:

C&I $65,246 $36 $7 $151 $65,440

CRE 6,716 3 1 21 6,741

Commercial construction 1,209 1 — 1 1,211

Total commercial loans 73,171 40 8 173 73,392

Residential loans:

Residential mortgages - guaranteed 176 34 422 — 632

Residential mortgages - nonguaranteed123,067 108 14 254 23,443

Home equity products 13,989 101 — 174 14,264

Residential construction 402 7 — 27 436

Total residential loans 37,634 250 436 455 38,775

Consumer loans:

Guaranteed student loans 3,801 425 601 — 4,827

Other direct 4,545 19 3 6 4,573

Indirect 10,537 104 3 — 10,644

Credit cards 887 8 6 — 901

Total consumer loans 19,770 556 613 6 20,945

Total LHFI $130,575 $846 $1,057 $634 $133,112

1 Includes $272 million of loans carried at fair value, the majority of which were accruing current.

2 Nonaccruing loans past due 90 days or more totaled $388 million. Nonaccruing loans past due fewer than 90 days include modified nonaccrual loans reported as TDRs and performing

second lien loans which are classified as nonaccrual when the first lien loan is nonperforming.

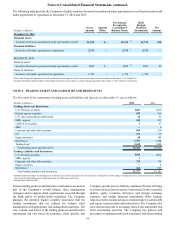

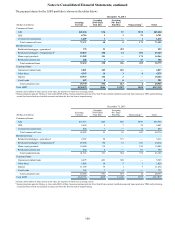

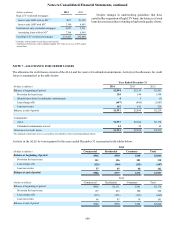

December 31, 2013

(Dollars in millions) Accruing

Current

Accruing

30-89 Days

Past Due

Accruing

90+ Days

Past Due Nonaccruing 2Total

Commercial loans:

C&I $57,713 $47 $18 $196 $57,974

CRE 5,430 5 7 39 5,481

Commercial construction 842 1 — 12 855

Total commercial loans 63,985 53 25 247 64,310

Residential loans:

Residential mortgages - guaranteed 2,787 58 571 — 3,416

Residential mortgages - nonguaranteed123,808 150 13 441 24,412

Home equity products 14,480 119 — 210 14,809

Residential construction 488 4 — 61 553

Total residential loans 41,563 331 584 712 43,190

Consumer loans:

Guaranteed student loans 4,475 461 609 — 5,545

Other direct 2,803 18 3 5 2,829

Indirect 11,189 75 1 7 11,272

Credit cards 718 7 6 — 731

Total consumer loans 19,185 561 619 12 20,377

Total LHFI $124,733 $945 $1,228 $971 $127,877

1 Includes $302 million of loans carried at fair value, the majority of which were accruing current.

2 Nonaccruing loans past due 90 days or more totaled $653 million. Nonaccruing loans past due fewer than 90 days include modified nonaccrual loans reported as TDRs and performing

second lien loans which are classified as nonaccrual when the first lien loan is nonperforming.