SunTrust 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

balance liquidity against investment returns. Over the longer

term, the size and composition of the investment portfolio will

reflect balance sheet trends, our overall liquidity position, and

interest rate risk management objectives. Accordingly, the size

and composition of the investment portfolio could change over

time.

Federal Home Loan Bank and Federal Reserve Bank Stock

We acquire capital stock in the FHLB of Atlanta as a precondition

for becoming a member of that institution. This enables us to

take advantage of competitively priced advances as a wholesale

funding source and to access grants and low-cost loans for

affordable housing and community development projects,

amongst other benefits. At December 31, 2014, we held a total

of $376 million of capital stock in the FHLB, an increase of $40

million compared to December 31, 2013. During the year ended

December 31, 2014, we recognized dividends related to FHLB

capital stock of $13 million, compared to $8 million during the

year ended December 31, 2013.

Similarly, to become a member of the Federal Reserve

System, regulations require that we hold a certain amount of

capital stock, determined as either a percentage of the Bank’s

capital or as a percentage of total deposit liabilities. At

December 31, 2014, we held $402 million of Federal Reserve

Bank of Atlanta stock, unchanged from December 31, 2013.

During the year ended December 31, 2014 and 2013, we

recognized dividends related to Federal Reserve Bank of Atlanta

stock of $24 million for both periods.

Investment in The Coca-Cola Company

Prior to September 2012, we owned common shares of The Coca-

Cola Company since 1919. These shares grew in value and were

classified as securities AFS with unrealized gains, net of tax,

recorded as a component of shareholders' equity. Because of the

low accounting cost basis of these shares, we accumulated

significant unrealized gains in shareholders' equity.

In September 2012, we divested our ownership of The Coca-

Cola Company shares through sales in the market, sales to the

counterparty under certain Agreements, and a charitable

contribution of shares. As a result of The Coca-Cola Company

stock sales, charitable contribution, and termination of the

Agreements, we recorded a pre-tax gain of approximately $1.9

billion during the year ended December 31, 2012. The execution

and termination of the Agreements is discussed further in Note

17, "Derivative Financial Instruments," to the Consolidated

Financial Statements in this Form 10-K.

DEPOSITS

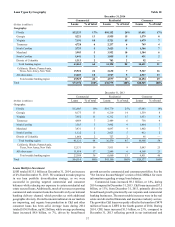

Composition of Average Deposits Table 18

Year Ended December 31 Percent of Total

(Dollars in millions) 2014 2013 2012 2014 2013 2012

Noninterest-bearing $40,411 $38,643 $37,329 30% 30% 29%

NOW accounts 28,879 26,083 25,155 22 20 20

Money market accounts 44,813 42,655 42,101 33 33 33

Savings 6,076 5,740 5,113 54 4

Consumer time 7,539 9,018 10,597 67 8

Other time 4,294 4,937 5,954 34 4

Total consumer and commercial deposits 132,012 127,076 126,249 99 98 98

Brokered time deposits 1,584 2,030 2,204 12 2

Foreign deposits 146 35 51 —— —

Total deposits $133,742 $129,141 $128,504 100% 100% 100%

During 2014, we experienced solid deposit growth and improved

deposit mix as the proportion of lower-cost deposit account

balances increased, while higher-cost time deposit account

balances decreased due to maturities. These favorable trends

contributed to our decline in interest expense on deposits during

the year.

Average consumer and commercial deposits increased $4.9

billion, or 4%, compared to 2013, driven by improved and broad-

based growth across all of our business segments. While a portion

of the low-cost deposit growth has been attributable to clients’

desires related to increased liquidity, a majority of the growth

reflects investments we have made in client-facing platforms, as

well as our overall increased focus on meeting more of our

clients' deposit needs through exceptional service and relevant

deposit products.

Consumer and commercial deposit growth remains one of

our key areas of focus. During 2014, we continued to focus on

deepening our relationships with existing clients, growing our

client base, and increasing deposits, while managing the rates

we pay for deposits. We maintained pricing discipline, through

a judicious use of competitive rates in select products and

markets as we allowed higher rate time deposits to run-off, while

growing balances in other deposit categories. Other initiatives

to attract deposits included advancements in analytics that

leverage client segmentation to identify optimal products and

solutions, as well as the deployment of new tools that enhance

client-facing teammates’ focus on providing clients with

personalized options and an exceptional client experience. We

continued to leverage our brand to improve our visibility in the

marketplace and to inspire client loyalty and capitalize on some

of the opportunities presented by the evolving banking

landscape.