SunTrust 2014 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

108

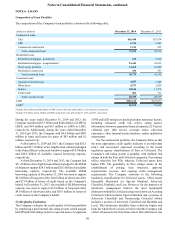

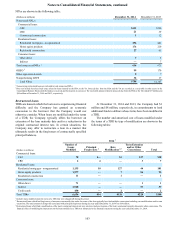

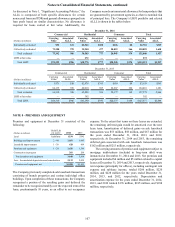

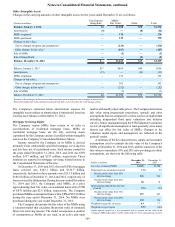

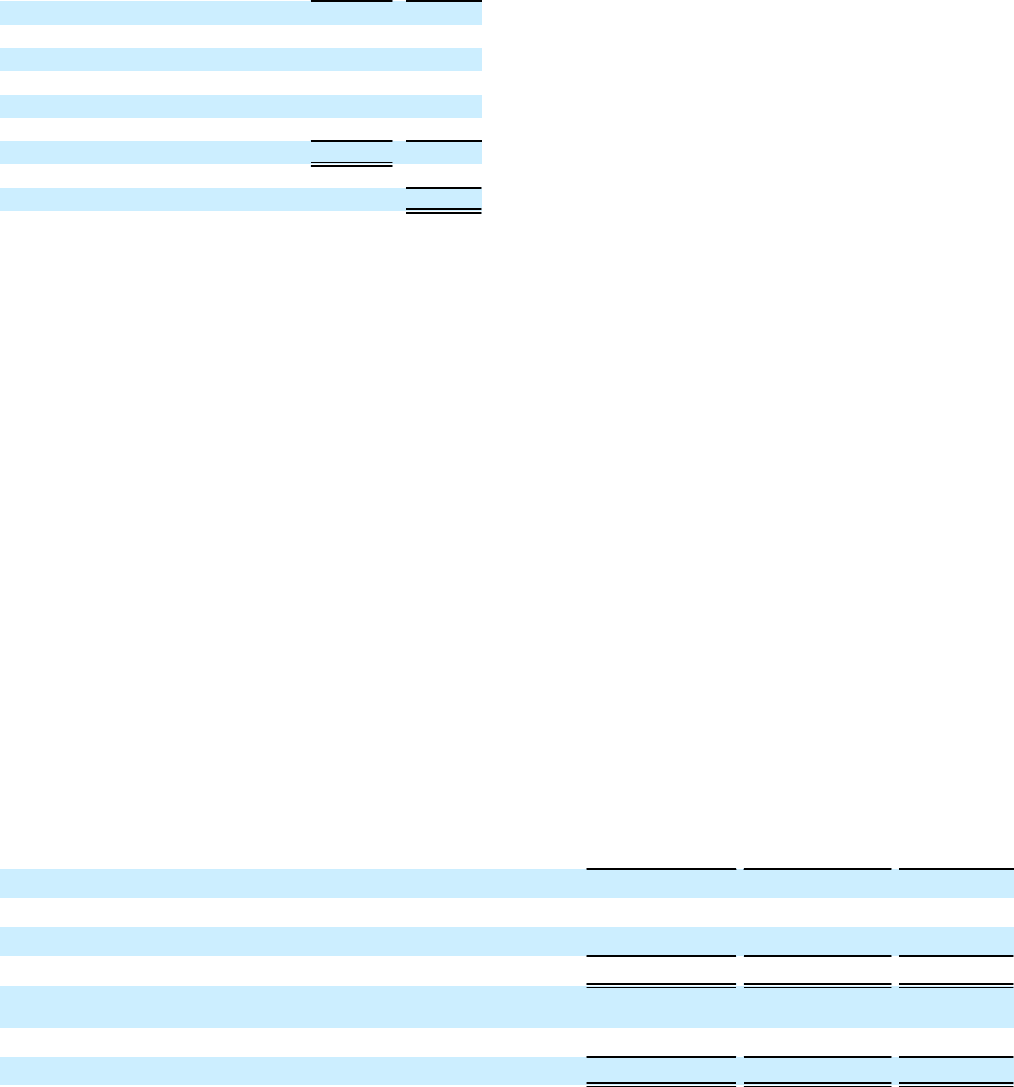

Various Company facilities are leased under capital leases

and noncancelable operating leases with initial remaining terms

in excess of one year. The following table presents future

minimum lease payments at December 31, 2014.

(Dollars in millions) Operating

Leases Capital

Leases

2015 $205 $2

2016 201 2

2017 183 2

2018 107 2

2019 87 3

Thereafter 328 —

Total minimum lease payments $1,111 11

Less: Amounts representing interest 2

Present value of net minimum lease payments $9

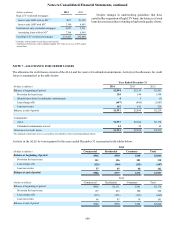

NOTE 9 – GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill

The Company evaluates goodwill for impairment each year as

of September 30, or as events occur or circumstances change

that would more-likely-than-not reduce the fair value of a

reporting unit below its carrying amount.

The fair value of a reporting unit is determined by using

discounted cash flow analyses and, when applicable, guideline

company information. The carrying value of a reporting unit is

determined using an equity allocation methodology that

allocates the total equity of the Company to each of its reporting

units considering both regulatory risk-based capital and tangible

equity relative to tangible assets. See Note 1, "Significant

Accounting Policies" for additional information regarding the

Company's goodwill accounting policy.

The Company performed a goodwill impairment analysis

for all of its reporting units with goodwill balances as of

September 30, 2014 and 2013, and based on the results of the

annual goodwill impairment test, the Company determined that

there was no impairment. The Company monitored events and

circumstances during the fourth quarter of 2014 and determined

that due to an increase in the carrying value of the Wholesale

Banking reporting unit, driven primarily by asset growth and

increased total equity of the Company, it was necessary to

perform an interim goodwill impairment analysis for the

Wholesale Banking reporting unit as of December 31, 2014.

Based on the results of the interim goodwill impairment analysis,

the Company determined that there was no impairment.

As discussed in Note 2, "Acquisitions/Dispositions," the

Company completed the sale of its asset management subsidiary,

RidgeWorth, during the second quarter of 2014. Also, during the

year ended December 31, 2013, branch-managed business

banking clients were transferred from Wholesale Banking to

Consumer Banking and Private Wealth Management, resulting

in the reallocation of $300 million in goodwill. The changes in

the carrying amount of goodwill by reportable segment for the

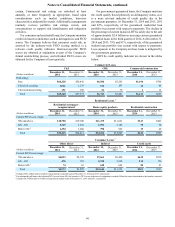

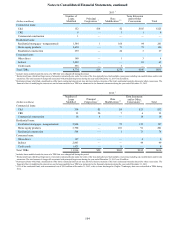

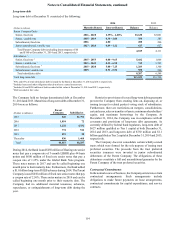

years ended December 31 are as follows:

(Dollars in millions)

Consumer Banking

and Private Wealth

Management Wholesale

Banking Total

Balance, January 1, 2014 $4,262 $2,107 $6,369

Acquisition of Lantana Oil and Gas Partners, Inc. — 8 8

Sale of RidgeWorth — (40) (40)

Balance, December 31, 2014 $4,262 $2,075 $6,337

Balance, January 1, 2013 $3,962 $2,407 $6,369

Intersegment transfers 300 (300) —

Balance, December 31, 2013 $4,262 $2,107 $6,369