SunTrust 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

93

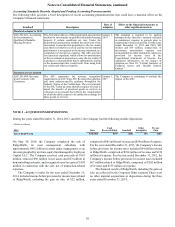

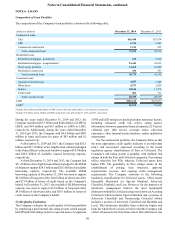

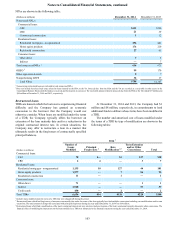

NOTE 3 - FEDERAL FUNDS SOLD AND SECURITIES FINANCING ACTIVITIES

Fed funds sold and securities borrowed or purchased under

agreements to resell were as follows:

(Dollars in millions) December 31,

2014 December 31,

2013

Fed funds sold $38 $75

Securities borrowed or purchased 290 184

Resell agreements 832 724

Total fed funds sold and securities

borrowed or purchased under

agreements to resell $1,160 $983

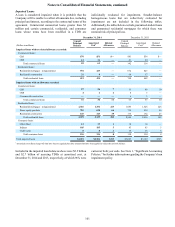

Securities purchased under agreements to resell are primarily

collateralized by U.S. government or agency securities and are

carried at the amounts at which securities will be subsequently

resold. Securities borrowed are primarily collateralized by

corporate securities. The Company takes possession of all

securities purchased under agreements to resell and securities

borrowed and performs a margin evaluation on the acquisition

date based on market volatility, as necessary. It is the Company's

policy to obtain possession of collateral with a fair value between

95% to 110% of the principal amount loaned under resell and

securities borrowing agreements. At December 31, 2014 and

2013, the total market value of collateral held was $1.1 billion

and $913 million, of which $222 million and $234 million was

repledged, respectively.

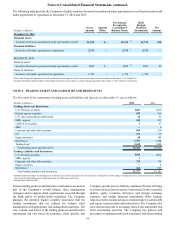

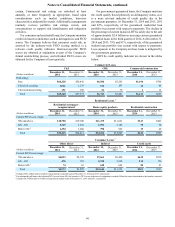

Securities sold under agreements to repurchase are

accounted for as secured borrowings. The following table

presents the Company’s related activity, by collateral type and

remaining contractual maturity, at December 31, 2014.

Remaining Contractual

Maturity of the Agreements

(Dollars in millions)

Overnight

and

Continuous

Up to

30

days Total

U.S. Treasury securities $376 $— $376

Federal agency securities 231 — 231

MBS - agency 1,059 45 1,104

CP 238 — 238

Corporate and other debt securities 327 — 327

Total securities sold under agreements

to repurchase $2,231 $45 $2,276

For these securities sold under agreements to repurchase,

the Company would be obligated to provide additional collateral

in the event of a significant decline in fair value of the collateral

pledged. This risk is managed by monitoring the liquidity and

credit quality of the collateral, as well as the maturity profile of

the transactions.

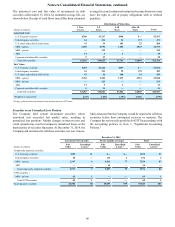

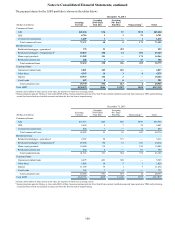

Netting of Securities - Repurchase and Resell Agreements

The Company has various financial assets and financial

liabilities that are subject to enforceable master netting

agreements or similar agreements. The Company's derivatives

that are subject to enforceable master netting agreements or

similar agreements are discussed in Note 17, "Derivative

Financial Instruments." Securities borrowed or purchased under

agreements to resell and securities sold under agreements to

repurchase are governed by a MRA. Under the terms of the MRA,

all transactions between the Company and the counterparty

constitute a single business relationship such that in the event of

default, the nondefaulting party is entitled to set off claims and

apply property held by that party in respect of any transaction

against obligations owed. Any payments, deliveries, or other

transfers may be applied against each other and netted. These

amounts are limited to the contract asset/liability balance, and

accordingly, do not include excess collateral received/pledged.