SunTrust 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

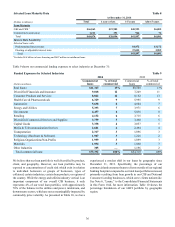

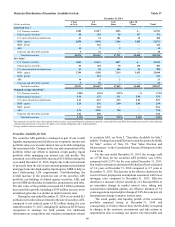

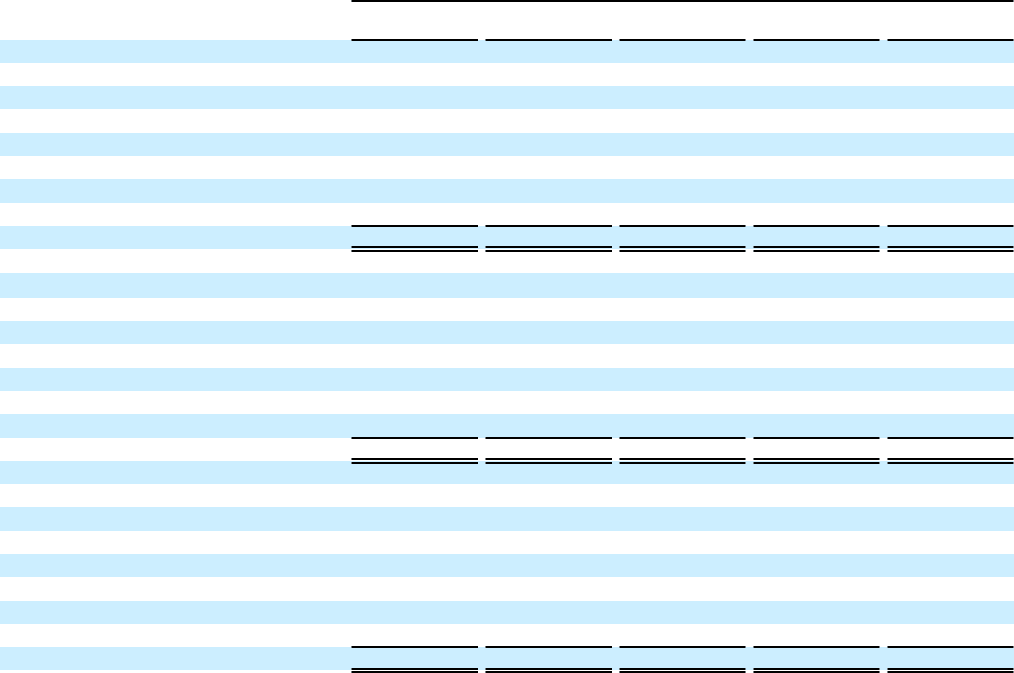

Maturity Distribution of Securities Available for Sale Table 17

December 31, 2014

(Dollars in millions) 1 Year

or Less 1-5

Years 5-10

Years After 10

Years Total

Amortized Cost 1:

U.S. Treasury securities $200 $1,217 $496 $— $1,913

Federal agency securities 64 234 36 137 471

U.S. states and political subdivisions 43 34 101 22 200

MBS - agency 2,550 8,992 7,106 3,925 22,573

MBS - private — 122 — — 122

ABS 14 3 2 — 19

Corporate and other debt securities 5 33 — — 38

Total debt securities $2,876 $10,635 $7,741 $4,084 $25,336

Fair Value 1:

U.S. Treasury securities $203 $1,221 $497 $— $1,921

Federal agency securities 64 244 38 138 484

U.S. states and political subdivisions 43 36 106 24 209

MBS - agency 2,704 9,202 7,219 3,923 23,048

MBS - private — 123 — — 123

ABS 14 5 2 — 21

Corporate and other debt securities 5 36 — — 41

Total debt securities $3,033 $10,867 $7,862 $4,085 $25,847

Weighted average yield (FTE) 2:

U.S. Treasury securities 1.98% 1.59% 1.99% —% 1.73%

Federal agency securities 4.38 3.32 3.11 2.86 3.31

U.S. states and political subdivisions 6.41 6.19 4.93 5.89 5.57

MBS - agency 2.26 2.36 2.80 2.88 2.58

MBS - private — 9.64 — — 9.64

ABS 0.76 39.38 7.28 — 7.99

Corporate and other debt securities 1.42 4.00 — — 3.66

Total debt securities 2.34% 2.40% 2.78% 2.90% 2.59%

1 The amortized cost and fair value of investments in debt securities are presented based on estimated average life. Actual cash flows may differ from estimated average lives and contractual

maturities because borrowers may have the right to call or prepay obligations with or without penalties.

2 Average yields are based on amortized cost.

Securities Available for Sale

The securities AFS portfolio is managed as part of our overall

liquidity management and ALM process to optimize income and

portfolio value over an entire interest rate cycle while mitigating

the associated risks. Changes in the size and composition of the

portfolio reflect our efforts to maintain a high quality, liquid

portfolio while managing our interest rate risk profile. The

amortized cost of the portfolio increased $3.6 billion during the

year ended December 31, 2014, largely due to the reinvestment

of proceeds from the sale of government-guaranteed residential

mortgage loans into high-quality, liquid agency MBS to help us

meet forthcoming LCR requirements. Notwithstanding the

overall increase in the amortized cost of the securities AFS

portfolio, our holdings of federal agency securities, ABS, and

private MBS declined due to maturities, prepayments, and sales.

The fair value of the portfolio increased $4.2 billion primarily

due to portfolio growth, including a $593 million increase in net

unrealized gains due to a decline in market interest rates.

During the year ended December 31, 2014, we recorded $15

million in net realized losses related to the sale of securities AFS,

compared to net realized gains of $2 million during the year

ended December 31, 2013, including $1 million in OTTI losses

recognized in earnings for both periods. For additional

information on composition and valuation assumptions related

to securities AFS, see Note 5, "Securities Available for Sale,"

and the “Trading Assets and Derivatives and Securities Available

for Sale” section of Note 18, “Fair Value Election and

Measurement,” to the Consolidated Financial Statements in this

Form 10-K.

For the year ended December 31, 2014, the average yield

on a FTE basis for the securities AFS portfolio was 2.56%,

compared with 2.57% for the year ended December 31, 2013.

Our total investment securities portfolio had an effective duration

of 3.6 years at December 31, 2014 compared to 4.7 years at

December 31, 2013. The decrease in the effective duration is the

result of faster prepayment assumptions associated with lower

mortgage rates compared to December 31, 2013. Effective

duration is a measure of price sensitivity of a bond portfolio to

an immediate change in market interest rates, taking into

consideration embedded options. An effective duration of 3.6

years suggests an expected price change of 3.6% for a one percent

instantaneous change in market interest rates.

The credit quality and liquidity profile of the securities

portfolio remained strong at December 31, 2014 and

consequently, we believe that we have the flexibility to respond

to changes in the economic environment and take actions as

opportunities arise to manage our interest rate risk profile and