SunTrust 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

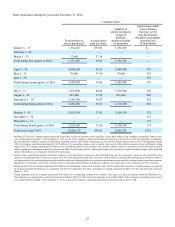

Share Repurchases

SunTrust did not repurchase any shares of Series A Preferred

Stock Depositary Shares, Series B Preferred Stock, Series E

Preferred Stock Depositary Shares, Series F Preferred Stock

Depositary Shares, or warrants to purchase common stock during

the year ended December 31, 2014, and there was no unused

Board authority to repurchase any shares of Series A Preferred

Stock Depositary Shares, Series B Preferred Stock, Series E

Preferred Stock Depositary Shares, or the Series F Preferred

Stock Depositary Shares.

On September 12, 2006, SunTrust issued and registered

under Section 12(b) of the Exchange Act, 20 million depositary

shares, each representing a 1/4,000th interest in a share of

Perpetual Preferred Stock, Series A. In 2011, the Series A

Preferred Stock became redeemable at the Company’s option at

a redemption price equal to $100,000 per share, plus any declared

and unpaid dividends.

On March 30, 2011, the Company repurchased $3.5 billion

of Fixed Rate Cumulative Preferred Stock-Series C, and $1.4

billion of Fixed Rate Cumulative Preferred Stock-Series D,

which was issued to the U.S. Treasury under the CPP. Warrants

to purchase common stock issued to the U.S. Treasury in

connection with the issuance of Series C and D preferred stock

remained outstanding. The Board authorized the Company to

repurchase all of the remaining outstanding warrants to purchase

our common stock that were issued to the U.S. Treasury in

connection with its investment in SunTrust Banks, Inc. under the

CPP. On September 28, 2011, the Company purchased and

retired 4 million warrants to purchase SunTrust common stock

in connection with the U.S. Treasury's resale, via a public

secondary offering of the warrants that the Treasury held. At

December 31, 2014, 13.9 million warrants remained outstanding

and the Company had authority from its Board to repurchase all

of the 13.9 million outstanding stock purchase warrants.

However, any such repurchase would be subject to the prior

approval of the Federal Reserve through the capital planning and

stress testing process.

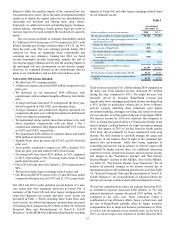

On December 15, 2011, SunTrust issued 1,025 shares of

Perpetual Preferred Stock-Series B, no par value and $100,000

liquidation preference per share (the "Series B Preferred Stock")

to SunTrust Preferred Capital I. The Series B Preferred Stock by

its terms is redeemable by the Company at $100,000 per share

plus any declared and unpaid dividends.

On December 13, 2012, SunTrust issued depositary shares

representing ownership interest in 4,500 shares of Perpetual

Preferred Stock-Series E, no par value and $100,000 liquidation

preference per share (the "Series E Preferred Stock"). The Series

E Preferred Stock by its terms is redeemable by the Company at

$100,000 per share plus any declared and unpaid dividends.

On November 4, 2014, SunTrust issued depositary shares

representing ownership interest in 5,000 shares of Perpetual

Preferred Stock-Series F, no par value and $100,000 liquidation

preference per share (the "Series F Preferred Stock"). The Series

F Preferred Stock by its terms is redeemable after 2019 by the

Company at $100,000 per share plus any declared and unpaid

dividends.