SunTrust 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.71

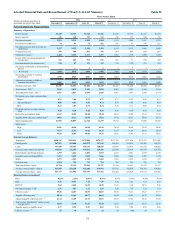

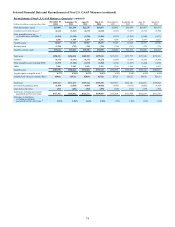

decreased $17 million during the fourth quarter of 2014

compared to the fourth quarter of 2013, primarily driven by lower

fixed income-related trading revenue.

Mortgage production related income was $61 million, an

increase of $30 million, during the fourth quarter of 2014

compared to the fourth quarter of 2013. The increase was due to

a 20% increase in mortgage production volume and a lower

mortgage repurchase provision. Mortgage servicing income

increased $15 million compared to the fourth quarter of 2013

due to higher servicing fees and improved net hedge

performance.

Other noninterest income decreased $13 million during the

fourth quarter of 2014 compared to the fourth quarter of 2013,

primarily driven by lower gains on the sale of lease financing

and other assets, partially offset by lower asset impairment

charges.

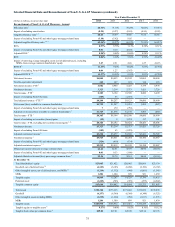

Total noninterest expense was $1.4 billion during the fourth

quarter of 2014 which included the aforementioned $145 million

legal provision for legacy mortgage matters. Excluding this

legacy mortgage matter, noninterest expense declined $96

million, or 7%, driven by lower employee compensation and

benefits expense and, more broadly, our overall efficiency and

disciplined expense management focus.

Employee compensation and benefits expense decreased

$53 million during the fourth quarter of 2014 compared to the

fourth quarter of 2013, primarily due to a decline in salaries,

incentive compensation, and employee benefits costs, including

medical costs, due to a decline in full-time equivalent employees

as a result of our ongoing branch staffing model efficiency

improvements and the sale of RidgeWorth.

Other noninterest expense decreased $41 million compared

to the fourth quarter of 2013, primarily driven by lower credit

and collections services expenses and higher costs related to the

resolution of certain legacy mortgage matters recognized in the

fourth quarter of 2013.

The income tax provision for the fourth quarter of 2014 was

$128 million compared to the income tax provision of $138

million for the fourth quarter of 2013. Excluding the $57 million

tax impact of the $145 million legal provision related to legacy

mortgage matters in the fourth quarter of 2014, the tax provision

was $185 million, which was higher than the fourth quarter of

2013, primarily as a result of higher pre-tax income, resulting in

a quarterly effective tax rate of approximately 28%.