Sallie Mae 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

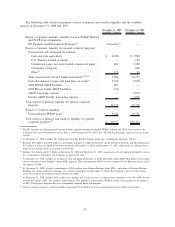

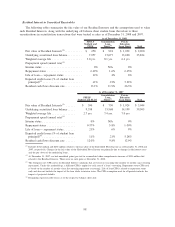

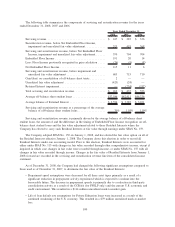

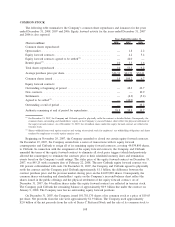

Residual Interest in Securitized Receivables

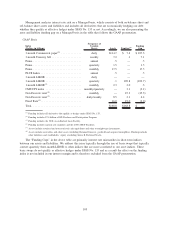

The following tables summarize the fair value of our Residual Interests and the assumptions used to value

such Residual Interests, along with the underlying off-balance sheet student loans that relate to those

securitizations in securitization transactions that were treated as sales as of December 31, 2008 and 2007.

FFELP

Stafford and

PLUS

Consolidation

Loan

Trusts

(1)

Private

Education

Loan Trusts Total

As of December 31, 2008

Fair value of Residual Interests

(2)

........... $ 250 $ 918 $ 1,032 $ 2,200

Underlying securitized loan balance ......... 7,057 15,077 13,690 35,824

Weighted average life ................... 3.0yrs. 8.1 yrs. 6.4 yrs

Prepayment speed (annual rate)

(3)

Interim status ......................... 0% N/A 0%

Repayment status ...................... 2-19% 1-6% 2-15%

Life of loan — repayment status ........... 12% 4% 6%

Expected credit losses (% of student loan

principal)

(4)

......................... .11% .23% 5.22%

Residual cash flows discount rate ........... 13.1% 11.9% 26.3%

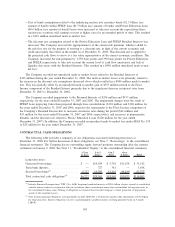

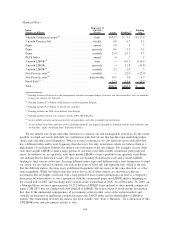

FFELP

Stafford and PLUS

Consolidation

Loan

Trusts

(1)

Private

Education

Loan Trusts Total

As of December 31, 2007

Fair value of Residual Interests

(2)

...... $ 390 $ 730 $ 1,924 $ 3,044

Underlying securitized loan balance ..... 9,338 15,968 14,199 39,505

Weighted average life ............... 2.7yrs. 7.4 yrs. 7.0 yrs

Prepayment speed (annual rate)

(3)

Interim status ..................... 0% N/A 0%

Repayment status .................. 0-37% 3-8% 1-30%

Life of loan — repayment status ....... 21% 6% 9%

Expected credit losses (% of student loan

principal)

(4)

..................... .11% .21% 5.28%

Residual cash flows discount rate ...... 12.0% 9.8% 12.9%

(1)

Includes $762 million and $283 million related to the fair value of the Embedded Floor Income as of December 31, 2008 and

2007, respectively. Changes in the fair value of the Embedded Floor Income are primarily due to changes in the interest rates

and the pay down of the underlying loans.

(2)

At December 31, 2007, we had unrealized gains (pre-tax) in accumulated other comprehensive income of $301 million that

related to the Residual Interests. There were no such gains at December 31, 2008.

(3)

The Company uses CPR curves for Residual Interest valuations that are based on seasoning (the number of months since entering

repayment). Under this methodology, a different CPR is applied to each year of a loan’s seasoning. Repayment status CPR used

is based on the number of months since first entering repayment (seasoning). Life of loan CPR is related to repayment status

only and does not include the impact of the loan while in interim status. The CPR assumption used for all periods includes the

impact of projected defaults.

(4)

Remaining expected credit losses as of the respective balance sheet date.

98