Sallie Mae 2008 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.18. Benefit Plans (Continued)

27 percent in cash which is invested in U.S. government securities, the duration of which closely matches that

of the traditional and cash balance nature of plan liabilities.

Cash Flows

The Company did not contribute to its qualified pension plan in 2008 and does not expect to contribute

in 2009. There are no plan assets in the nonqualified plans due to the nature of the plans, and benefits are

paid from corporate assets when due to the participant. It is estimated that approximately $3 million will be

paid in 2009 for these benefits. No plan assets are expected to be returned to the employer during 2009.

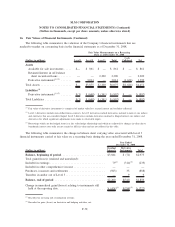

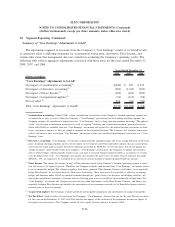

Estimated Future Benefit Payments

The following qualified and nonqualified plan benefit payments, which reflect future service as appropri-

ate, are expected to be paid:

2009 ................................................................ $18,350

2010 ................................................................ 16,228

2011 ................................................................ 16,490

2012 ................................................................ 15,199

2013 ................................................................ 14,533

2014 — 2018 .......................................................... 73,904

401(k) Plans

The Company maintains two safe harbor 401(k) savings plans as defined contribution plans intended to

qualify under section 401(k) of the Internal Revenue Code. The Sallie Mae 401(k) Savings Plan covers

substantially all employees of the Company outside of Asset Performance Group hired before August 1, 2007.

Effective October 1, 2008 the Company matches up to 100 percent on the first 3 percent of contributions and

50 percent on the next 2 percent of contributions after one year of service, and all eligible employees receive

a 1 percent core employer contribution. Prior to October 1, 2008, up to 6 percent of employee contributions

were matched 100 percent by the Company after one year of service and certain eligible employees received a

2 percent core employer contribution.

The Sallie Mae 401(k) Retirement Savings Plan covers substantially all employees of Asset Performance

Group, and after August 1, 2007, the Retirement Savings Plan covers substantially all new hires of the

Company. Effective October 1, 2008 the Company matches up to 100 percent on the first 3 percent of

contributions and 50 percent on the next 2 percent of contributions after one year of service, and all eligible

employees receive a 1 percent core employer contribution. Between August 1, 2007 and September 30, 2008,

the match formula was up to 100 percent on the first 5 percent of contributions after one year of service.

During 2006 until July 31, 2007 the match formula was up to 100 percent on the first 3 percent of

contributions and 50 percent on the next 2 percent of contributions after one year of service.

The Company also maintains a non-qualified plan to ensure that designated participants receive benefits

not available under the 401(k) Plan due to compensation limits imposed by the Internal Revenue Code.

Total expenses related to the 401(k) plans were $21 million, $22 million and $21 million in 2008, 2007

and 2006, respectively.

F-86

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)