Sallie Mae 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

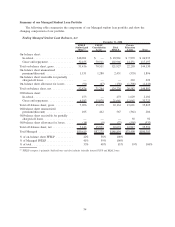

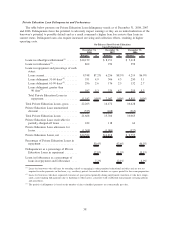

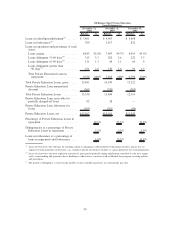

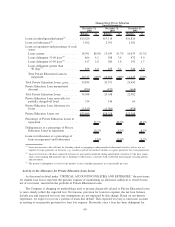

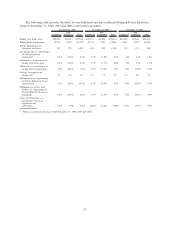

Balance % Balance % Balance %

December 31,

2008

December 31,

2007

December 31,

2006

Managed Basis Private Education

Loan Delinquencies

Loans in-school/grace/deferment

(1)

....... $13,620 $13,114 $10,826

Loans in forbearance

(2)

................ 1,562 2,391 1,181

Loans in repayment and percentage of each

status:

Loans current ..................... 18,591 89.8% 13,639 91.7% 10,633 91.3%

Loans delinquent 31-60 days

(3)

........ 866 4.2 508 3.4 472 4.0

Loans delinquent 61-90 days

(3)

........ 417 2.0 260 1.8 192 1.7

Loans delinquent greater than

90 days

(3)

...................... 838 4.0 459 3.1 346 3.0

Total Private Education Loans in

repayment...................... 20,712 100% 14,866 100% 11,643 100%

Total Private Education Loans, gross...... 35,894 30,371 23,650

Private Education Loan unamortized

discount ......................... (896) (823) (668)

Total Private Education Loans .......... 34,998 29,548 22,982

Private Education Loan receivable for

partially charged-off loans ........... 314 146 64

Private Education Loan allowance for

losses ........................... (1,813) (1,366) (458)

Private Education Loans, net ........... $33,499 $28,328 $22,588

Percentage of Private Education Loans in

repayment ....................... 57.7% 48.9% 49.2%

Delinquencies as a percentage of Private

Education Loans in repayment ........ 10.2% 8.3% 8.7%

Loans in forbearance as a percentage of

loans in repayment and forbearance .... 7.0% 13.9% 9.2%

(1)

Loans for borrowers who still may be attending school or engaging in other permitted educational activities and are not yet

required to make payments on the loans, e.g., residency periods for medical students or a grace period for bar exam preparation.

(2)

Loans for borrowers who have requested extension of grace period generally during employment transition or who have tempo-

rarily ceased making full payments due to hardship or other factors, consistent with established loan program servicing policies

and procedures.

(3)

The period of delinquency is based on the number of days scheduled payments are contractually past due.

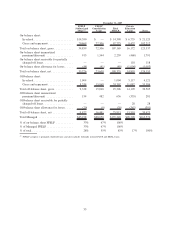

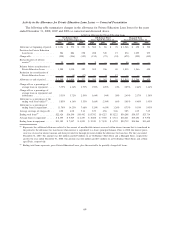

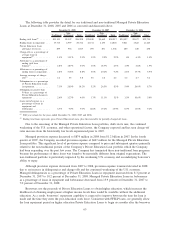

Activity in the Allowance for Private Education Loan Losses

As discussed in detail under “CRITICAL ACCOUNTING POLICIES AND ESTIMATES,” the provisions

for student loan losses represent the periodic expense of maintaining an allowance sufficient to absorb losses,

net of recoveries, incurred in the portfolio of Private Education Loans.

The Company is changing its methodology used to present charge-offs related to Private Education Loans

to more clearly reflect the expected loss. Net income, provision for loan loss expense, the net loan balance,

default rate and expected recovery rate assumptions are not impacted by this change. Based on our historic

experience, we expect to recover a portion of loans that default. This expected recovery is taken into account

in arriving at our periodic provision for loan loss expense. Previously, once a loan has been delinquent for

60