Sallie Mae 2008 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

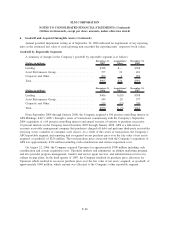

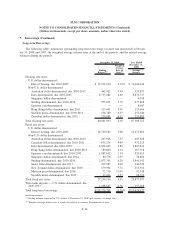

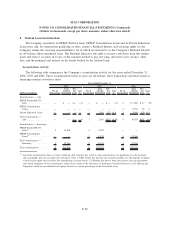

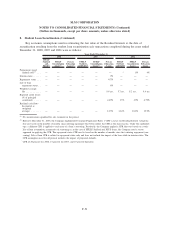

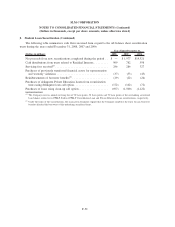

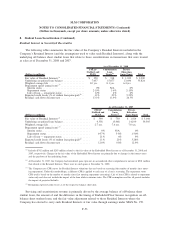

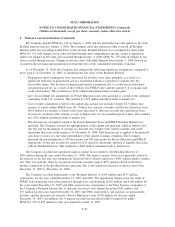

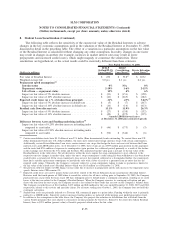

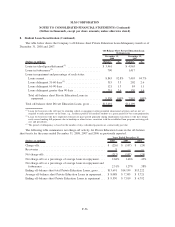

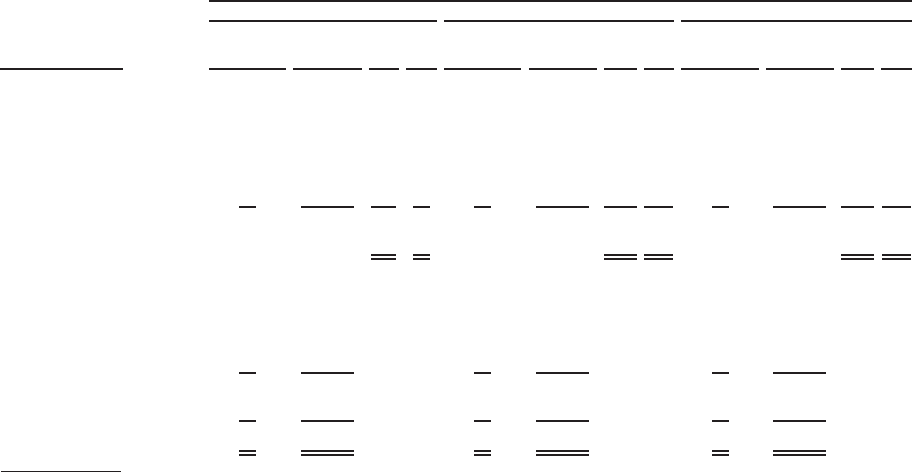

8. Student Loan Securitization

The Company securitizes its FFELP Stafford loans, FFELP Consolidation Loans and its Private Education

Loan assets and, for transactions qualifying as sales, retains a Residual Interest and servicing rights (as the

Company retains the servicing responsibilities), all of which are referred to as the Company’s Retained Interest

in off-balance sheet securitized loans. The Residual Interest is the right to receive cash flows from the student

loans and reserve accounts in excess of the amounts needed to pay servicing, derivative costs (if any), other

fees, and the principal and interest on the bonds backed by the student loans.

Securitization Activity

The following table summarizes the Company’s securitization activity for the years ended December 31,

2008, 2007 and 2006. Those securitizations listed as sales are off-balance sheet transactions and those listed as

financings remain on-balance sheet.

(Dollars in millions)

No. of

Transactions

Loan

Amount

Securitized

Pre-

Tax

Gain

Gain

%

No. of

Transactions

Loan

Amount

Securitized

Pre-

Tax

Gain

Gain

%

No. of

Transactions

Loan

Amount

Securitized

Pre-

Tax

Gain

Gain

%

2008 2007 2006

Years Ended December 31,

Securitizations — sales:

FFELP Stafford/PLUS

loans . . ............. — $ — $— —% — $ — $ — —% 2 $5,004 $ 17 .3%

FFELP Consolidation

Loans. . ............. — — — — — — — — 4 9,503 55 .6

Private Education Loans . . . . — — — — 1 2,001 367 18.4 3 5,088 830 16.3

Total securitizations —

sales . . ............. — — $— —% 1 2,001 $367 18.4% 9 19,595 $902 4.6%

Securitizations — financings:

FFELP Stafford/PLUS

loans

(1)

.............. 9 18,546 3 8,955 — —

FFELP Consolidation

Loans

(1)

............. — — 5 14,476 4 12,506

Total securitizations —

financings ............ 9 18,546 8 23,431 4 12,506

Total securitizations ....... 9 $18,546 9 $25,432 13 $32,101

(1)

In certain securitizations there are terms within the deal structure that result in such securitizations not qualifying for sale treatment

and accordingly, they are accounted for on-balance sheet as VIEs. Terms that prevent sale treatment include: (1) allowing the Company

to hold certain rights that can affect the remarketing of certain bonds, (2) allowing the trust to enter into interest rate cap agreements

after initial settlement of the securitization, which do not relate to the reissuance of third-party beneficial interests or (3) allowing the

Company to hold an unconditional call option related to a certain percentage of the securitized assets.

F-50

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)