Sallie Mae 2008 Annual Report Download - page 223

Download and view the complete annual report

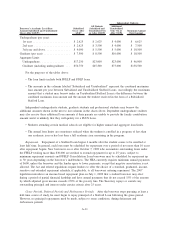

Please find page 223 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.for the lender’s continued FFELP participations and making of FFELP loans. Authorizes the Secretary

to contract for the servicing of purchased FFELP loans, including with selling lenders, as long as the

cost is not more than it would be otherwise.

The Higher Education Opportunity Act of 2008 reauthorized the loan programs of the HEA through

September 30, 2014. Major provisions, which became effective August 14, 2008 (unless stated otherwise),

include:

• Clarifies the repayment period and the terms for commencement of repayment of PLUS loans made on

or after July 1, 2008, (superseding ECASLA provisions) and makes available in-school deferment to

parent borrowers when the student beneficiary is enrolled and a 6-month post-enrollment deferment to

all PLUS borrowers following any period of enrollment of the borrower or the student beneficiary.

• Makes Section 207 of the Servicemembers Civil Relief Act applicable to FFELP loans, upon borrower

request, reducing the interest rate on such loans to 6% (which encompasses certain fees and other

charges), and establishes that as the applicable rate for calculating special allowance payments (for

loans made on or after July 1, 2008).

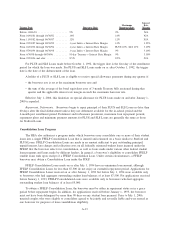

• Expands the criteria for disability discharge, including qualifying borrowers with a permanent disability

rating from the Veterans Administration.

• Requires a lender to provide information on the impact of interest capitalization when granting

deferment on for an unsubsidized Stafford loan or forbearance for any FFELP loan and, for

forbearance, to provide the borrower with specific information about interest and capitalization at least

every 180 days during the forbearance.

• Adds items that the lender must disclose before disbursement and items that the lender must disclose

before repayment.

• Requires a lender to provide a bill or statement that corresponds to each payment installment time

period and include specific disclosures (for loans with a first payment due on or after July 1, 2009).

• Requires a lender to provide specified information to borrowers who notify the lender of difficulty in

paying (for loans with a first payment due on or after July 1, 2009) and to borrowers who become

60 days delinquent (for loans that become delinquent on or after July 1, 2009).

• Eliminates guarantor and Department obligations for insurance and reinsurance in instances of

nondisclosure.

• Adds income-based repayment to plans the lender must offer (except for parent PLUS loans or

Consolidation loans that discharged such loans) and adds income-based repayment for FFELP borrow-

ers to repay defaulted loans to ED.

• Permits borrower eligibility for in-school deferment to be based on National Student Loan Data System

information.

• Adds prohibited inducements that can subject lenders and guarantors to disqualification from the

program and clarifies that both lenders and guarantors may provide technical assistance comparable to

that provided to schools by the Department.

• Allows FFELP borrowers to consolidate directly into the FDLP program to use the zero interest feature

available to servicemembers.

• Requires a consolidation lender to provide disclosures regarding any loss of benefits, availability of

repayment plans, and certain other information.

• Requires the guarantor to notify a borrower twice of options to remove a loan from default.

• Limits a borrower to loan rehabilitation once and, upon successful rehabilitation, provides for financial

and economic education materials to be available to the borrower and for removal of the default from

the borrower’s credit report.

A-5