Sallie Mae 2008 Annual Report Download - page 238

Download and view the complete annual report

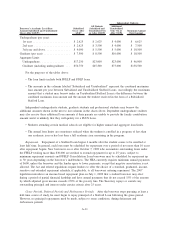

Please find page 238 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.on that notional amount, regardless of the actual balance of underlying student loans, over the life of the

contract. The contracts generally do not extend over the life of the underlying student loans. This contract

effectively locks in the amount of Floor Income the Company will earn over the period of the contract. Floor

Income Contracts are not considered effective hedges under SFAS No. 133, “Accounting for Derivative

Instruments and Hedging Activities,” and each quarter the Company must record the change in fair value of

these contracts through income.

Front-End Borrower Benefits — Financial incentives offered to borrowers at origination. Front-End

Borrower Benefits primarily represent the Company’s payment on behalf of borrowers for required FFELP

fees, including the federal origination fee and federal default fee. The Company accounts for these Front-End

Borrower Benefits as loan premiums amortized over the estimated life of the loans as an adjustment to the

loan’s yield.

Gross Floor Income — Floor Income earned before payments on Floor Income Contracts.

Guarantors — State agencies or non-profit companies that guarantee (or insure) FFELP loans made by

eligible lenders under The Higher Education Act of 1965 (“HEA”), as amended.

Interim ABCP Facility — An aggregate of $30 billion asset-backed commercial paper conduit facilities

that the Company entered into on April 30, 2007 in connection with the April 16, 2007 announcement of a

proposed acquisition of the Company by J.C. Flowers & Co., Bank of America, N.A., and JPMorgan Chase,

N.A., which was terminated on January 25, 2008.

Lender Partners — Lender Partners are lenders who originate loans under forward purchase commit-

ments under which the Company owns the loans from inception or, in most cases, acquires the loans soon

after origination.

Managed Basis — The Company generally analyzes the performance of its student loan portfolio on a

Managed Basis. The Company views both on-balance sheet student loans and off-balance sheet student loans

owned by the securitization trusts as a single portfolio, and the related on-balance sheet financings are

combined with off-balance sheet debt. When the term Managed is capitalized in this document, it is referring

to Managed Basis.

Private Education Loans — Education loans to students or parents of students that are not guaranteed

under the FFELP. Private Education Loans include loans for higher education (undergraduate and graduate

degrees) and for alternative education, such as career training, private kindergarten through secondary

education schools and tutorial schools. Higher education loans have repayment terms similar to FFELP loans,

whereby repayments begin after the borrower leaves school. The Company’s higher education Private

Education Loans are not dischargeable in bankruptcy, except in certain limited circumstances. Repayment for

alternative education generally begins immediately.

In the context of the Company’s Private Education Loan business, the Company uses the term “non-

traditional loans” to describe education loans made to certain borrowers that have or are expected to have a

high default rate as a result of a number of factors, including having a lower tier credit rating, low program

completion and graduation rates or, where the borrower is expected to graduate, a low expected income

relative to the borrower’s cost of attendance.

Preferred Channel Originations — Preferred Channel Originations are comprised of: 1) loans that are

originated by internally marketed Sallie Mae brands, and 2) student loans that are originated by Lender

Partners (defined above).

Proposed Merger — On April 16, 2007, the Company announced that a buyer group (“Buyer Group”)

led by J.C. Flowers & Co. (“J.C. Flowers”), Bank of America, N.A. and JPMorgan Chase, N.A. (the

“Merger”) signed a definitive agreement (“Merger Agreement”) to acquire the Company for approximately

$25.3 billion or $60.00 per share of common stock. (See also “Merger Agreement” filed with the SEC on the

Company’s Current Report on Form 8-K, dated April 18, 2007.) On January 25, 2008, the Company, Mustang

Holding Company Inc. (“Mustang Holding”), Mustang Merger Sub, Inc. (“Mustang Sub”), J.C. Flowers, Bank

of America, N.A. and JPMorgan Chase Bank, N.A. entered into a Settlement, Termination and Release

G-4