Sallie Mae 2008 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

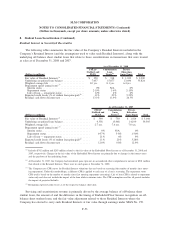

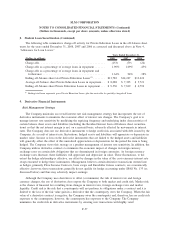

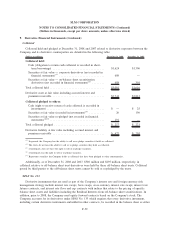

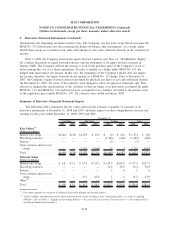

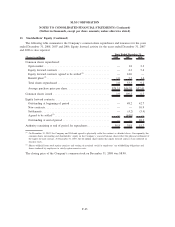

9. Derivative Financial Instruments (Continued)

Collateral

Collateral held and pledged at December 31, 2008 and 2007 related to derivative exposures between the

Company and its derivative counterparties are detailed in the following table:

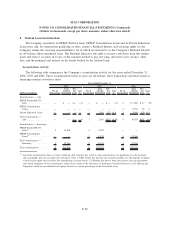

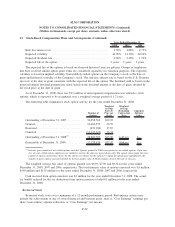

(Dollars in millions) December 31, 2008 December 31, 2007

Collateral held:

Cash (obligation to return cash collateral is recorded in short-

term borrowings) ................................. $1,624 $1,306

Securities at fair value — corporate derivatives (not recorded in

financial statements)

(1)

............................. 689 —

Securities at fair value — on-balance sheet securitization

derivatives (not recorded in financial statements)

(2)

........ 688 310

Total collateral held ................................... $3,001 $1,616

Derivative asset at fair value including accrued interest and

premium receivable ................................. $3,741 $3,812

Collateral pledged to others:

Cash (right to receive return of cash collateral is recorded in

investments) ..................................... $ — $ 25

Securities at fair value (recorded in investments)

(3)

.......... 26 196

Securities at fair value re-pledged (not recorded in financial

statements)

(4)(5)

................................... 191 —

Total collateral pledged ................................ $ 217 $ 221

Derivative liability at fair value including accrued interest and

premium receivable ................................. $ 677 $ 201

(1)

In general, the Company has the ability to sell or re-pledge securities it holds as collateral.

(2)

The trusts do not have the ability to sell or re-pledge securities they hold as collateral.

(3)

Counterparty does not have the right to sell or re-pledge securities.

(4)

Counterparty has the right to sell or re-pledge securities.

(5)

Represents securities the Company holds as collateral that have been pledged to other counterparties.

Additionally, as of December 31, 2008 and 2007, $340 million and $295 million, respectively, in

collateral relative to off-balance sheet trust derivatives were held by these off-balance sheet trusts. Collateral

posted by third parties to the off-balance sheet trusts cannot be sold or re-pledged by the trusts.

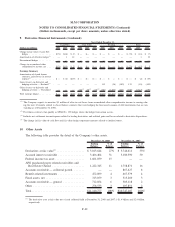

SFAS No. 133

Derivative instruments that are used as part of the Company’s interest rate and foreign currency risk

management strategy include interest rate swaps, basis swaps, cross-currency interest rate swaps, interest rate

futures contracts, and interest rate floor and cap contracts with indices that relate to the pricing of specific

balance sheet assets and liabilities including the Residual Interests from off-balance sheet securitizations. In

addition, prior to 2008, the Company used equity forward contracts based on the Company’s stock. The

Company accounts for its derivatives under SFAS No. 133 which requires that every derivative instrument,

including certain derivative instruments embedded in other contracts, be recorded in the balance sheet as either

F-59

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)