Sallie Mae 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expects to announce in the first quarter of 2009 when lending under TALF will commence. While we expect

TALF to improve our access to and reduce our cost of ABS funding, we are unable to predict, at this time, the

impact TALF will ultimately have on our funding activities.

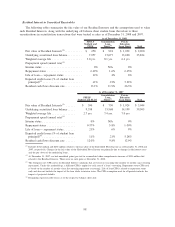

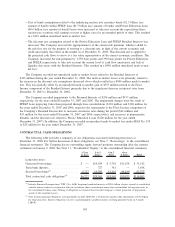

At December 31, 2008, we had $3.3 billion of taxable and $1.4 billion of tax-exempt auction rate

securities outstanding in on-balance sheet securitizations and indentured trusts, respectively, on a Managed

Basis. Since February 2008, an imbalance of supply and demand in the auction rate securities market as a

whole led to failures of the auctions pursuant to which certain of our auction rate securities’ interest rates are

set. As a result, all of the Company’s auction rate securities as of December 31, 2008 bore interest at the

maximum rate allowable under their terms. The maximum allowable interest rate on our $3.3 billion of taxable

auction rate securities is generally LIBOR plus 1.50 percent. The maximum allowable interest rate on many of

the Company’s $1.4 billion of tax-exempt auction rate securities was amended to LIBOR plus 2.00 percent

through May 31, 2008. After May 31, 2008, the maximum allowable rate on these securities reverted to a

formula driven rate, which produced various maximum rates up to 14 percent during 2008 but averaged

1.60 percent at December 31, 2008.

Certain tranches of our term ABS are reset rate notes. Reset rate notes are subject to periodic

remarketing, at which time the interest rates on the reset rate notes are reset. The Company also has the option

to repurchase the reset rate note prior to a failed remarketing and hold it as an investment until such time it

can be remarketed. In the event a reset rate note cannot be remarketed on its remarketing date, and is not

repurchased, the interest rate generally steps up to and remains at LIBOR plus 0.75 percent, until such time as

the bonds are successfully remarketed or repurchased. The Company’s repurchase of a reset rate note requires

additional funding, the availability and pricing of which may be less favorable to the Company than it was at

the time the reset rate note was originally issued. Unlike the repurchase of a reset rate note, the occurrence of

a failed remarketing does not require additional funding. As a result of the ongoing dislocation in the capital

markets, at December 31, 2008, $407 million of our reset rate notes, representing a single tranche of a single

ABS issue, bore interest at LIBOR plus 0.75 percent due to a failed remarketing. Until capital markets

conditions improve, it is possible additional reset rate notes will experience failed remarketings. As of

December 31, 2008, on a Managed Basis, the Company had $3.7 billion and $2.5 billion of reset rate notes

due to be remarketed in 2009 and 2010, respectively, and an additional $8.5 billion to be remarketed

thereafter.

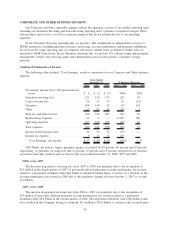

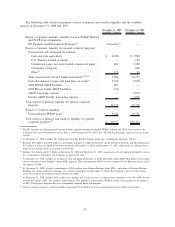

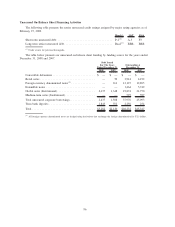

Primary Sources of Liquidity and Available Capacity

We expect to fund our ongoing liquidity needs, including the origination of new loans and the repayment

of $6.8 billion of senior unsecured notes maturing in 2009, through our current cash and investment portfolio,

cash flow provided by earnings and repayment of principal on unencumbered student loan assets, the liquidity

facilities made available by ED, TALF, the 2008 Asset-Backed Financing Facilities, the issuance of term ABS,

term bank deposits, and, to a lesser extent, if possible, unsecured debt and other sources.

To supplement our funding sources, we maintained an additional $5.2 billion in unsecured revolving

credit facilities as of December 31, 2008. These facilities include a $1.4 billion revolving credit facility

maturing in October 2009; $1.9 billion maturing in October 2010; and $1.9 billion maturing in October 2011.

They do not include a $0.3 billion commitment from a subsidiary of Lehman Brothers Holding, Inc. The

principal financial covenants in the unsecured revolving credit facilities require the Company to maintain

tangible net worth of at least $1.38 billion at all times. Consolidated tangible net worth as calculated for

purposes of this covenant was $3.2 billion as of December 31, 2008. The covenants also require the Company

to meet either a minimum interest coverage ratio or a minimum net adjusted revenue test based on the four

preceding quarters’ adjusted “Core Earnings” financial performance. The Company was compliant with the

minimum net adjusted revenue test as of the quarter ended December 31, 2008. In the past, we have not relied

upon our unsecured revolving credit facilities as a primary source of liquidity. Although we have never

borrowed under these facilities, they are available to be drawn upon for general corporate purposes.

91