Sallie Mae 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

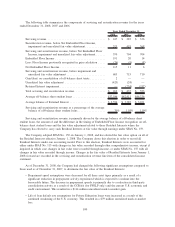

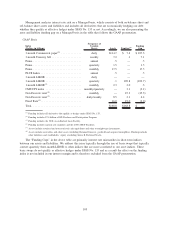

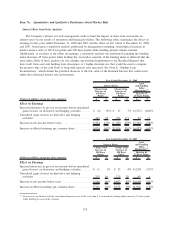

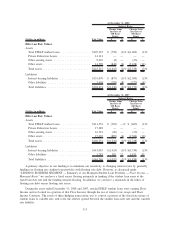

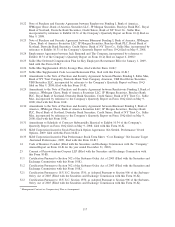

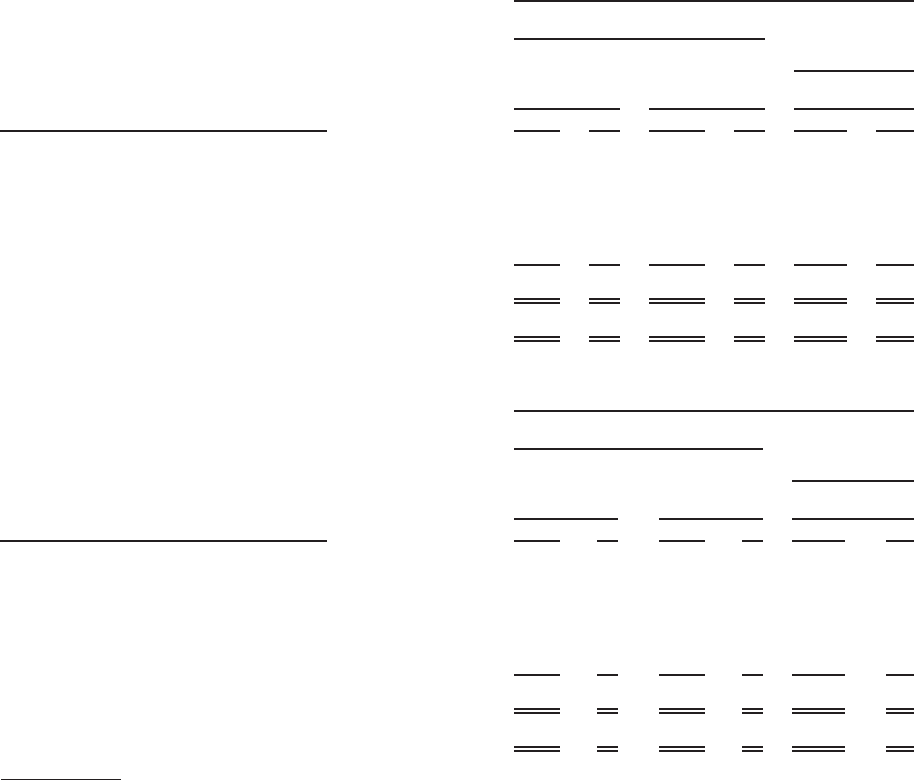

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Interest Rate Sensitivity Analysis

The Company’s interest rate risk management seeks to limit the impact of short-term movements in

interest rates on our results of operations and financial position. The following tables summarize the effect on

earnings for the years ended December 31, 2008 and 2007 and the effect on fair values at December 31, 2008

and 2007, based upon a sensitivity analysis performed by management assuming a hypothetical increase in

market interest rates of 100 basis points and 300 basis points while funding spreads remain constant.

Additionally, as it relates to the effect on earnings, a sensitivity analysis was performed assuming the funding

index increases 25 basis points while holding the asset index constant, if the funding index is different that the

asset index. Both of these analyses do not consider any potential impairment to our Residual Interests that

may result from asset and funding basis divergence or a higher discount rate that would be used to compute

the present value of the cash flows if long-term interest rates increased. See Note 8, “Student Loan

Securitization,” which details the potential decrease to the fair value of the Residual Interest that could occur

under the referenced interest rate environment.

(Dollars in millions, except per share amounts) $ % $ % $ %

Increase of

25 Basis Points

Change from

Increase of

300 Basis

Points

Change from

Increase of

100 Basis

Points

Asset

and Funding

Index

Mismatches

(1)

Interest Rates:

Year Ended December 31, 2008

Effect on Earnings

Increase/(decrease) in pre-tax net income before unrealized

gains (losses) on derivative and hedging activities ...... $ (6) (3)% $ 13 7% $ (297) (162)%

Unrealized gains (losses) on derivative and hedging

activities .................................... 460 82 956 171 95 17

Increase in net income before taxes .................. $454 121% $ 969 258% $ (202) (54)%

Increase in diluted earnings per common share .......... $.974 141% $2.076 301% $(.433) (63)%

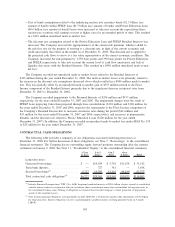

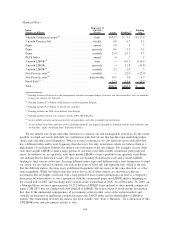

(Dollars in millions, except per share amounts) $ % $ % $ %

Change from

Increase of

100 Basis

Points

Change from

Increase of

300 Basis

Points

Increase of

25 Basis Points

Asset

and Funding

Index

Mismatches

(1)

Interest Rates:

Year Ended December 31, 2007

Effect on Earnings

Increase/(decrease) in pre-tax net income before unrealized

gains (losses) on derivative and hedging activities ...... $ 11 1% $ 32 4% $(229) (27)%

Unrealized gains (losses) on derivative and hedging

activities .................................... 213 16 375 28 80 6

Increase in net income before taxes .................. $224 46% $407 85% $(149) (31)%

Increase in diluted earnings per common share .......... $.361 16% $.674 30% $(.361) (16)%

(1)

If an asset is not funded with the same index/frequency reset of the asset then it is assumed the funding index increases 25 basis points

while holding the asset index constant.

110