Sallie Mae 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.borrower benefits and other costs. As a result of these factors, we believe that as the largest student lender, we

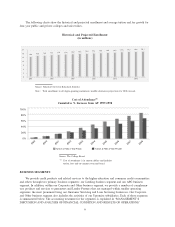

are well positioned to increase market share in the coming years. Our FFY 2008 FFELP originations totaled

$17.1 billion, representing a 23 percent market share.

ASSET PERFORMANCE GROUP BUSINESS SEGMENT

In our APG business segment, we provide accounts receivable and collections services including student

loan default aversion services, defaulted student loan portfolio management services, and contingency

collections services for student loans and other asset classes. In 2008, we decided to wind down our accounts

receivable management and collections services on consumer and mortgage receivable portfolios that we

purchased because we did not realize the expected synergies between this business and our traditional

contingent student loan collection business.

In 2008, our APG business segment had revenues totaling $277 million and net loss of $106 million. Our

largest customer, “United Student Aid Funds, Inc. (“USA Funds”), accounted for 37 percent, excluding

impairments, of our revenue in this segment in 2008.

Products and Services

Student Loan Default Aversion Services

We provide default aversion services for five guarantors, including the nation’s largest, USA Funds. These

services are designed to prevent a default once a borrower’s loan has been placed in delinquency status.

Defaulted Student Loan Portfolio Management Services

Our APG business segment manages the defaulted student loan portfolios for six guarantors under long-

term contracts. APG’s largest customer, USA Funds, represents approximately 17 percent of defaulted student

loan portfolios in the market. Our portfolio management services include selecting collection agencies and

determining account placements to those agencies, processing loan consolidations and loan rehabilitations, and

managing federal and state offset programs.

Contingency Collection Services

Our APG business segment is also engaged in the collection of defaulted student loans on behalf of

various clients including guarantors, federal and state agencies, and schools. We earn fees that are contingent

on the amounts collected. We provide collection services for ED and now have approximately 10 percent of

the total market for such services. We have relationships with approximately 900 colleges and universities to

provide collection services for delinquent student loans and other receivables from various campus-based

programs. We also collected other debt for credit card issuers, federal and state agencies, and retail clients.

Competition

The private sector collections industry is highly fragmented with few large companies and a large number

of small scale companies. The APG businesses that provide third-party collections services for ED, FFELP

guarantors and other federal holders of defaulted debt are highly competitive. In addition to competing with

other collection enterprises, we also compete with credit grantors who each have unique mixes of internal

collections, outsourced collections and debt sales. The scale, diversification and performance of our APG

business segment has been a competitive advantage for the Company.

CORPORATE AND OTHER BUSINESS SEGMENT

The Company’s Corporate and Other business segment includes the aggregate activity of its smaller

operating segments, primarily its Guarantor Servicing, Loan Servicing, and Upromise operating segments.

Corporate and Other also includes several smaller products and services, including comprehensive financing

and loan delivery solutions to college financial aid offices and students to streamline the financial aid process.

9