Sallie Mae 2008 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

discontinues the hedge accounting prospectively, ceases recording changes in the fair value of the hedged

item, and begins amortization of any basis adjustments that exist related to the hedged item.

The Company also has a number of derivatives, primarily Floor Income Contracts and certain basis

swaps, that the Company believes are effective economic hedges but are not considered hedges under

SFAS No. 133. These derivatives are classified as “trading” for GAAP purposes and as a result they are

marked-to-market through GAAP earnings with no consideration for the price fluctuation of the economically

hedged item.

Under SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of both

Liabilities and Equity,” equity forward contracts that allow a net settlement option either in cash or the

Company’s stock are required to be accounted for in accordance with SFAS No. 133 as derivatives. Prior to

2008, the Company used these contracts to lock-in the purchase price of the Company’s stock related to share

repurchases. As a result, the Company marks its equity forward contracts to market through earnings in the

“gains (losses) on derivative and hedging activities, net” line item in the consolidated statements of income

along with the net settlement expense on the contracts. See Note 11, “Stockholders’ Equity,” for a discussion

on the change in accounting related to equity forward contracts as of December 31, 2007. As of January 2008,

these contracts had been settled.

The “gains (losses) on derivative and hedging activities, net” line item in the consolidated statements of

income includes the unrealized changes in the fair value of the Company’s derivatives (except effective cash

flow hedges which are recorded in other comprehensive income), the unrealized changes in fair value of

hedged items in qualifying fair value hedges, as well as the realized changes in fair value related to derivative

net settlements and dispositions that do not qualify for hedge accounting. Net settlement income/expense on

derivatives that qualify as hedges under SFAS No. 133 are included with the income or expense of the hedged

item (mainly interest expense).

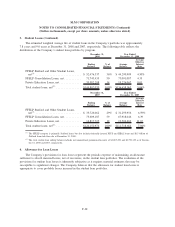

Goodwill and Acquired Intangible Assets

The Company accounts for goodwill and acquired intangible assets in accordance with SFAS No. 142,

“Goodwill and Other Intangible Assets,” pursuant to which goodwill is not amortized. Goodwill is tested for

impairment annually as of September 30 at the reporting unit level, which is the same as or one level below

an operating segment as defined in SFAS No. 131, “Disclosure About Segments of an Enterprise and Related

Information.” Goodwill is also tested at interim periods if an event occurs or circumstances change that would

indicate the carrying amount may be impaired.

In accordance with SFAS No. 142, Step 1 of the goodwill impairment analysis consists of a comparison

of the fair value of the reporting unit to its carrying value, including goodwill. If the carrying value of the

reporting unit exceeds the fair value, Step 2 in the goodwill impairment analysis is performed to measure the

amount of impairment loss, if any. Step 2 of the goodwill impairment analysis compares the implied fair value

of the reporting unit’s goodwill to the carrying value of the reporting unit’s goodwill. The implied fair value

of goodwill is determined in a manner consistent with determining goodwill in a business combination. If the

carrying amount of the reporting unit’s goodwill exceeds the implied fair value of the goodwill, an impairment

loss is recognized in an amount equal to that excess.

Other acquired intangible assets, which include but are not limited to tradenames, customer and other

relationships, and non-compete agreements, are also accounted for in accordance with SFAS No. 142.

Acquired intangible assets with definite or finite lives are amortized over their estimated useful lives in

proportion to their estimated economic benefit. Finite-lived acquired intangible assets are reviewed for

impairment using an undiscounted cash flow analysis when an event occurs or circumstances change

F-18

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)