Sallie Mae 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

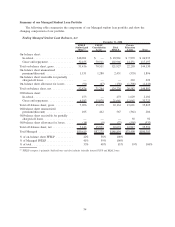

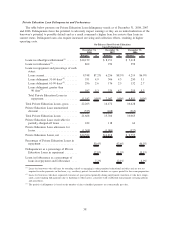

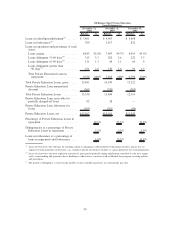

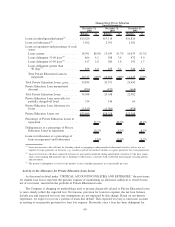

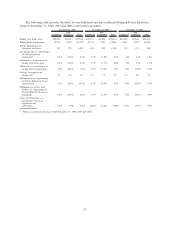

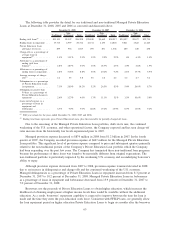

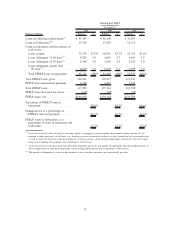

The following table summarizes changes in the allowance for Private Education Loan losses for the years

ended December 31, 2008, 2007 and 2006 as previously reported.

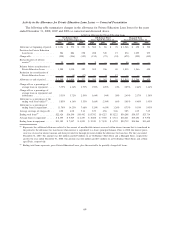

Activity in the Allowance for Private Education Loan Losses — Prior Presentation

2008 2007 2006 2008 2007 2006 2008 2007 2006

On-Balance Sheet

Years Ended December 31,

Off-Balance Sheet

Years Ended December 31,

Managed Basis

Years Ended December 31,

Activity in Allowance for Private Education Loans

Allowance at beginning of period . . $ 886 $ 308 $ 204 $ 334 $ 86 $ 78 $ 1,220 $ 394 $ 282

Provision for Private Education

Loan losses . ............. 586 884 258 288 349 15 874 1,233 273

Charge-offs . ............. (460) (332) (160) (226) (107) (24) (686) (439) (184)

Recoveries . . ............. 36 32 23 9 — — 45 32 23

Net charge-offs. ............. (424) (300) (137) (217) (107) (24) (641) (407) (161)

Reclassification of interest

reserve

(1)

................ 38 — — 8 — — 46 — —

Balance before securitization of

Private Education Loans . . . . . . 1,086 892 325 413 328 69 1,499 1,220 394

Reduction for securitization of

Private Education Loans . . . . . . — (6) (17) — 6 17 — — —

Allowance at end of period . . . . . . $ 1,086 $ 886 $ 308 $ 413 $ 334 $ 86 $ 1,499 $ 1,220 $ 394

Net charge-offs as a percentage of

average loans in repayment . . . . 4.98% 5.04% 3.22% 2.68% 1.46% .43% 3.86% 3.07% 1.62%

Net charge-offs as a percentage of

average loans in repayment and

forbearance . ............. 4.39% 4.54% 2.99% 2.31% 1.27% .38% 3.37% 2.71% 1.47%

Allowance as a percentage of

ending total loans, gross . . . . . . 4.89% 5.48% 2.96% 3.02% 2.35% .65% 4.18% 4.02% 1.66%

Allowance as a percentage of

ending loans in repayment . . . . . 9.71% 12.57% 6.36% 4.34% 4.28% 1.26% 7.24% 8.21% 3.38%

Average coverage of net charge-

offs.................... 2.56 2.95 2.25 1.91 3.13 3.46 2.34 3.00 2.44

Ending total loans, gross ....... $22,203 $16,172 $10,428 $13,691 $14,199 $13,222 $35,894 $30,371 $23,650

Average loans in repayment . . . . . $ 8,533 $ 5,949 $ 4,257 $ 8,088 $ 7,305 $ 5,721 $16,621 $13,254 $ 9,978

Ending loans in repayment . . . . . . $11,182 $ 7,047 $ 4,851 $ 9,530 $ 7,819 $ 6,792 $20,712 $14,866 $11,643

(1)

Represents the additional allowance related to the amount of uncollectible interest reserved within interest income that is transferred in

the period to the allowance for loan losses when interest is capitalized to a loan’s principal balance. Prior to 2008, the interest provi-

sion was reversed in interest income and then provided for through provision within the allowance for loan loss. For the year ended

December 31, 2007, this amount was $21 million and $27 million on an On-Balance Sheet Basis and a Managed Basis, respectively,

and for the year ended December 31, 2006, this amount was $12 million and $15 million on an On-Balance Sheet Basis and a Man-

aged Basis, respectively.

62