Sallie Mae 2008 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

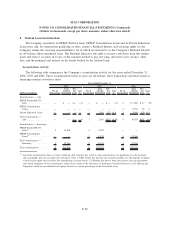

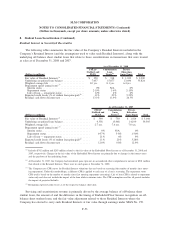

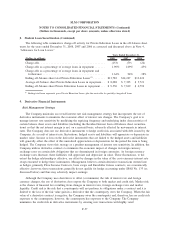

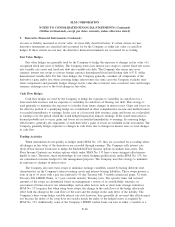

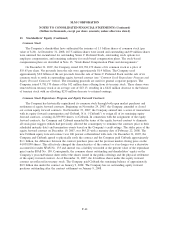

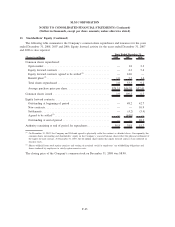

9. Derivative Financial Instruments (Continued)

counterparties that are reviewed periodically by the Company’s credit department. The Company also

maintains a policy of requiring that all derivative contracts be governed by an International Swaps and

Derivative Association Master Agreement. Depending on the nature of the derivative transaction, bilateral

collateral arrangements generally are required as well. When the Company has more than one outstanding

derivative transaction with the counterparty, and there exists legally enforceable netting provisions with the

counterparty (i.e. a legal right to offset receivable and payable derivative contracts), the “net” mark-to-market

exposure represents the netting of the positive and negative exposures with the same counterparty. When there

is a net negative exposure, the Company considers its exposure to the counterparty to be zero. At December 31,

2008 and 2007, the Company had a net positive exposure (derivative gain positions to the Company less

collateral which has been posted by counterparties to the Company) related to corporate derivatives of

$234 million and $463 million, respectively.

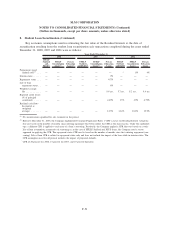

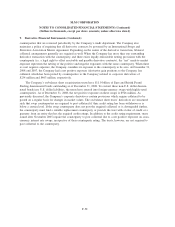

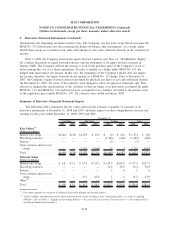

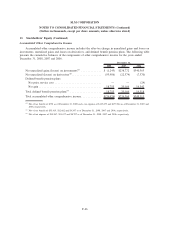

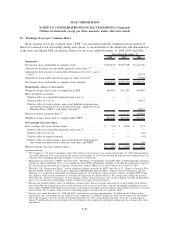

The Company’s on-balance sheet securitization trusts have $11.0 billion of Euro and British Pound

Sterling denominated bonds outstanding as of December 31, 2008. To convert these non-U.S. dollar denomi-

nated bonds into U.S. dollar liabilities, the trusts have entered into foreign-currency swaps with highly-rated

counterparties. As of December 31, 2008, the net positive exposure on these swaps is $926 million. As

previously discussed, the Company’s corporate derivatives contain provisions which require collateral to be

posted on a regular basis for changes in market values. The on-balance sheet trusts’ derivatives are structured

such that swap counterparties are required to post collateral if their credit rating has been withdrawn or is

below a certain level. If the swap counterparty does not post the required collateral or is downgraded further,

the counterparty must find a suitable replacement counterparty or provide the trust with a letter of credit or a

guaranty from an entity that has the required credit ratings. In addition to the credit rating requirement, trusts

issued after November 2005 require the counterparty to post collateral due to a net positive exposure on cross-

currency interest rate swaps, irrespective of their counterparty rating. The trusts, however, are not required to

post collateral to the counterparty.

F-58

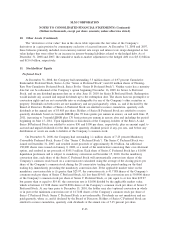

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)