Sallie Mae 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Residual Interests (see “LIQUIDITY AND CAPITAL RESOURCES — Residual Interest in Securitized

Receivables”).

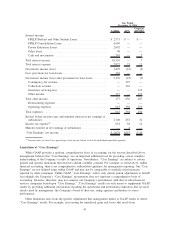

Net interest income after provisions for loan losses decreased by $594 million versus the year ended

December 31, 2006. The decrease was due to the year-over-year increase in the provisions for loan losses of

$728 million, which offset the year-over-year $134 million increase in net interest income. The increase in net

interest income was primarily due to an increase of $30.8 billion in the average balance of on-balance sheet

interest earning assets offset by a decrease in the student loan spread (see “LENDING BUSINESS

SEGMENT — Net Interest Income — Net Interest Margin-On-Balance Sheet—Student Loan Spread — On-

Balance Sheet”). The increase in provisions for loan losses relates to higher provision amounts for Private

Education Loans, FFELP loans, and mortgage loans primarily due to a weakening U.S. economy (see

“LENDING BUSINESS SEGMENT — Activity in the Allowance for Private Education Loan Losses; and —

Total Provisions for Loan Losses”).

Fee and other income and collections revenue increased $42 million from $1.11 billion for the year ended

December 31, 2006 to $1.15 billion for the year ended December 31, 2007.

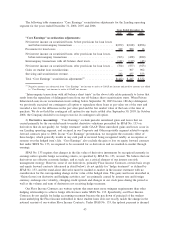

As noted above, we began restructuring our business in the fourth quarter of 2007 in response to the

impact of the CCRAA and current challenges in the capital markets. As part of our cost reduction efforts,

$23 million of severance costs related to the elimination of approximately 400 positions across all areas of the

Company were incurred in the fourth quarter of 2007.

Operating expenses increased by $183 million year-over-year. This increase in operating expenses was

primarily due to $56 million in the Proposed Merger-related expenses incurred in 2007. Operating expenses in

2007 also included $93 million related to a full year of expenses for Upromise, acquired in August 2006,

compared to $33 million incurred in 2006.

Our Managed student loan portfolio grew by $21.5 billion (or 15 percent), from $142.1 billion at

December 31, 2006 to $163.6 billion at December 31, 2007. In 2007 we acquired $40.3 billion of student

loans, an 8 percent increase over the $37.4 billion acquired in the year-ago period. The 2007 acquisitions

included $9.3 billion in Private Education Loans, an 11 percent increase over the $8.4 billion acquired in

2006. In the year ended December 31, 2007, we originated $25.2 billion of student loans through our Preferred

Channel, an increase of 8 percent over the $23.4 billion originated in the year-ago period.

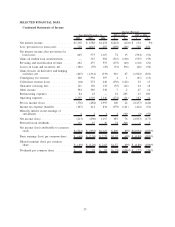

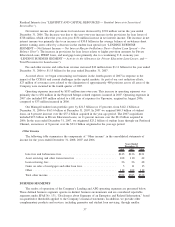

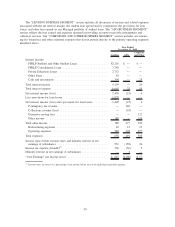

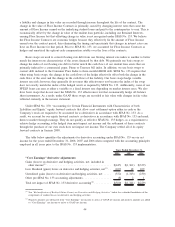

Other Income

The following table summarizes the components of “Other income” in the consolidated statements of

income for the years ended December 31, 2008, 2007 and 2006.

2008 2007 2006

Years Ended

December 31,

Late fees and forbearance fees ................................... $143 $136 $121

Asset servicing and other transaction fees .......................... 108 110 42

Loan servicing fees ........................................... 26 26 48

Gains on sales of mortgages and other loan fees...................... 3 11 15

Other ..................................................... 112 102 112

Total other income ........................................... $392 $385 $338

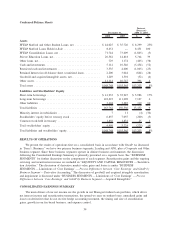

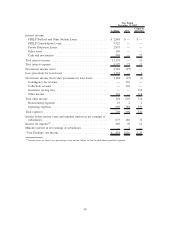

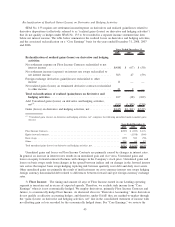

BUSINESS SEGMENTS

The results of operations of the Company’s Lending and APG operating segments are presented below.

These defined business segments operate in distinct business environments and are considered reportable

segments under SFAS No. 131, “Disclosures about Segments of an Enterprise and Related Information,” based

on quantitative thresholds applied to the Company’s financial statements. In addition, we provide other

complementary products and services, including guarantor and student loan servicing, through smaller

37