Sallie Mae 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Credit Risk Management

We bear the full risk of loss on our Private Education Loan portfolio. These loans are underwritten and

priced according to risk, generally determined by a consumer credit scoring system, FICO. Because our

borrowers often have limited repayment history on other loan products and the addition of our loans increases

the debt burden of our borrowers, the origination of our loans generally results in an initial decrease in

borrowers’ FICO scores. After this initial decrease, borrowers’ FICO scores generally improve over time as

the financial positions of our borrowers become more established and their repayment history on all loans

becomes more seasoned. Additionally, for borrowers who do not meet our lending requirements or who desire

more favorable terms, we generally require credit-worthy cosigners.

We have defined underwriting and collection policies, and ongoing risk monitoring and review processes

for all Private Education Loans. Potential credit losses are considered in our risk-based pricing model. The

performance of the Private Education Loan portfolio may be affected by borrowers who fail to complete their

education and by the economy; a prolonged economic downturn may have an adverse effect on our credit

performance. This is taken into account when establishing allowances to cover the incurred losses.

We have credit risk exposure to the various counterparties with whom we have entered into derivative

contracts. We review the credit standing of these companies. Our credit policies place limits on the amount of

exposure we may take with any one party and in most cases, require collateral to secure the position. The

credit risk associated with derivatives is measured based on the replacement cost should the counterparties

with contracts in a gain position to the Company fail to perform under the terms of the contract.

Credit risk in our investment portfolio is minimized by only investing in paper with highly rated issuers.

Additionally, limits per issuer are determined by our internal credit and investment guidelines to limit our

exposure to any one issuer. We also have credit risk with several higher education institutions related to

academic facilities loans secured by real estate.

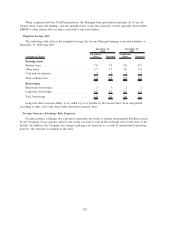

Market and Interest Rate Risk Management

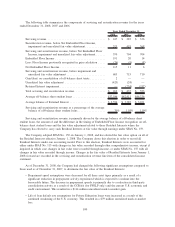

We measure interest rate risk by calculating the variability of net interest income in future periods under

various interest rate scenarios using projected balances for interest-earning assets, interest-bearing liabilities

and derivatives used to hedge interest rate risk. Many assumptions are utilized by management to calculate the

impact that changes in interest rates may have on net interest income, the more significant of which are related

to student loan volumes and pricing, the timing of cash flows from our student loan portfolio, particularly the

impact of Floor Income and the rate of student loan consolidations, basis risk, credit spreads and the maturity

of our debt and derivatives.

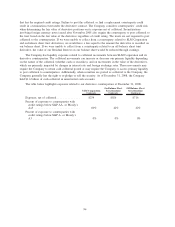

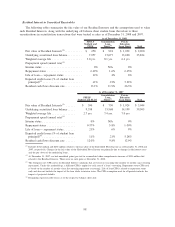

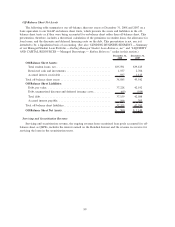

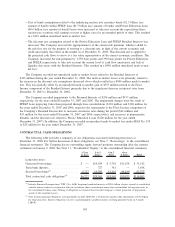

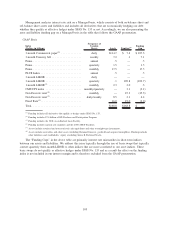

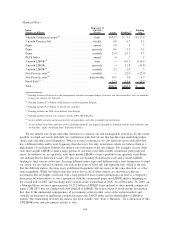

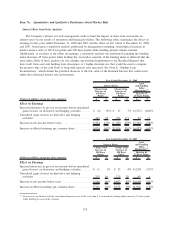

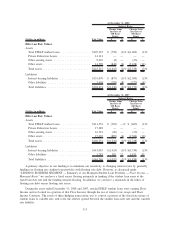

Asset and Liability Funding Gap

The tables below present our assets and liabilities (funding) arranged by underlying indices as of

December 31, 2008. In the following GAAP presentation, the funding gap only includes derivatives that

qualify as effective SFAS No. 133 hedges (those derivatives which are reflected in net interest margin, as

opposed to those reflected in the “gains/(losses) on derivatives and hedging activities, net” line on the income

statement). The difference between the asset and the funding is the funding gap for the specified index. This

represents our exposure to interest rate risk in the form of basis risk and repricing risk, which is the risk that

the different indices may reset at different frequencies or may not move in the same direction or at the same

magnitude.

104