Sallie Mae 2008 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

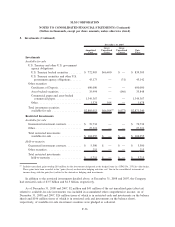

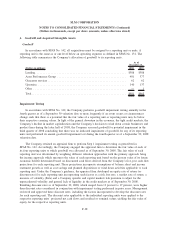

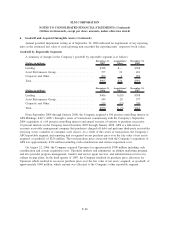

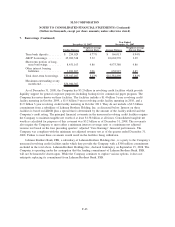

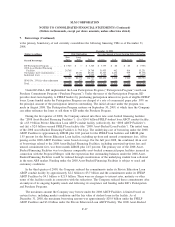

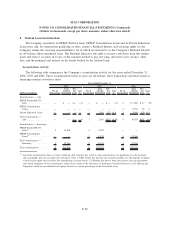

6. Goodwill and Acquired Intangible Assets (Continued)

Annual goodwill impairment testing as of September 30, 2006 indicated no impairment of any reporting

units as the estimated fair value of each reporting unit exceeded the reporting units’ respective book values.

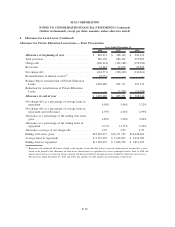

Goodwill by Reportable Segments

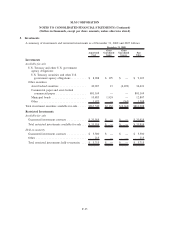

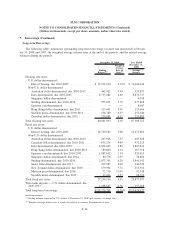

A summary of changes in the Company’s goodwill by reportable segment is as follows:

(Dollars in millions)

December 31,

2007

Acquisitions/

Other

December 31,

2008

Lending ..................................... $388 $— $388

Asset Performance Group ........................ 377 24 401

Corporate and Other ............................ 200 2 202

Total ....................................... $965 $26 $991

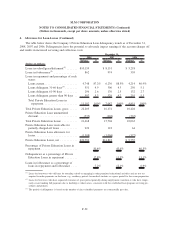

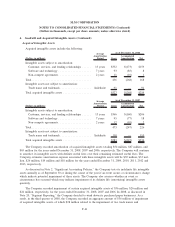

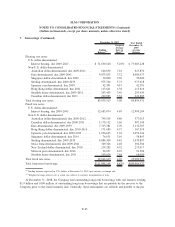

(Dollars in millions)

December 31,

2006

Acquisitions/

Other

December 31,

2007

Lending ..................................... $406 $(18) $388

Asset Performance Group ........................ 349 28 377

Corporate and Other ............................ 215 (15) 200

Total ....................................... $970 $ (5) $965

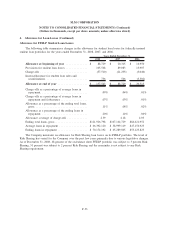

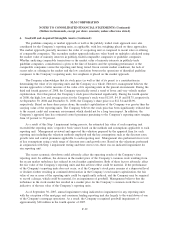

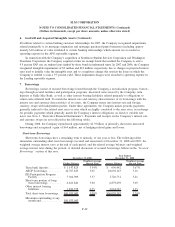

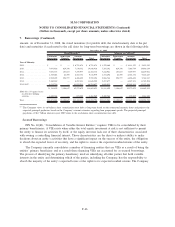

From September 2004 through January 2008, the Company acquired a 100 percent controlling interest in

AFS Holdings, LLC (“AFS”) through a series of transactions commencing with the Company’s September

2004 acquisition of a 64 percent controlling interest and annual exercise of options to purchase successive

12 percent interests in the Company from December 2005 through January 2008. AFS is a full-service

accounts receivable management company that purchases charged off debt and performs third-party receivables

servicing across a number of consumer asset classes. As a result of this series of transactions, the Company’s

APG reportable segment and reporting unit recognized excess purchase price over the fair value of net assets

acquired, or goodwill, of $226 million. The total purchase price associated with the Company’s acquisition of

AFS was approximately $324 million including cash consideration and certain acquisition costs.

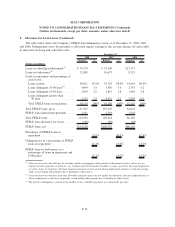

On August 22, 2006, the Company acquired Upromise for approximately $308 million including cash

consideration and certain acquisition costs. Upromise markets and administers an affinity marketing program

and also provides program management, transfer and service agent services, and administration services for

college savings plans. In the third quarter of 2007, the Company finalized its purchase price allocation for

Upromise which resulted in an excess purchase price over the fair value of net assets acquired, or goodwill, of

approximately $140 million, which amount was allocated to the Company’s other reportable segment.

F-40

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)