Sallie Mae 2008 Annual Report Download - page 94

Download and view the complete annual report

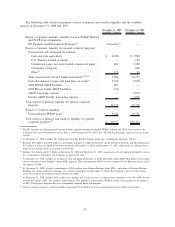

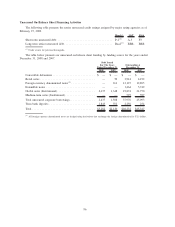

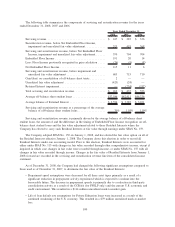

Please find page 94 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition to the assets listed in the table above, we hold on-balance sheet a number of other

unencumbered assets, consisting primarily of Private Education Loans, Retained Interests and other assets. At

December 31, 2008, we had a total of $36.1 billion (including assets in the table above) of unencumbered

assets, including goodwill and acquired intangibles. Student loans, net, comprised $21.1 billion of this

unencumbered asset total.

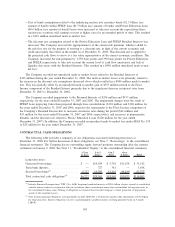

As disclosed, we have extended the 2008 Asset-Backed Financing Facilities to mature on April 28, 2009.

We believe that we will be successful in our effort to refinance the facility at a lower balance at such time. If

we are unable to refinance the 2008 Asset-Backed Financing Facilities and if our obligation was settled

through the lenders possession of posted collateral we would incur a charge of $8.4 billion, ($5.3 billion after

tax) representing the difference between our cost basis in the collateral and current borrowings under the

facility as of December 31, 2008. As a result, we would no longer meet the covenants related to our lines of

credit and our ability to conduct business could be materially changed. While we would still be able to

originate loans into the ED Participation and Purchase program, our ability to originate private credit loans

could be limited or curtailed. However, even if we are unsuccessful in this renegotiation, we believe that our

current investment portfolio, when combined with our net expected cash inflows (principally from loan

repayments) and the ED Conduit Program borrowing we expect to begin using in the first quarter of 2009 will

provide sufficient liquidity to meet our short term obligations.

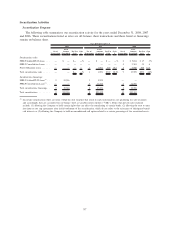

Counterparty Exposure

As of December 31, 2008, the Company had certain exposures to counterparties impacted by the ongoing

credit market dislocation. Counterparty exposure related to financial instruments arises from the risk that a

lending, investment or derivative counterparty will not be able to meet its obligations to the Company.

Lehman Brothers Bank, FSB, a subsidiary of Lehman Brothers Holdings Inc., is a party to the Company’s

unsecured revolving credit facilities under which they provide the Company with a $308 million commitment.

Lehman Brothers Holdings Inc., declared bankruptcy on September 15, 2008. The Company is operating under

the assumption that the lending commitment of Lehman Brothers Bank, FSB, will not be honored if drawn

upon. While the Company continues to explore various options, it does not anticipate replacing its commitment

from Lehman Brothers Bank, FSB.

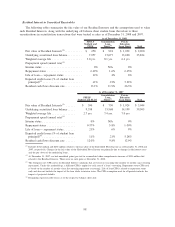

To provide liquidity for future cash needs, SLM invests in high quality money market investments. At

December 31, 2008, the Company had investments of $97 million with The Reserve Primary Fund (“The

Fund”). In September 2008, the Company requested redemption of all monies invested in The Fund prior to

The Fund’s announcement that it suspended distributions as a result of The Fund’s exposure to Lehman

Brothers Holdings Inc.’s bankruptcy filing and The Fund’s net asset value being below one dollar per share.

The Company was originally informed by The Fund that the Company would receive its entire investment

amount. Subsequently, the SEC granted The Fund an indefinite extension to pay distributions as The Fund is

being liquidated. The Company has received, to date, a total of $394 million of an initial investment of

$500 million from The Fund. The Company anticipates further delay of remaining distributions and a potential

loss on its investments, even though the Company is legally entitled to receive 100 percent of its remaining

investment amount. In the fourth quarter of 2008, we recorded an impairment of $8 million related to our

investment in the Fund.

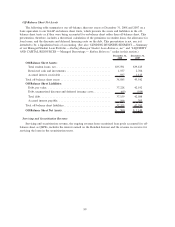

Protection against counterparty risk in derivative transactions is generally provided by the International

Swaps and Derivatives Association, Inc. (“ISDA”) Credit Support Annexes (“CSAs”). CSAs require a

counterparty to post collateral if a potential default would expose the other party to a loss. The Company is a

party to derivative contracts for its corporate purposes and also within its securitization trusts. The Company

has CSAs and collateral requirements with all of its corporate derivative counterparties requiring collateral to

be exchanged based on the net fair value of derivatives with each counterparty above a threshold. Additionally,

credit downgrades below a preset level can eliminate this threshold. The Company’s securitization trusts

require collateral in all cases if the counterparty’s credit rating is withdrawn or downgraded below a certain

level. If the counterparty does not post the required collateral or is downgraded further, the counterparty must

find a suitable replacement counterparty or provide the trust with a letter of credit or a guaranty from an entity

93