Sallie Mae 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.average spread of 125 basis points over LIBOR. The Company has not accessed the market for Private

Education Loan ABS since 2007.

In the past, the Company primarily relied on the unsecured debt market for the balance of its funding. In

June 2008, the Company issued a $2.5 billion, ten-year unsecured note at an equivalent cost of 400 basis

points over LIBOR. This rate is more than 300 basis points higher than the cost of any previously issued

unsecured debt. Subsequent to this debt issuance, the market for unsecured, non-U.S. government guaranteed

debt issued by financial services companies materially deteriorated and became unavailable at profitable terms.

The net interest margin earned on a newly-originated FFELP loan came under pressure as the asset yield

was cut and funding costs increased, making new lending unprofitable. As a result, over 160 student lenders

have exited the business since the implementation of CCRAA, and most remaining issuers significantly

reduced their lending activities. By January 2008, it became clear that unless the capital markets recovered

there would be a sharp contraction in the number of student loans available. The Company, along with other

participants in the student loan industry, began to bring this to the attention of legislators, schools and students.

As early as February 2008, members of Congress were writing to the U.S. Department of Education (“ED”)

and the Federal Reserve alerting them to the imminent crisis and urging them to find a solution. Congress

acted quickly and passed legislation that authorized ED to take action.

The Ensuring Continued Access to Student Loans Act of 2008 (“ECASLA”) was passed in both houses

of Congress with overwhelming bipartisan support and was signed into law on May 7, 2008. Under ECASLA,

ED implemented two programs in 2008, the Loan Participation Program and Loan Purchase Commitment

Program (“Participation Program” and “Purchase Program”). Through the Participation Program, ED provides

interim short-term liquidity to FFELP lenders by purchasing participation interests in pools of FFELP loans.

FFELP lenders are charged at the commercial paper (“CP”) rate plus 0.50 percent on the principal amount of

participation interests outstanding. Loans funded under the Participation Program must be either refinanced by

the lender or sold to ED pursuant to the Purchase Program prior to its expiration on September 30, 2010.

Under the Purchase Program, ED purchases eligible FFELP loans at a price equal to the sum of (i) par value,

(ii) accrued interest, (iii) the one-percent origination fee paid to ED, and (iv) a fixed amount of $75 per loan.

Generally, loans originated between May 1, 2008 and June 30, 2010 are eligible for these programs. ECASLA

also significantly increased student loan limits. A description of ECASLA can be found in APPENDIX A,

“FEDERAL FAMILY EDUCATION LOAN PROGRAM.”

The Participation Program enabled the Company to make a pledge to make “every loan to every eligible

student on every campus” under FFELP and to help the country avoid a major crisis on campuses across the

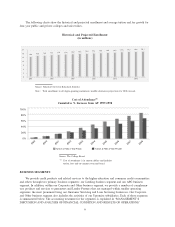

United States. In the first six months of academic year (“AY”) 2008-2009, the Company originated $9.5 billion

of FFELP loans, an increase of 3 percent from the prior year. In addition, it originated $1.4 billion of FFELP

loans for third parties.

In addition to the Participation and Purchase Programs, ECASLA authorized funding vehicles for FFELP

loans originated after October 1, 2003 through June 30, 2009. On January 15, 2009, ED published summary

terms under which it will purchase eligible FFELP Stafford and PLUS loans from a conduit vehicle established

to provide funding for eligible student lenders (the “ED Conduit Program”). Funding for the ED Conduit

Program will be provided by the capital markets at a cost based on market rates. The ED Conduit Program

will have a term of five years. An estimated $16.0 billion of our Stafford and PLUS loans (excluding loans

currently in the Participation Program) were eligible for funding under the ED Conduit Program as of

December 31, 2008. We expect to utilize the ED Conduit Program to fund a significant percentage of these

assets over time. The initial funding under the ED Conduit Program is expected to occur in the first quarter of

2009.

Interest paid on FFELP loans is set by law and is based on the Federal Reserve’s Statistical Release H.15

90-day financial CP rate. As of December 31, 2008, on a Managed Basis, the Company had approximately

$127.2 billion of FFELP loans indexed to three-month financial CP that are funded with debt indexed or

swapped to LIBOR. Due to the unintended consequences of government actions in other areas of the capital

markets and limited issuances of qualifying financial CP, the relationship between the three-month financial

3