Sallie Mae 2008 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19. Income Taxes (Continued)

investor. In addition, during the third quarter of 2007, the Company filed an administrative-level appeal related

to one unagreed item originating from the Company’s 2004 U.S. federal tax return. The IRS is also currently

examining the Company’s 2005 and 2006 federal income tax returns. It is reasonably possible that there will

be a decrease in the Company’s unrecognized tax benefits as a result of the resolution of these items. When

considering both tax and interest amounts, the decrease could be approximately $12 million to $18 million.

In the event that the Company is not contacted for exam by additional tax authorities by the end of 2009,

it is reasonably possible that there will be a decrease in the Company’s unrecognized tax benefits as a result

of the lapse of various statute of limitations periods. When considering both tax and interest amounts, the

decrease could be approximately $2 million to $5 million.

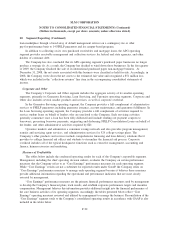

Tax Years Remaining Subject to Exam

The Company or one of its subsidiaries files income tax returns at the U.S. federal level, in most

U.S. states, and various foreign jurisdictions. U.S. federal income tax returns filed for years prior to 2003 have

been audited and are now resolved. As shown in the table below, the Company’s primary operating subsidiary

has been audited by the listed states through the year shown, again with all issues resolved. Other

combinations of subsidiaries, tax years, and jurisdictions remain open for review, subject to statute of

limitations periods (typically 3 to 4 prior years).

State Year audited through

Florida ....................................................... 2000

Indiana....................................................... 2000

Pennsylvania . ................................................. 2000

California ..................................................... 2002

Missouri...................................................... 2003

NewYork..................................................... 2004

North Carolina ................................................. 2005

Texas........................................................ 2004

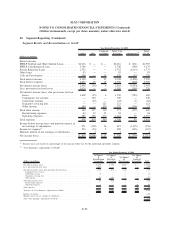

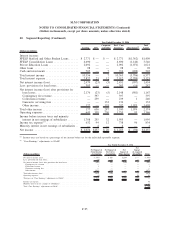

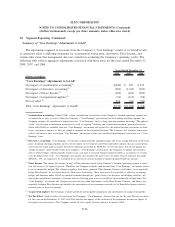

20. Segment Reporting

The Company has two primary operating segments as defined in SFAS No. 131, the Lending operating

segment and the APG (formerly known as DMO) operating segment. The Lending and APG operating

segments meet the quantitative thresholds for reportable segments identified in SFAS No. 131. Accordingly,

the results of operations of the Company’s Lending and APG reportable segments are presented below. The

Company has smaller operating segments including the Guarantor Servicing, Loan Servicing, and Upromise

operating segments, as well as certain other products and services provided to colleges and universities which

do not meet the quantitative thresholds identified in SFAS No. 131. Therefore, the results of operations for

these operating segments and the revenues and expenses associated with these other products and services are

combined with corporate overhead and other corporate activities within the Corporate and Other reportable

segment.

The management reporting process measures the performance of the Company’s operating segments

based on the management structure of the Company as well as the methodology used by management to

evaluate performance and allocate resources. Management, including the Company’s chief operating decision

makers, evaluates the performance of the Company’s operating segments based on their profitability. As

discussed further below, management measures the profitability of the Company’s operating segments based

F-90

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)