Sallie Mae 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Conduit Program will be provided by the capital markets at a cost based on market rates. The ED Conduit

Program will have a term of five years. An estimated $16.0 billion of our Stafford and PLUS loans (excluding

loans currently in the Participation Program) were eligible for funding under the ED Conduit Program as of

December 31, 2008. We expect to utilize the ED Conduit Program to fund a significant percentage of these

assets over time. The initial funding under the ED Conduit Program is expected to occur in the first quarter of

2009.

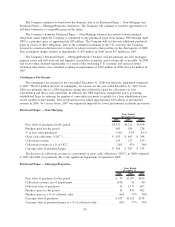

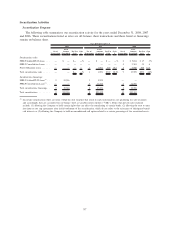

On November 20, 2008, ED announced it was using its authority under ECASLA to directly purchase

certain eligible FFELP Stafford and PLUS loans originated during AY 2007-2008. This purchase program

began in December 2008 and will end the earlier of the date the ED Conduit Program becomes operational or

February 28, 2009. Pursuant to this program, ED proposed to purchase up to a total of $6.5 billion of loans, in

increments of up to $500 million per week, at a price of 97 percent of principal and unpaid interest. In late

December 2008, we sold to ED approximately $494 million (principal and accrued interest) of qualifying

FFELP loans and realized $480 million in net proceeds. In early January 2009, we executed an additional

asset sale under the program of approximately $486 million (principal and accrued interest) and received

$472 million in net proceeds. The related loss was recognized in the fourth quarter and year ended

December 31, 2008, as the loans were classified as “held-for-sale” under GAAP. Our servicing rights on the

loans were released upon sale.

Additional Funding Sources for General Corporate Purposes

The Company has encountered many challenges to its business model over the course of the last several

years. In order to continue to meet our mission of providing access to higher education we have worked with

Congress, ED and the Treasury Department to find solutions to those challenges that have been created by

market conditions.

In addition to funding FFELP loans through ED’s Participation and Purchase Programs, the Company

employs other financing sources for general corporate purposes, which includes originating Private Education

Loans and repayments of unsecured debt obligations.

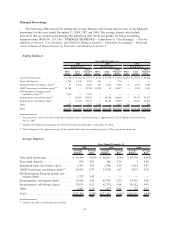

During the fourth quarter of 2008, Sallie Mae Bank, our Utah banking subsidiary, began expanding its

deposit base to fund new Private Education Loan originations. Sallie Mae Bank raises deposits primarily

through intermediaries in the retail brokered CD market. From the period October 1, 2008 to December 31,

2008, Sallie Mae Bank raised $1.6 billion of term bank deposits with a weighted average life of 2.2 years and

a weighted average cost of approximately three-month LIBOR plus 0.97 percent. As of December 31, 2008,

total term bank deposits were $2.3 billion. We expect Sallie Mae Bank to fund newly originated Private

Education Loans by continuing to raise term bank deposits. We ultimately expect to raise long-term financing,

through Private Education Loan securitizations or otherwise, to fund these loans.

We completed nine FFELP term ABS transactions totaling $18.5 billion during the nine months ended

September 30, 2008. We did not complete an ABS transaction during the fourth quarter of 2008. Although we

expect ABS financing to remain our primary source of funding over the long term, we expect our transaction

volumes to be more limited and pricing less favorable than prior to the credit market dislocation that began in

the summer of 2007, with significantly reduced opportunities to place subordinated tranches of ABS with

investors. All-in costs of our new issue FFELP term ABS averaged LIBOR plus 1.25 percent for the full year

ended December 31, 2008.

Since late September 2008, there has been severe dislocation in the financial markets. At present, we are

unable to predict when market conditions will allow for more regular and reliable access to the term ABS

market.

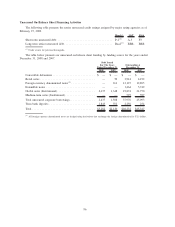

During the first quarter of 2008, the Company entered into three new asset-backed financing facilities

(the “2008 Asset-Backed Financing Facilities”): (i) a $26.0 billion FFELP student loan ABCP conduit facility;

(ii) a $5.9 billion Private Education Loan ABCP conduit facility (collectively, the “2008 ABCP Facilities”);

and (iii) a $2.0 billion secured FFELP loan facility (the “2008 Asset-Backed Loan Facility”). The initial term

of the 2008 Asset-Backed Financing Facilities is 364 days. The underlying cost of borrowing under the 2008

89