Sallie Mae 2008 Annual Report Download - page 174

Download and view the complete annual report

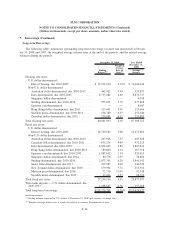

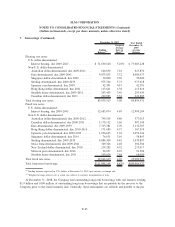

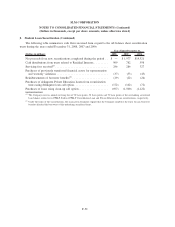

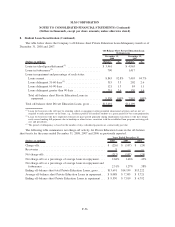

Please find page 174 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8. Student Loan Securitization (Continued)

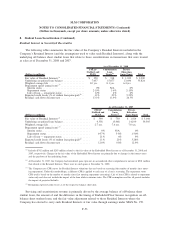

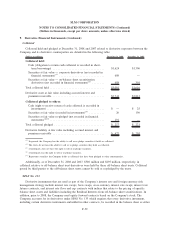

The Company adopted SFAS No. 159 on January 1, 2008, and has elected the fair value option on all of the

Residual Interests effective January 1, 2008. The Company chose this election in order to record all Residual

Interests under one accounting model. Prior to this election, Residual Interests were accounted for either under

SFAS No. 115 with changes in fair value recorded through other comprehensive income, except if impaired in

which case changes in fair value were recorded through income, or under SFAS No. 155 with all changes in fair

value recorded through income. Changes in the fair value of Residual Interests from January 1, 2008 forward are

recorded in the servicing and securitization revenue line item of the consolidated statements of income.

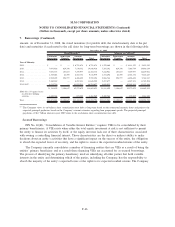

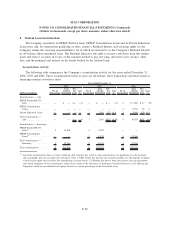

As of December 31, 2008, the Company had changed the following significant assumptions compared to

those used as of December 31, 2007, to determine the fair value of the Residual Interests:

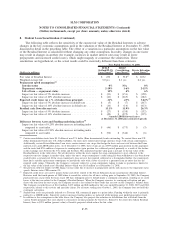

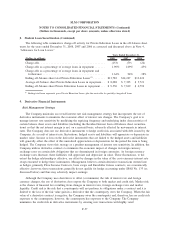

• Prepayment speed assumptions were decreased for all three asset types primarily as a result of a

significant reduction in prepayment activity experienced which is expected to continue into the

foreseeable future. The decrease in prepayment speeds is primarily due to a reduction in third-party

consolidation activity as a result of the CCRAA (for FFELP only) and the current U.S. economic and

credit environment. This resulted in a $114 million unrealized mark-to-market gain.

• Life of loan default rate assumptions for Private Education loans were increased as a result of the continued

weakening of the U.S. economy. This resulted in a $79 million unrealized mark-to-market loss.

• Cost of funds assumptions related to the underlying auction rate securities bonds ($2.3 billion face

amount of bonds) within FFELP loan ($1.7 billion face amount of bonds) and Private Education Loan

($0.6 billion face amount of bonds) trusts were increased to take into account the expectations these

auction rate securities will continue to reset at higher rates for an extended period of time. This resulted

in a $116 million unrealized mark-to-market loss.

• The discount rate assumption related to the Private Education Loan and FFELP Residual Interests was

increased. The Company assessed the appropriateness of the current risk premium, which is added to the

risk free rate for the purpose of arriving at a discount rate, in light of the current economic and credit

uncertainty that exists in the market as of December 31, 2008. This discount rate is applied to the projected

cash flows to arrive at a fair value representative of the current economic conditions. The Company

increased the risk premium by 1,550 basis points and 390 basis points for Private Education and FFELP,

respectively, to take into account the current level of cash flow uncertainty and lack of liquidity that exists

with the Residual Interests. This resulted in a $904 million unrealized mark-to-market loss.

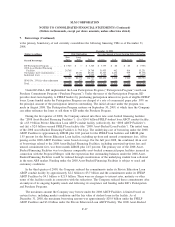

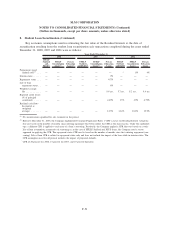

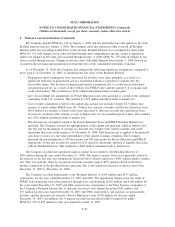

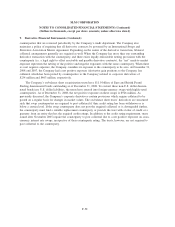

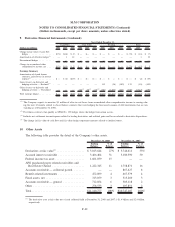

The Company recorded net unrealized mark-to-market losses related to the Residual Interests of

$425 million during the year ended December 31, 2008. The mark-to-market losses were primarily related to

the increase in the discount rate assumptions discussed above which resulted in a $904 million mark-to-market

loss. This was partially offset by an unrealized mark-to-market gain of $555 million related to the Floor

Income component of the Residual Interest primarily due to the significant decrease in interest rates from

December 31, 2007 to December 31, 2008.

The Company recorded impairments to the Retained Interests of $254 million and $157 million,

respectively, for the years ended December 31, 2007 and 2006. The impairment charges were the result of

FFELP loans prepaying faster than projected through loan consolidations ($110 million and $104 million for

the years ended December 31, 2007 and 2006, respectively), impairment to the Floor Income component of

the Company’s Retained Interest due to increases in interest rates during the period ($24 million and

$53 million for the years ended December 31, 2007 and 2006, respectively), and increases in prepayments,

defaults, and the discount rate related to Private Education Loans ($120 million for the year ended

December 31, 2007). In addition, the Company recorded an unrealized mark-to-market loss under

SFAS No. 155 of $25 million for the year ended December 31, 2007.

F-54

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)