Sallie Mae 2008 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

of the Company’s assets and liabilities. To the extent tax laws change, deferred tax assets and liabilities are

adjusted in the period that the tax change is enacted.

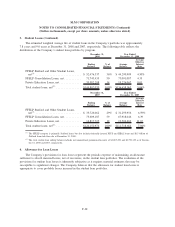

“Income tax expense” includes (i) deferred tax expense, which represents the net change in the deferred

tax asset or liability balance during the year plus any change in a valuation allowance, and (ii) current tax

expense, which represents the amount of tax currently payable to or receivable from a tax authority plus

amounts accrued for unrecognized tax benefits. Income tax expense excludes the tax effects related to

adjustments recorded in equity.

The Company adopted the provisions of the FASB’s FIN No. 48, “Accounting for Uncertainty in Income

Taxes,” on January 1, 2007. Under FIN No. 48, an uncertain tax position is recognized only if it is more likely

than not to be sustained upon examination based on the technical merits of the position. The amount of tax

benefit recognized in the financial statements is the largest amount of benefit that is more than fifty percent

likely of being sustained upon ultimate settlement of the uncertain tax position. The Company recognizes

interest related to unrecognized tax benefits in income tax expense, and penalties, if any, in operating

expenses.

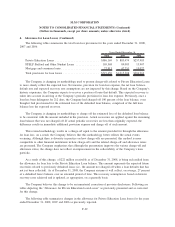

Earnings (Loss) per Common Share

The Company computes earnings (loss) per common share (“EPS”) in accordance with SFAS No. 128,

“Earnings per Share.” See Note 12, “Earnings (Loss) per Common Share,” for further discussion.

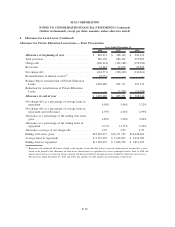

Foreign Currency Transactions

The Company has financial services operations in foreign countries. The financial statements of these

foreign businesses have been translated into U.S. dollars in accordance with U.S. GAAP. The net investments

of the parent in the foreign subsidiary are translated at the current exchange rate at each period-end through

the “other comprehensive income” component of stockholders’ equity for net investments deemed to be long-

term in nature or through net income if the net investment is short-term in nature. Income statement items are

translated at the average exchange rate for the period through income. Transaction gains and losses resulting

from exchange rate changes on transactions denominated in currencies other than the entity’s functional

currency are included in other operating income.

Statement of Cash Flows

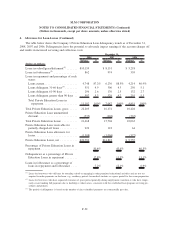

Included in the Company’s financial statements is the consolidated statement of cash flows. It is the

policy of the Company to include all derivative net settlements, irrespective of whether the derivative is a

qualifying hedge, in the same section of the statement of cash flows that the derivative is economically

hedging.

As discussed above under “Restricted Cash and Investments,” the Company’s restricted cash balances

primarily relate to on-balance sheet securitizations. This balance is primarily the result of timing differences

between when principal and interest is collected on the trust assets and when principal and interest is paid on

the trust liabilities. As such, changes in this balance are reflected in investing activities.

Reclassifications

Certain reclassifications have been made to the balances as of and for the years ended December 31,

2007 and 2006, to be consistent with classifications adopted for 2008.

F-22

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)