Sallie Mae 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

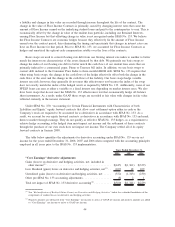

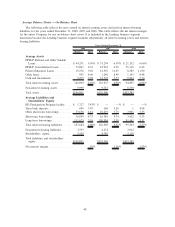

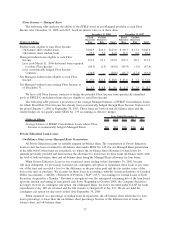

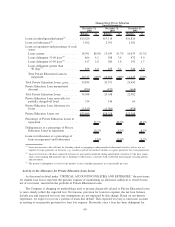

in the on-balance sheet student loan and other asset spreads. The student loan portfolio as a percentage of the

overall interest earning asset portfolio did not change substantially from 2006 to 2007. The decrease in spread

from 2006 to 2007 primarily related to the previously discussed changes in the on-balance sheet student loan

and other asset spreads.

The 2008 Asset-Backed Financing Facilities closed on February 29, 2008. Amortization of the upfront

commitment and liquidity fees began on that date.

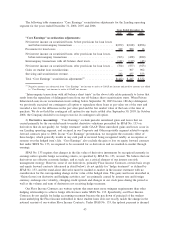

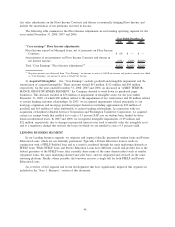

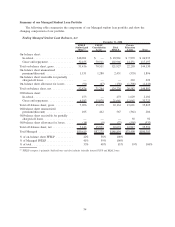

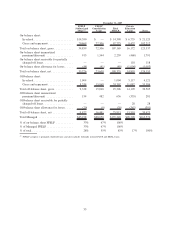

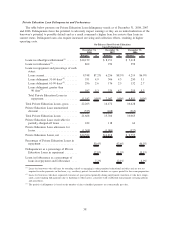

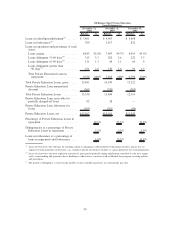

“Core Earnings” Net Interest Margin

The following table analyzes the earnings from our portfolio of Managed interest-earning assets on a

“Core Earnings” basis (see “BUSINESS SEGMENTS — Limitations of ‘Core Earnings’ — Pre-tax Differences

between ‘Core Earnings’ and GAAP by Business Segment”). The “‘Core Earnings’ Net Interest Margin”

presentation and certain components used in the calculation differ from the “Net Interest Margin — On-

Balance Sheet” presentation. The “Core Earnings” presentation, when compared to our on-balance sheet

presentation, is different in that it:

• includes the net interest margin related to our off-balance sheet student loan securitization trusts. This

includes any related fees or costs such as the Consolidation Loan Rebate Fees, premium/discount

amortization and Repayment Borrower Benefits yield adjustments;

• includes the reclassification of certain derivative net settlement amounts. The net settlements on certain

derivatives that do not qualify as SFAS No. 133 hedges are recorded as part of the “gain (loss) on

derivative and hedging activities, net” line on the income statement and are therefore not recognized in

the on-balance sheet student loan spread. Under this presentation, these gains and losses are reclassified

to the income statement line item of the economically hedged item. For our “Core Earnings” net

interest margin, this would primarily include: (a) reclassifying the net settlement amounts related to our

written Floor Income Contracts to student loan interest income and (b) reclassifying the net settlement

amounts related to certain of our basis swaps to debt interest expense;

• excludes unhedged Floor Income earned on the Managed student loan portfolio; and

• includes the amortization of upfront payments on Floor Income Contracts in student loan income that

we believe are economically hedging the Floor Income.

51