Sallie Mae 2008 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

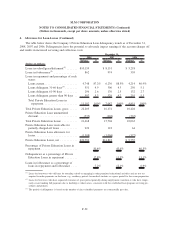

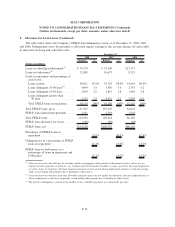

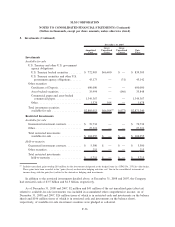

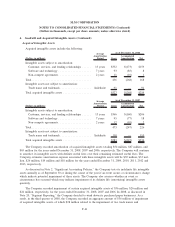

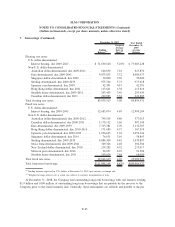

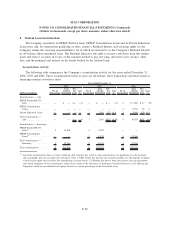

6. Goodwill and Acquired Intangible Assets (Continued)

Acquired Intangible Assets

Acquired intangible assets include the following:

(Dollars in millions)

Average

Amortization

Period Gross

Accumulated

Amortization Net

As of December 31, 2008

Intangible assets subject to amortization:

Customer, services, and lending relationships ...... 13years $332 $(173) $159

Software and technology ..................... 7years 93 (85) 8

Non-compete agreements ..................... 2years 11 (10) 1

Total ...................................... 436 (268) 168

Intangible assets not subject to amortization:

Trade name and trademark .................... Indefinite 91 — 91

Total acquired intangible assets .................. $527 $(268) $259

(Dollars in millions)

Average

Amortization

Period Gross

Accumulated

Amortization Net

As of December 31, 2007

Intangible assets subject to amortization:

Customer, services, and lending relationships ...... 13years $366 $(160) $206

Software and technology ..................... 7years 95 (77) 18

Non-compete agreements ..................... 2years 12 (10) 2

Total ...................................... 473 (247) 226

Intangible assets not subject to amortization:

Trade name and trademark .................... Indefinite 110 — 110

Total acquired intangible assets .................. $583 $(247) $336

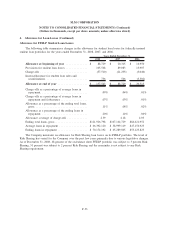

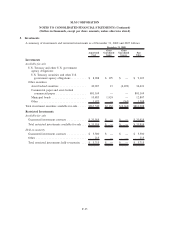

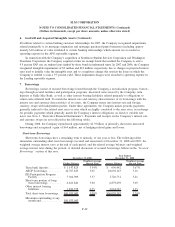

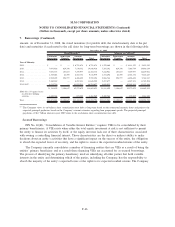

The Company recorded amortization of acquired intangible assets totaling $54 million, $67 million, and

$65 million for the years ended December 31, 2008, 2007 and 2006, respectively. The Company will continue

to amortize its intangible assets with definite useful lives over their remaining estimated useful lives. The

Company estimates amortization expense associated with these intangible assets will be $39 million, $33 mil-

lion, $26 million, $19 million and $18 million for the years ended December 31, 2009, 2010, 2011, 2012 and

2013, respectively.

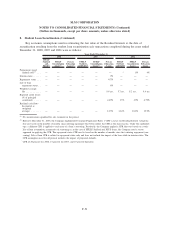

As discussed in Note 2, “Significant Accounting Policies,” the Company tests its indefinite life intangible

assets annually as of September 30 or during the course of the year if an event occurs or circumstances change

which indicate potential impairment of these assets. The Company also assesses whether an event or

circumstance has occurred which may indicate impairment of its definite life (amortizing) intangible assets

quarterly.

The Company recorded impairment of certain acquired intangible assets of $36 million, $26 million and

$24 million, respectively, for the years ended December 31, 2008, 2007 and 2006. In 2008, as discussed in

Note 20, “Segment Reporting,” the Company decided to wind down its purchased paper businesses. As a

result, in the third quarter of 2008, the Company recorded an aggregate amount of $36 million of impairment

of acquired intangible assets, of which $28 million related to the impairment of two trade names and

F-41

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)