Sallie Mae 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

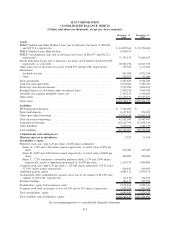

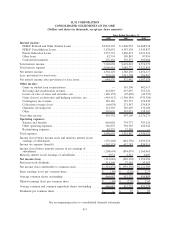

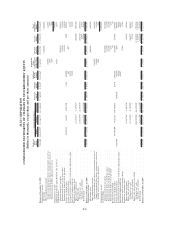

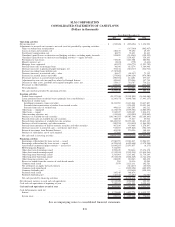

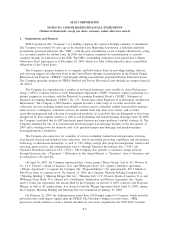

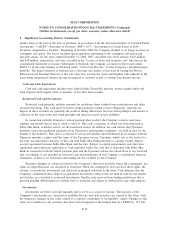

SLM CORPORATION

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Dollars in thousands, except share and per share amounts)

Preferred

Stock

Shares Issued Treasury Outstanding

Preferred

Stock

Common

Stock

Additional

Paid-In

Capital

Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings

Treasury

Stock

Total

Stockholders’

Equity

Common Stock Shares

Balance at December 31, 2005 ..................... 7,300,000 426,483,527 (13,346,717) 413,136,810 $ 565,000 $ 85,297 $2,233,647 $ 367,910 $1,111,743 $ (572,172) $ 3,791,425

Comprehensive income:

Net income ................................ 1,156,956 1,156,956

Other comprehensive income:

Change in unrealized gains (losses) on investments, net of tax . . (41,953) (41,953)

Change in unrealized gains (losses) on derivatives, net of tax. . . 4,990 4,990

Minimum pension liability adjustment, net of tax ........ (569) (569)

Comprehensive income . . . ........................ 1,119,424

Adjustment to initially apply SFAS No. 158, net of tax ........ 18,733 18,733

Cash dividends:

Common stock ($.97 per share) .................... (398,414) (398,414)

Preferred stock, Series A ($3.48 per share) .............. (11,500) (11,500)

Preferred stock, Series B ($5.82 per share) .............. (23,420) (23,420)

Issuance of common shares ........................ 6,629,455 64,141 6,693,596 1,326 204,996 3,499 209,821

Issuance of preferred shares ........................ 647 (647) —

Tax benefit related to employee stock option and purchase plans . . 54,522 54,522

Stock-based compensation cost ...................... 71,399 71,399

Repurchase of common shares:

Open market repurchases ........................ (2,159,827) (2,159,827) (100,000) (100,000)

Equity forwards:

Settlement cost, cash . ........................ (5,395,979) (5,395,979) (295,376) (295,376)

(Gain)/loss on settlement ....................... — — 10,907 10,907

Benefit plans . . . . . . . ........................ (1,657,788) (1,657,788) (87,479) (87,479)

Balance at December 31, 2006 ..................... 7,300,000 433,112,982 (22,496,170) 410,616,812 $ 565,000 $ 86,623 $2,565,211 $ 349,111 $1,834,718 $(1,040,621) $ 4,360,042

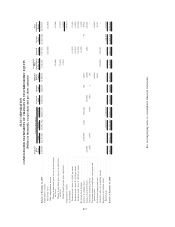

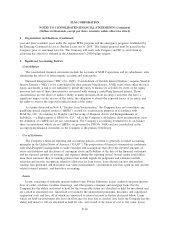

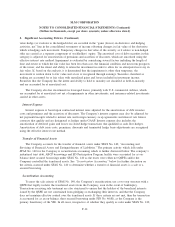

Comprehensive income:

Net income (loss) . . . . ........................ (896,394) (896,394)

Other comprehensive income:

Change in unrealized gains (losses) on investments, net of tax . . (101,591) (101,591)

Change in unrealized gains (losses) on derivatives, net of tax. . . (15,004) (15,004)

Defined benefit pension plans adjustment ............. 3,848 3,848

Comprehensive income . . . ........................ (1,009,141)

Cash dividends:

Common stock ($.25 per share) .................... (102,658) (102,658)

Preferred stock, Series A ($3.49 per share) .............. (11,500) (11,500)

Preferred stock, Series B ($6.25 per share) .............. (24,796) (24,796)

Preferred stock, Series C ($.20 per share) .............. (201) (201)

Restricted stock dividend . ........................ (8) (8)

Issuance of common shares ........................ 99,380,099 9,816,534 109,196,633 19,876 1,940,708 (235,548) 423,446 2,148,482

Issuance of preferred shares ........................ 1,000,000 1,000,000 (30,678) (648) 968,674

Tax benefit related to employee stock option and purchase plans . . 49,016 49,016

Stock-based compensation cost ...................... 65,917 65,917

Cumulative effect of accounting change . . ............... (5,761) (5,761)

Repurchase of common shares:

Open market repurchases ........................ (1,809,700) (1,809,700) (65,018) (65,018)

Equity forward settlement:

Settlement cost, cash . ........................ (4,110,929) (4,110,929) (164,437) (164,437)

(Gain)/loss on settlement ....................... — — 54,716 54,716

Equity forwards agreed to be settled:

Settlement cost, cash . ........................ (44,039,890) (44,039,890) (1,992,938) (1,992,938)

(Gain)/loss on settlement ....................... — — 1,105,975 1,105,975

Benefit plans . . . . . . . ........................ (3,311,239) (3,311,239) (152,829) (152,829)

Balance at December 31, 2007 ..................... 8,300,000 532,493,081 (65,951,394) 466,541,687 $1,565,000 $106,499 $4,590,174 $ 236,364 $ 557,204 $(1,831,706) $ 5,223,535

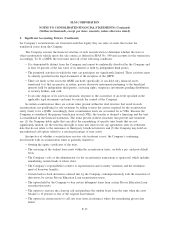

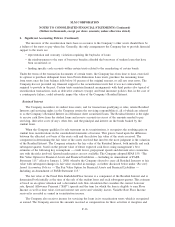

F-6