Sallie Mae 2008 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

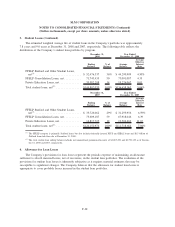

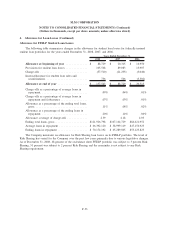

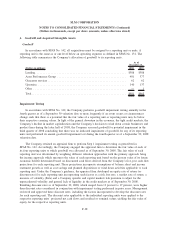

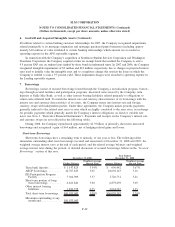

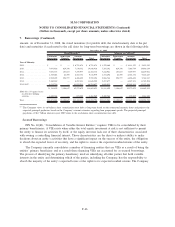

6. Goodwill and Acquired Intangible Assets

Goodwill

In accordance with SFAS No. 142, all acquisitions must be assigned to a reporting unit or units. A

reporting unit is the same as or one level below an operating segment, as defined in SFAS No. 131. The

following table summarizes the Company’s allocation of goodwill to its reporting units.

(Dollars in millions) 2008 2007

As of

December 31,

Lending.......................................................... $388 $388

Asset Performance Group ............................................ 401 377

Guarantor services .................................................. 62 62

Upromise ........................................................ 140 137

Other ........................................................... — 1

Total ............................................................ $991 $965

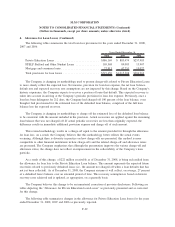

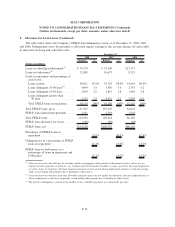

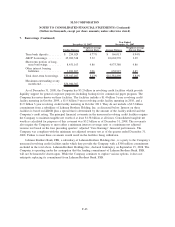

Impairment Testing

In accordance with SFAS No. 142, the Company performs goodwill impairment testing annually in the

fourth quarter as of a September 30 valuation date or more frequently if an event occurs or circumstances

change such that there is a potential that the fair value of a reporting unit or reporting units may be below

their respective carrying values. In light of the general downturn in the economy, the tight credit markets, the

Company’s decline in market capitalization and the Company’s decision to wind down certain businesses and

product lines during the latter half of 2008, the Company assessed goodwill for potential impairment in the

third quarter of 2008 concluding that there was no indicated impairment of goodwill for any of its reporting

units and performed its annual goodwill impairment test during the fourth quarter as of a September 30, 2008

valuation date.

The Company retained an appraisal firm to perform Step 1 impairment testing as prescribed in

SFAS No. 142. Accordingly, the Company engaged the appraisal firm to determine the fair value of each of

its four reporting units to which goodwill was allocated as of September 30, 2008. The fair value of each

reporting unit was determined by weighting different valuation approaches with the primary approach being

the income approach which measures the value of each reporting unit based on the present value of its future

economic benefit determined based on discounted cash flows derived from the Company’s five-year cash flow

projections for each reporting unit. These projections incorporate assumptions of balance sheet and income

statement growth as well as cost savings and planned dispositions or wind down activities applicable to each

reporting unit. Under the Company’s guidance, the appraisal firm developed an equity rate of return (or

discount rate) for each reporting unit incorporating such factors as a risk free rate, a market rate of return, a

measure of volatility (Beta) and a Company specific and capital markets risk premium to adjust for the

unprecedented volatility and general lack of liquidity in the credit markets as of September 30, 2008.

Resulting discount rates as of September 30, 2008, which ranged from 13 percent to 17 percent, were higher

than discount rates considered in conjunction with impairment testing performed in prior years. Management

reviewed and approved these discount rates, including the factors incorporated to develop the discount rates

for each reporting unit. The discount rates applicable to the individual reporting units were applied to the

respective reporting units’ projected net cash flows and residual or terminal values yielding the fair value of

equity for the respective reporting units.

F-38

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)